Latest News

- Crypto ETFs for XRP, SOL, and DOGE? The race heats up

- Avalanche Explained: Inside the Blockchain’s Three-Chain Architecture

- Cardano (ADA) Might Join Spot ETF Race

- Bitwise Files for Solana ETF as Donald Trump Era Sparks Crypto Optimism

Current Price

The current price of AVAX is $35.27450

Introduction

Welcome to our Avalanche review.

Avalanche (AVAX) has emerged as a significant contender in the layer 1 blockchain landscape since its inception in September 2020.

With a focus on scalability and rapid transaction finality, Avalanche offers a robust platform for decentralized applications and enterprise solutions alike.

Its unique consensus mechanism and Ethereum compatibility present intriguing advantages for developers and users.

However, as the blockchain space evolves, questions arise regarding its long-term viability and competitive positioning.

What factors will shape the future of Avalanche, and how does it compare to its contemporaries?

Let’s find out in this review.

Quick Overview

- Avalanche offers high scalability and speed, processing thousands of transactions per second with sub-second transaction finality.

- Its unique consensus mechanism enhances security and resilience against attacks while supporting interoperability with Ethereum dApps.

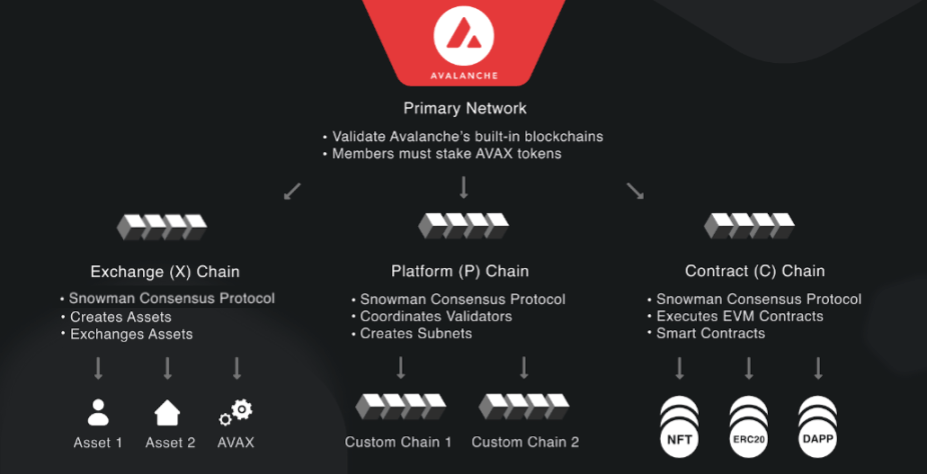

- The multi-chain architecture includes X-Chain, C-Chain, and P-Chain, allowing tailored blockchain creation for diverse applications.

- Staking on Avalanche incentivizes user participation in network security and governance, offering potential rewards for stakers.

- Despite its advantages, Avalanche faces challenges like a nascent ecosystem and regulatory scrutiny impacting adoption and user engagement.

Overview of Avalanche

Here is an excellent explainer video all about Avalanche blockchain:

Avalanche (AVAX) is frequently recognized as one of the leading blockchain platforms designed for decentralized applications and enterprise blockchain solutions. Since its launch in September 2020, Avalanche has positioned itself as a scalable, high-performance alternative to existing blockchain networks, addressing key issues such as transaction speed and interoperability.

The platform utilizes a unique consensus mechanism known as Avalanche consensus, which enables rapid transaction finality and supports thousands of transactions per second. This architecture is particularly beneficial for decentralized finance (DeFi) applications, where speed and efficiency are paramount.

Furthermore, Avalanche supports the Ethereum Virtual Machine (EVM), allowing developers to easily migrate their applications from Ethereum, thereby enhancing its appeal within the developer community.

Additionally, Avalanche employs a multi-chain architecture, which facilitates the creation of subnets—customized blockchains that can operate independently while benefiting from the security and scalability of the larger Avalanche network. This flexibility is essential for enterprises seeking tailored blockchain solutions.

Key Features of AVAX

The key features of AVAX highlight its innovative approach to blockchain technology, setting it apart from its competitors. One of the most notable aspects of Avalanche is its consensus mechanism, which combines the benefits of classical and Nakamoto consensus models. This enables high throughput and low latency, allowing for thousands of transactions per second while maintaining decentralization.

Additionally, Avalanche supports multiple virtual machines, including the Ethereum Virtual Machine (EVM), facilitating seamless interoperability with existing Ethereum dApps and smart contracts. This cross-compatibility is essential for developers looking to leverage Avalanche’s scalability without having to rewrite their code.

Another significant feature is the platform’s architecture, which comprises three distinct blockchains—X-Chain, C-Chain, and P-Chain—each optimized for specific functions. This modular approach enhances performance and flexibility, allowing for optimized resource allocation.

Furthermore, Avalanche’s emphasis on security through its unique subnet feature enables the creation of customized blockchains tailored for specific applications or regulatory requirements. This adaptability positions AVAX as a promising solution for a wide range of use cases, from DeFi to enterprise applications, solidifying its potential in the evolving blockchain landscape.

How Avalanche Works

Avalanche operates through a unique consensus mechanism that enhances both speed and security within its network.

This mechanism is complemented by a robust network architecture designed to support high throughput and scalability.

Understanding these components is essential to appreciate how Avalanche achieves its performance goals in the blockchain ecosystem.

Consensus Mechanism Explained

At the core of Avalanche’s functionality lies its innovative consensus mechanism, which distinguishes it from traditional blockchain protocols. This mechanism is primarily based on a unique variant of the Proof of Stake (PoS) model, utilizing a multi-layered approach that enhances scalability and transaction finality.

Unlike conventional systems that rely on linear chains, Avalanche employs a Directed Acyclic Graph (DAG) structure, allowing multiple transactions to be processed simultaneously.

The consensus process involves a novel technique known as “Snowball,” which aggregates the opinions of network validators through repeated sampling. Validators randomly select a subset of peers to confirm transactions, which promotes rapid propagation of information throughout the network. This approach reduces the time to finality to mere seconds, making Avalanche particularly suitable for decentralized finance (DeFi) applications and high-frequency trading.

Additionally, the system’s ability to achieve consensus without a central authority guarantees resilience against attacks, thereby enhancing security.

Network Architecture Overview

Built upon a robust and modular framework, Avalanche’s network architecture is designed to optimize performance and flexibility in blockchain operations. This architecture consists of three integrated blockchains: the Exchange Chain (X-Chain), the Contract Chain (C-Chain), and the Platform Chain (P-Chain), each serving distinct purposes while working cohesively to enhance overall functionality.

The X-Chain is primarily responsible for asset transfers, utilizing the Avalanche consensus protocol to guarantee rapid transaction finality and high throughput. The C-Chain, built on the Ethereum Virtual Machine (EVM), enables the deployment of smart contracts, facilitating interoperability with existing Ethereum applications.

Meanwhile, the P-Chain manages network validators and coordinates the creation of subnets—customized blockchains tailored to specific use cases.

This unique architecture supports scalability and decentralization, allowing for parallel processing of transactions across subnets. By enabling developers to create specialized environments, Avalanche can accommodate a wide range of applications without compromising performance.

Consequently, Avalanche’s network architecture not only addresses the limitations of traditional blockchain frameworks but also positions it as a versatile platform for future innovations in the blockchain space.

Consensus Mechanism Explained

In the domain of blockchain technology, the consensus mechanism plays a pivotal role in ensuring the integrity and efficiency of transactions. Avalanche employs a unique consensus protocol known as Avalanche consensus, which combines aspects of classical consensus mechanisms with novel approaches to achieve high throughput and low latency.

Unlike traditional Proof of Work or Proof of Stake systems, Avalanche’s consensus is based on a directed acyclic graph (DAG) structure, allowing for parallel processing of transactions.

The Avalanche consensus mechanism operates through repeated random sampling of nodes, enabling the network to reach consensus quickly and efficiently. Each participant in the network verifies transactions by querying a small, randomly selected subset of nodes, which reduces the time and computational resources needed for agreement.

This method facilitates a high degree of scalability, as the network can accommodate a growing number of transactions without significant delays.

Moreover, the Avalanche consensus is designed to be resilient against various attack vectors, enhancing its security profile. By leveraging the benefits of both classical and probabilistic approaches, Avalanche stands out as a robust solution for decentralized applications and smart contracts, maintaining a balance between performance and security.

Advantages of Using AVAX

The advantages of using Avalanche (AVAX) are closely tied to its innovative consensus mechanism, which not only enhances transaction speed and efficiency but also promotes a versatile environment for decentralized applications.

The Avalanche protocol achieves sub-second transaction finality, allowing users to interact with the network in real-time, an essential feature for applications requiring immediate responses, such as decentralized finance (DeFi) platforms and gaming.

Additionally, the platform’s architecture supports the creation of custom blockchains, enabling developers to tailor their environments to specific use cases without sacrificing performance.

This flexibility encourages innovation, as projects can leverage the unique characteristics of their own chains while still benefiting from the security and interoperability provided by the Avalanche ecosystem.

Furthermore, AVAX employs a robust staking mechanism that incentivizes users to participate in network security and governance.

This not only enhances the decentralization of the network but also provides stakers with potential rewards, aligning the interests of the community with the overall health of the platform.

Potential Drawbacks

Despite its numerous advantages, Avalanche (AVAX) is not without potential drawbacks that users and developers should consider. One significant concern is the platform’s relatively nascent ecosystem compared to more established blockchain networks like Ethereum.

While AVAX offers innovative features, the volume of decentralized applications (dApps) and user engagement may not yet match that of its competitors, potentially limiting its immediate utility.

Additionally, the consensus mechanism that underpins Avalanche, while efficient, has faced scrutiny regarding its security and resilience against certain types of attacks. The reliance on a limited number of validators can pose risks, particularly in scenarios where malicious actors attempt to disrupt the network’s operations.

Moreover, the volatility of AVAX’s market price can be a double-edged sword. While it may present investment opportunities, it also introduces uncertainty for developers and users who may rely on stable transaction costs for their applications.

Lastly, regulatory scrutiny surrounding cryptocurrencies continues to evolve, and Avalanche is not immune to potential regulatory challenges that could impact its usage and adoption in various jurisdictions.

This regulatory landscape remains a critical factor that could influence the platform’s long-term viability.

Comparison With Other Blockchains

In comparing Avalanche (AVAX) to other blockchain platforms, two critical factors emerge: scalability and speed, alongside smart contract functionality.

Avalanche’s unique consensus mechanism allows for high throughput and low latency, positioning it favorably against established networks like Ethereum.

Evaluating these characteristics provides insight into Avalanche’s competitive edge and potential use cases in the evolving blockchain landscape.

Scalability and Speed

Avalanche (AVAX) distinguishes itself with its remarkable scalability and speed, positioning it favorably against other prominent blockchains. Unlike Ethereum, which has faced challenges with network congestion and high transaction fees, Avalanche offers a highly efficient consensus mechanism that allows it to process thousands of transactions per second (TPS). This capability stems from its unique architecture, which employs three interoperable blockchains—X-Chain, C-Chain, and P-Chain—each optimized for different functionalities.

When compared to competitors like Solana and Binance Smart Chain, Avalanche maintains a strong performance regarding transaction finality, achieving this in under one second. This rapid confirmation time enhances user experience and facilitates real-time applications, making Avalanche appealing for decentralized finance (DeFi) and other use cases.

Moreover, the platform’s ability to scale horizontally by adding more validators contributes to its resilience against potential bottlenecks. This scalability guarantees that as user demand increases, the network can adapt without sacrificing performance.

Layer 1 Blockchain Comparison

Our expert team here at Trade Wise has researched and created a comparison table of the most popular layer 1 blockchains including all of the most important data on each chain, including; theoretical transactions per second, average transaction fee, time to finality and much more.

We collected this data in June 2024 so it may change over time (especially gas fees, and Solana’s theoretical TPS will increase significantly with the Firedancer upgrade for example).

This table contains all the data you need to make an informed comparison of how the most popular layer 1 blockchains perform and the strengths and weaknesses of each.

Blockchain Performance Comparison (June 12, 2024)

| Ethereum | Cardano | Solana | Avalanche | Algorand | Internet Computer | |

|---|---|---|---|---|---|---|

| Theoretical TPS | 119 | 386 | 65,000 | n/a (4,500 TPS was claimed previously) | 6,000 | 11,500 |

| Live TPS | 14 | 1.96 | 2,100 (including vote TXs) 980 (excluding vote TXs) | 3.5 (C-Chain only) 15.5 (including subnets) | 28.9 | ~6,000 |

| Average Transaction Fee | $8.57 | $0.17 | $0.02 | $0.27 | $0.0008 | $0.0012 (ICP transfers) |

| Transaction Finality | ~15 minutes | 12 hours (absolute certainty) Between 2 min and 25 min (practical purposes) | ~12 seconds | ~1 second | Instant (~3 second block time) | ~2 seconds (NNS transactions) |

| Node Count | 6,592 | 3,088 | 4,046 | 1,731 | 1,489 | 559 |

| Energy Consumption | 0.0026 TWh (annualized) | 0.0025 TWh (annualized) | 0.022 TWh (Mar 2022 – Feb 2023) | 0.00046 TWh (annualized) | 0.00070 TWh (annualized) | 0.00074 TWh (annualized) |

Smart Contract Functionality

Frequently, the effectiveness of smart contract functionality serves as a essential differentiator among blockchain platforms.

Avalanche (AVAX) distinguishes itself through its unique architecture that supports the Ethereum Virtual Machine (EVM), allowing developers to easily deploy Ethereum-compatible smart contracts. This compatibility is important as it facilitates a seamless migration of existing dApps and attracts a wider developer community.

When compared to Ethereum, Avalanche offers enhanced scalability and lower transaction costs, addressing some of the long-standing issues that have plagued Ethereum’s network.

However, unlike Solana, which boasts high throughput due to its unique consensus mechanism, Avalanche maintains a balance between decentralization and performance, supporting a diverse array of applications without sacrificing security.

Moreover, Avalanche’s multi-chain structure allows for the creation of custom blockchains, or subnets, each with tailored regulatory and governance frameworks.

This is a significant advantage over more rigid infrastructures, as it caters to niche use cases and compliance needs.

Future Prospects for AVAX

The future prospects for Avalanche (AVAX) appear promising, driven by its unique consensus mechanism and the growing demand for scalable blockchain solutions. As decentralized finance (DeFi) and non-fungible tokens (NFTs) continue to gain traction, Avalanche’s ability to process thousands of transactions per second positions it as a strong competitor in the blockchain landscape.

Several factors contribute to the optimistic outlook for AVAX:

- Scalability: Its architecture allows for parallel processing, enabling efficient handling of high transaction volumes without compromising security.

- Interoperability: Avalanche’s ability to create custom blockchains facilitates seamless communication between different networks, which is increasingly essential in a multi-chain ecosystem.

- Developer Adoption: The growing community of developers creating dApps on Avalanche indicates a robust ecosystem that can attract users and investors alike.

- Institutional Interest: Increasing interest from institutional players could further bolster AVAX’s market position and credibility.

Getting Started With Avalanche

To commence utilizing Avalanche (AVAX), users should first familiarize themselves with the platform’s foundational components and ecosystem. Avalanche is a decentralized platform designed for launching decentralized applications (dApps) and custom blockchain networks. Its unique architecture, consisting of three integrated blockchains—X-Chain, C-Chain, and P-Chain—enables high throughput and rapid finality, making it an attractive option for developers and users alike.

To get started, users need to create a wallet that supports AVAX. Several options exist, including the Avalanche Wallet, which offers a user-friendly interface and seamless asset management. Once the wallet is set up, users can acquire AVAX through various exchanges that list the token, such as Binance or Coinbase.

After obtaining AVAX, users can participate in the network by staking their tokens to secure the ecosystem and earn rewards. This is particularly relevant given Avalanche’s consensus mechanism, which prioritizes both speed and decentralization.

Additionally, users can explore dApps built on Avalanche, ranging from DeFi platforms to NFT marketplaces, thereby maximizing the utility of their AVAX holdings. Understanding these elements will empower users to navigate the Avalanche ecosystem effectively.

Frequently Asked Questions

What Wallets Support Avalanche (Avax) Tokens?

Various wallets support AVAX tokens, including hardware wallets like Ledger and Trezor, as well as software wallets such as MetaMask, Trust Wallet, and the official Avalanche Wallet. These options provide secure storage and easy access to assets.

How Can I Stake AVAX Tokens?

To stake AVAX tokens, users typically select a compatible wallet, delegate their tokens to a chosen validator, and follow the staking process outlined by the platform, ensuring compliance with minimum requirements and understanding potential risks involved.

Is AVAX Available on Major Exchanges?

Avalanche (AVAX) is indeed available on several major cryptocurrency exchanges, including Binance, Coinbase, and Kraken. This accessibility enhances its liquidity and allows users to trade and invest in AVAX with relative ease and security.

What Is the Total Supply of AVAX Tokens?

The total supply of AVAX tokens is capped at 720 million. This predetermined limit aims to create scarcity, enhance value, and guarantee a balanced economic structure within the Avalanche ecosystem, fostering sustainable growth and development.

How Does AVAX Handle Network Security?

Network security in blockchain ecosystems is critical, and AVAX employs a unique consensus mechanism called Avalanche Consensus. This method enhances security by enabling rapid finality, reducing the risk of double-spending, and ensuring robust network resilience against attacks.

Wrapping Up

In conclusion, Avalanche (AVAX) delivers a robust blockchain platform characterized by its scalability, rapid transaction finality, and compatibility with Ethereum.

Its innovative consensus mechanism and multi-chain architecture facilitate a diverse range of applications, particularly within decentralized finance and non-fungible tokens.

The platform’s growing developer community and user engagement further enhance its ecosystem.

Future prospects for AVAX appear promising, indicating potential for continued growth and adoption in the evolving landscape of blockchain technology.