Latest News

- Key Economic Indicators May Influence Federal Reserve's Rate Decisions

- Nexo wins the Best Cryptocurrency Wallet award at FinTech Breakthrough Awards

- Bitcoin may recover to $90k amid easing inflation concerns after FOMC meeting

- Crypto companies seeking bank charters under Trump admin — Report

Current Price

The current price of NEXO is $1.08936

Introduction

Nexo (NEXO) emerges as a notable player in the cryptocurrency lending ecosystem, established in 2018 with a suite of features designed to cater to various financial needs.

Users can earn interest on their crypto assets, access instant loans, and enjoy a secure platform backed by robust security protocols.

However, while the advantages are compelling, there are underlying concerns regarding regulatory compliance and the range of supported cryptocurrencies that may impact a user’s decision. An exploration of these factors reveals a complex landscape that warrants closer examination.

Quick Overview

- Nexo is a cryptocurrency lending platform offering crypto-backed loans and interest-earning accounts since 2018, focusing on security and transparency.

- Users can earn competitive interest on various cryptocurrencies, with daily compounding and dynamic rates based on market conditions.

- Instant loans are available, allowing users to borrow up to 50% of their crypto holdings, with repayment options in both crypto and fiat.

- Nexo employs a multi-layered security approach, including cold storage for assets and insurance coverage, ensuring user funds are protected.

- The platform supports major cryptocurrencies like Bitcoin and Ethereum, and offers unique benefits for users holding NEXO tokens, enhancing overall returns.

Overview of Nexo

Nexo operates as a prominent player in the cryptocurrency lending and borrowing sector, offering users an extensive suite of financial services tailored for digital asset management. Established in 2018, the platform has positioned itself as a versatile solution that integrates traditional finance principles with the burgeoning digital asset ecosystem.

Nexo’s core offerings include crypto-backed loans, interest-earning accounts, and exchange service, thereby catering to a diverse range of financial needs for both individual and institutional clients.

The platform’s operational framework is built on a strong foundation of security and transparency, employing advanced technology to guarantee the safety of user funds. Nexo’s unique proposition lies in its liquidity model, which allows users to access immediate cash without the need to sell their assets, therefore enabling them to retain exposure to potential market gains.

Additionally, the integration of its native token, NEXO, enhances user engagement by providing various benefits, including higher interest rates and reduced borrowing costs.

Key Features of Nexo

Nexo presents several key features that enhance its appeal in the cryptocurrency space, including the ability to earn interest on crypto holdings.

Additionally, the platform offers instant crypto loans, enabling users to access liquidity without needing to liquidate their assets.

Moreover, Nexo prioritizes security and insurance measures, ensuring that users’ investments are protected against potential risks.

Earning Interest on Crypto

In the domain of cryptocurrency investments, earning interest on digital assets has emerged as a compelling strategy for both novice and experienced investors. Nexo offers a robust platform for users to generate interest on their cryptocurrency holdings, providing an appealing alternative to traditional banking systems. By depositing various cryptocurrencies, users can earn competitive interest rates, which often surpass those offered by conventional savings accounts.

Nexo employs a unique model that allows users to earn interest compounded daily, enhancing the potential for growth over time. The platform supports a diverse range of cryptocurrencies, including popular options like Bitcoin, Ethereum, and stablecoins, enabling users to diversify their portfolios while still earning interest.

Moreover, Nexo’s interest rates are dynamic, subject to market conditions, which means they can fluctuate but often remain attractive due to Nexo’s liquidity and the innovative financial mechanisms it employs. The interest earned is paid out in the form of NEXO tokens, providing additional growth potential and aligning the interests of users with those of the platform.

Instant Crypto Loans

Leveraging cryptocurrency holdings can extend beyond earning interest, as platforms like Nexo provide users with the ability to access instant crypto loans. This feature is particularly appealing to individuals seeking liquidity without the need to liquidate their assets.

Nexo allows users to borrow up to 50% of the value of their cryptocurrency holdings, utilizing a seamless process that enables instant approval and fund disbursement. The platform’s loan mechanism operates on a collateralized basis, where users must deposit their cryptocurrency as collateral. This minimizes risk for the lender while offering borrowers the flexibility to access funds quickly.

Nexo supports a variety of cryptocurrencies, making it accessible to a broad user base. Furthermore, interest rates on loans are competitive and depend on the type of collateral provided.

Repayment terms are also flexible; users can choose to repay the loans in either cryptocurrency or fiat, which adds an additional layer of convenience. The option to maintain ownership of their assets while accessing cash flow is a significant advantage for those looking to navigate the volatile crypto market effectively.

Security and Insurance Measures

The security of user assets is paramount in the cryptocurrency landscape, and Nexo addresses this concern through a robust framework of security and insurance measures.

By implementing a multi-layered approach, Nexo guarantees the safety of its users’ digital assets against potential threats, such as hacking and fraud.

Key features of Nexo’s security and insurance measures include:

- Cold Wallet Storage: The majority of user funds are stored in cold wallets, which are offline and less vulnerable to cyber attacks.

- Insurance Coverage: Nexo provides insurance for digital assets held in its custody, protecting against potential losses due to security breaches.

- Regulatory Compliance: The platform adheres to relevant regulations and best practices in the cryptocurrency industry, enhancing its credibility and user trust.

- Two-Factor Authentication (2FA): Users are encouraged to enable 2FA to add an additional layer of security to their accounts, requiring a second verification step during login.

- Regular Security Audits: Nexo engages third-party security firms to conduct routine audits, guaranteeing that its systems remain secure and resilient against emerging threats.

Through these measures, Nexo demonstrates a commitment to safeguarding user assets in a volatile market.

How Nexo Works

Nexo operates by allowing users to earn interest on their cryptocurrency holdings through a straightforward process that leverages blockchain technology.

Users can also access instant crypto loans, which utilize their digital assets as collateral, ensuring liquidity without necessitating the sale of their investments.

This dual functionality enhances the utility of cryptocurrencies while providing users with flexible financial options.

Earning Interest on Crypto

Through a straightforward process, earning interest on cryptocurrency with Nexo allows users to maximize their digital asset portfolios.

Nexo offers a unique platform where users can earn interest on a variety of cryptocurrencies, transforming idle assets into profitable investments. This service is particularly appealing as it capitalizes on the growing demand for yield generation in the crypto space.

Key features of Nexo’s interest-earning mechanism include:

- Competitive Interest Rates: Nexo provides attractive rates that can vary based on the type and amount of cryptocurrency deposited.

- Daily Payouts: Users receive interest payments daily, ensuring consistent returns on their investments.

- Flexible Terms: Nexo allows users to choose between fixed and flexible terms, catering to individual investment strategies.

- No Lock-in Periods: Funds can be withdrawn at any time without penalties, offering liquidity and flexibility.

- Wide Range of Supported Assets: Users can earn interest on a diverse array of cryptocurrencies, enhancing portfolio diversification.

Instant Crypto Loans Process

Offering a seamless experience for users, the instant crypto loans process on Nexo enables individuals to leverage their digital assets without the need to sell them. This innovative model allows users to obtain liquidity quickly by using their cryptocurrencies as collateral.

The process begins with the user creating an account on the Nexo platform, after which they can deposit their digital assets. Once the assets are deposited, Nexo’s proprietary algorithm determines the user’s borrowing limit based on the value of the collateral.

Users can then select a loan amount, which can be up to 90% of the collateral value, and the funds are disbursed instantly in various fiat currencies or stablecoins. Interest rates are competitive and calculated daily, providing flexibility to borrowers who can repay at their convenience.

Moreover, Nexo’s loan process is designed with security in mind, employing robust measures to protect user assets. The platform’s transparency regarding fees and terms further enhances user trust.

Benefits of Using Nexo

Utilizing Nexo’s robust platform provides users with a multitude of advantages that cater to both novice and experienced cryptocurrency investors. The platform is designed to streamline the investment process while offering features that enhance user experience and financial growth.

Here are some key benefits of using Nexo:

- Instant Liquidity: Users can access immediate credit lines against their crypto holdings, allowing for quick financial maneuverability without the need to liquidate assets.

- User-Friendly Interface: Nexo’s platform is intuitive, making it accessible for those new to crypto while still offering in-depth tools for seasoned investors.

- Security Measures: Nexo employs industry-leading security protocols, including cold storage and two-factor authentication, to protect users’ funds and personal information.

- Multi-Currency Support: The platform supports a wide range of cryptocurrencies and fiat currencies, facilitating diverse investment strategies.

- Staking Opportunities: Users can earn interest on their crypto assets through staking, providing an additional revenue stream while holding cryptocurrencies.

These features position Nexo as a compelling choice for those looking to leverage their cryptocurrency investments effectively.

Nexo’s Interest Rates Explained

Nexo’s interest rate structure is a critical aspect for users seeking to maximize their returns on crypto assets. Various factors, including market demand, asset type, and the user’s loyalty tier, influence these rates, making them dynamic rather than fixed.

A comparative analysis with competitors reveals how Nexo positions itself within the broader landscape of cryptocurrency lending platforms.

Interest Rate Structure

Interest rates play an essential role in the attractiveness of any financial platform, and Nexo’s structure is designed to cater to a range of user needs. The platform offers competitive interest rates on both deposits and loans, making it an appealing choice for crypto investors.

Nexo’s interest rates vary depending on several factors, including the type of cryptocurrency and the user’s loyalty tier.

Key features of Nexo’s interest rate structure include:

- Competitive Rates: Nexo provides some of the highest rates in the market for crypto deposits.

- Dynamic Interest: Rates are adjusted based on market conditions, ensuring they remain attractive.

- Tiered System: Users are classified into loyalty tiers, affecting their interest rates and benefits.

- No Lock-up Period: Users can withdraw their assets at any time without penalties, adding flexibility.

- Interest Paid in NEXO Tokens: Users can opt to receive interest payments in NEXO tokens, potentially increasing their returns.

This structured approach to interest rates not only enhances user experience but also incentivizes long-term engagement with the platform, making it a significant option for both seasoned and novice investors.

Factors Influencing Rates

Several factors come into play when determining the interest rates offered by Nexo, influencing how attractive these rates can be for users. One primary factor is the type of asset being deposited or borrowed. Cryptocurrencies and stablecoins often yield different interest rates due to their inherent volatility and market demand. For instance, stablecoins may typically offer lower rates than more volatile assets, reflecting their relative stability.

Another significant factor is the overall market conditions, including interest rate trends across the broader financial landscape. When traditional financial institutions adjust their rates, Nexo may respond to remain competitive or to manage liquidity effectively.

Additionally, user engagement plays an essential role; users who hold Nexo tokens (NEXO) may benefit from preferential rates due to loyalty incentives.

Furthermore, the duration of deposit or loan agreements can influence the rates offered. Longer-term commitments may result in higher rates, serving as a reward for the reduced liquidity risk.

Comparison With Competitors

A thorough analysis of Nexo’s interest rates reveals how the platform stacks up against its competitors in the rapidly evolving cryptocurrency lending landscape. Nexo offers a range of interest rates that can be competitive, but these rates vary based on factors such as the type of cryptocurrency deposited and whether users opt for the native NEXO token.

When comparing Nexo’s interest rates to those of its key competitors, several critical factors emerge:

- Interest Rates: Nexo typically provides higher rates for stablecoin deposits compared to traditional banks and some rivals.

- Token Utilization: Users who hold and use NEXO tokens may enjoy additional interest rate boosts.

- Flexibility: Nexo offers flexible terms, allowing users to withdraw their assets at any time without penalty.

- Asset Variety: Nexo supports a broad spectrum of cryptocurrencies, accommodating diverse investor preferences.

- Reward Structure: The platform’s rewards system incentivizes long-term deposits, enhancing overall yield.

Security Measures in Place

When evaluating the security measures in place at Nexo, it becomes evident that the platform prioritizes the protection of user assets through a multi-faceted approach.

Nexo employs industry-standard security protocols, including two-factor authentication (2FA) to enhance account protection. This adds an essential layer of security by requiring not only a password but also a secondary verification method, thereby mitigating risks associated with unauthorized access.

Additionally, Nexo utilizes cold storage for the vast majority of user assets, ensuring that digital currencies remain offline and less susceptible to hacking attempts. This storage strategy is complemented by regular security audits and thorough monitoring systems that detect and respond to potential threats in real time.

Furthermore, Nexo is compliant with regulatory standards, which reinforces its commitment to operational transparency and user trust.

The platform also carries insurance coverage for digital assets held in its custody, providing an additional assurance to users regarding the safety of their investments.

Supported Cryptocurrencies

Nexo’s commitment to security extends to its diverse range of supported cryptocurrencies, which plays a significant role in attracting users to the platform. By offering a broad selection of digital assets, Nexo caters to both novice and experienced investors, allowing them to diversify their portfolios easily.

This extensive support enhances user engagement and provides opportunities for various investment strategies.

The following cryptocurrencies are currently supported by Nexo:

Nexo continually evaluates market trends and user demand, ensuring that its offerings remain relevant and competitive. The inclusion of both established cryptocurrencies and emerging tokens reflects its adaptive approach to the evolving landscape of digital assets.

Additionally, the platform provides users with the ability to earn yield on their holdings, a feature that enhances the appeal of investing in supported cryptocurrencies.

User Experience and Interface

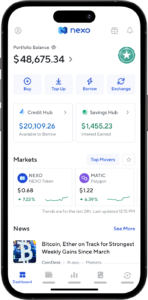

Designed to prioritize user engagement, the interface of Nexo offers a seamless experience for both novice and seasoned traders. The platform employs a clean and intuitive design, allowing users to navigate effortlessly through various features such as trading, lending, and borrowing.

The dashboard is well-organized, presenting essential information, including account balances, transaction history, and market trends, in a user-friendly format.

Nexo’s mobile application further enhances user experience by maintaining consistency with the web interface. It allows users to manage their assets on-the-go, guaranteeing that all functionalities, from trading to loan management, are easily accessible.

The responsive design guarantees that the platform is optimized for different screen sizes, facilitating usability across devices.

Additionally, the integration of advanced charting tools and analytics empowers users to make informed trading decisions. The inclusion of an educational section also aids beginners in understanding key concepts, which is vital for fostering confidence in their trading abilities.

Potential Drawbacks

While Nexo’s user experience and interface are commendable, several potential drawbacks warrant consideration for prospective users. Understanding these limitations is essential for informed decision-making in the cryptocurrency lending and borrowing space.

- Regulatory Concerns: Nexo operates in a rapidly evolving regulatory environment, which may impact its services and user experience.

- Interest Rates Variability: The interest rates offered on deposits and loans can fluctuate, potentially affecting user earnings and borrowing costs.

- Limited Cryptocurrency Support: Although Nexo supports a variety of cryptocurrencies, it may not include all popular assets, limiting options for users.

- Withdrawal Fees: Users may encounter fees when withdrawing funds or converting assets, which can diminish overall returns.

- Centralized Control: As a centralized platform, Nexo poses risks related to security breaches or operational failures, unlike decentralized alternatives.

These factors highlight the importance of conducting thorough research and weighing the pros and cons before committing to Nexo as a platform for cryptocurrency transactions.

Users should evaluate their individual needs and risk tolerance in light of these potential drawbacks.

Comparison With Competitors

A thorough comparison of Nexo with its competitors reveals significant differences in service offerings, user experience, and financial incentives. Nexo stands out primarily due to its unique combination of crypto lending, borrowing, and earning features, which are often not as seamlessly integrated in rival platforms such as BlockFi or Celsius.

Unlike some competitors that focus solely on lending or interest-earning products, Nexo offers an extensive suite that includes instant crypto loans, which are facilitated by its proprietary technology.

User experience is another area where Nexo excels. The platform’s interface is user-friendly, appealing to both novices and experienced users alike. In contrast, some competitors have been criticized for cumbersome processes and less intuitive designs, which can deter users from engaging fully with their services.

Financial incentives also vary markedly among platforms. Nexo’s competitive interest rates on deposits and flexible loan terms are attractive, particularly when compared to others that impose stricter conditions.

Additionally, Nexo’s loyalty program rewards users with higher interest rates based on their NEXO token holdings, providing a compelling reason for long-term engagement. Collectively, these factors position Nexo favorably within the rapidly evolving landscape of cryptocurrency financial services.

Frequently Asked Questions

Is Nexo Available in My Country?

To determine the availability of a specific cryptocurrency service in your country, it is essential to consult the platform’s official website or customer support for a thorough list of supported regions and regulatory compliance information.

How Do I Contact Nexo Customer Support?

To contact customer support, visit the official website and navigate to the support section. Utilize available communication channels, such as live chat, email, or phone, ensuring to provide relevant account details for efficient assistance.

What Are Nexo’s Fees for Transactions?

Transaction fees typically encompass various costs, including trading, withdrawal, and deposit fees. It is essential to review the specific fee structure provided by the platform, as these fees can greatly impact overall transaction costs.

Can I Earn Interest on Stablecoins With Nexo?

Yes, earning interest on stablecoins is possible through various platforms. Typically, users can deposit stablecoins to earn competitive interest rates, which may vary depending on the platform’s policies and market conditions. Always review specific terms.

Is There a Mobile App for Nexo?

Yes, a mobile application is available for users, providing a user-friendly interface to manage their accounts, access features, and perform transactions conveniently. This enhances usability and accessibility for individuals engaging with their digital assets on-the-go.

Wrapping Up

In conclusion, Nexo presents an extensive cryptocurrency lending and borrowing platform characterized by competitive interest rates and a user-friendly interface.

While advantages such as security measures and a diverse range of services are notable, potential drawbacks related to regulatory concerns and limited cryptocurrency support warrant consideration.

Overall, Nexo’s offerings position it as a viable option for users seeking flexible financial solutions within the cryptocurrency space, albeit with certain limitations that may impact user experience.