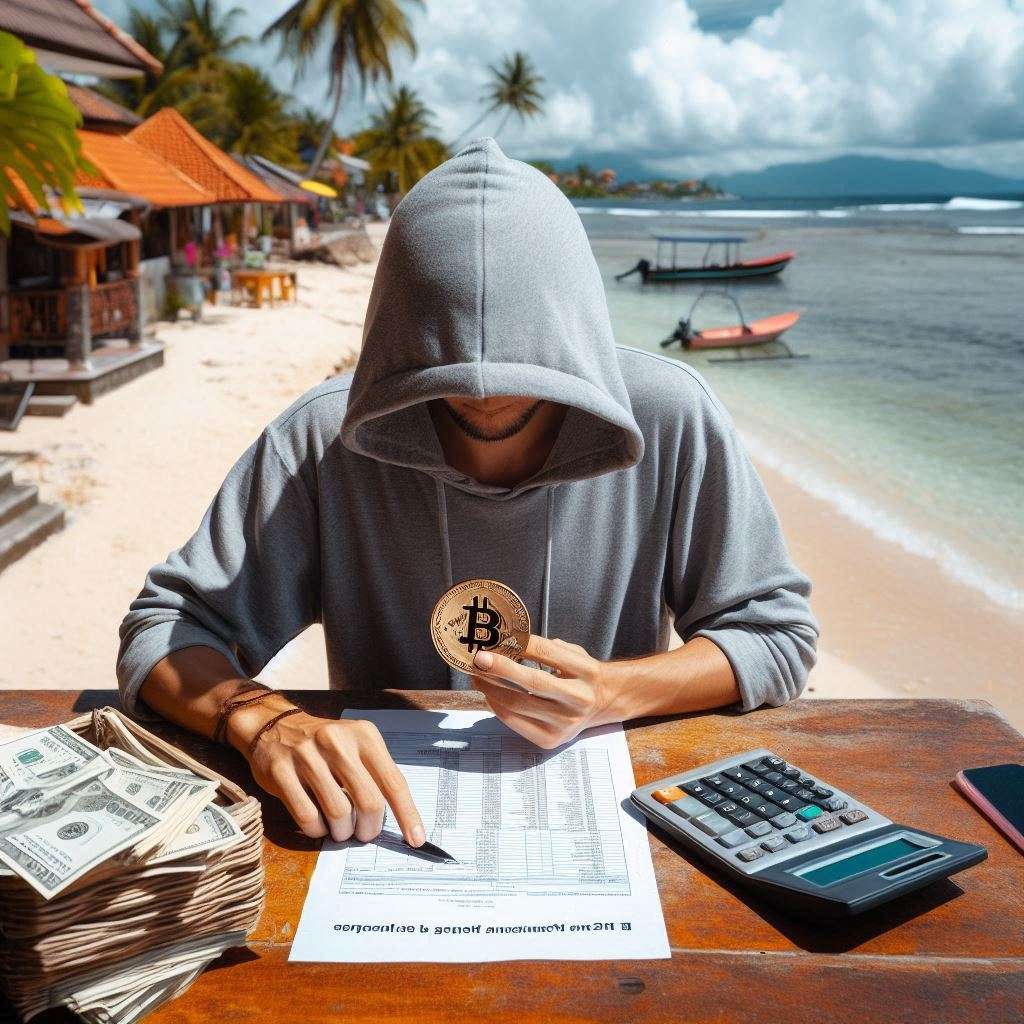

Did you know that 10% of crypto gains in Bali are subject to tax?

If you’re an investor, you need to pay attention.

Indonesia’s tax laws can be tricky, especially when it comes to digital assets.

Cryptocurrencies and NFTs fall under specific regulations. Reporting every transaction accurately is essential to avoid hefty penalties.

You’ll also need to understand how holding periods affect your tax rates.

Staying compliant is vital, but how do you do it effectively?

Let’s explore what you need to know to navigate the crypto tax landscape in Bali.

Quick Overview

- Cryptocurrencies are classified as digital assets in Bali, impacting their investment and taxation treatment.

- Capital gains from selling crypto are taxable, with rates varying based on the holding period.

- Accurate reporting of crypto transactions is mandatory to avoid penalties and ensure compliance.

- NFTs are treated similarly to cryptocurrencies and have specific tax rules.

- Consulting tax professionals can provide guidance on meeting local tax obligations and optimizing tax strategies.

Understanding Indonesia’s Tax Laws

Maneuvering Indonesia’s tax laws is vital if you’re dealing with crypto in Bali. Understanding the local tax framework helps you avoid penalties and keeps your investments safe.

Tax Residency

First, establish your tax residency. If you spend over 183 days in Indonesia within a year, you’re considered a tax resident. This status impacts your tax obligations.

Digital Assets

Digital assets, including cryptocurrencies, are subject to specific tax rules in Indonesia. You must report any gains from these assets. Ignoring this can lead to hefty fines.

Foreign Investments

Foreign investments add another layer of complexity. If you’re an expat or a foreign investor, you need to comply with both Indonesian laws and those of your home country.

Double-checking these details is necessary.

Compliance Obligations

Don’t overlook compliance obligations. You must file regular tax returns and maintain accurate records of your transactions.

This keeps you in good standing with tax authorities.

Capital Gains

Capital gains from digital assets are taxable. The rate may vary, so it’s wise to consult a tax advisor.

Properly reporting your gains guarantees you meet all legal requirements.

Cryptocurrency Classification in Bali

Understanding how cryptocurrencies are classified in Bali is vital. The way Bali handles crypto asset classification impacts how you invest and comply with local laws. Digital currency regulations here categorize cryptocurrencies mainly as assets rather than currencies.

Key Points to Know

- Crypto Asset Classification: In Bali, cryptocurrencies are considered “digital assets” under the law. This classification affects how they’re treated for investment and taxation purposes.

- Taxation of NFTs: Non-fungible tokens (NFTs) fall under the same digital currency regulations. Bali’s authorities treat them as unique digital assets, subject to specific tax rules.

- Blockchain Technology Implications: The adoption of blockchain technology in Bali influences regulations. Authorities monitor its use to guarantee compliance with investment categorization guidelines.

Why This Matters

Understanding these classifications helps you navigate the complex regulatory landscape. It also informs your investment decisions.

Knowing how Bali views different types of digital assets can save you from legal pitfalls and unexpected taxes.

Staying updated on digital currency regulations and blockchain technology implications is vital. Make certain your investments align with the local guidelines to optimize your returns and stay compliant.

Tax Implications for Crypto Transactions

Maneuvering the tax implications for crypto transactions in Bali can be complex but vital. Knowing how taxes affect your investments keeps you compliant and avoids penalties.

Capital Gains

When you sell crypto at a profit, you incur capital gains. You must pay taxes on these gains. The rate depends on how long you’ve held the asset. Short-term gains are taxed higher than long-term gains.

Transaction Fees

Transaction fees also come into play. They can be deductible if they’re directly related to buying or selling crypto. Keep a record of all transaction fees. They can lower your taxable income.

Taxable Events

Not all transactions are taxable events. Buying crypto with fiat is generally not taxable.

However, selling or trading crypto triggers a taxable event. Even using crypto to buy goods or services can be a taxable event.

Tax Exemptions

Some transactions might be eligible for tax exemptions. For example, if you donate crypto to a recognized charity, you might get a tax break.

Always check the latest regulations.

Record Keeping

Good record keeping is essential. Track every transaction, including dates, amounts, and purposes.

This makes it easier to calculate gains, losses, and fees come tax time.

Reporting Requirements for Investors

After understanding how different transactions impact your taxes, let’s focus on reporting requirements. You’ll need to stay on top of several key aspects to guarantee tax compliance.

Tax Forms

You’ll need to fill out specific tax forms for your crypto activities. It’s vital to accurately report all your transactions. This includes trades, sales, and any income you receive from crypto.

These forms help classify your income correctly.

Reporting Deadlines

Deadlines are essential. Missing them can lead to penalties. Bali’s tax authorities expect timely submissions.

Usually, the deadline aligns with the annual tax filing date. However, always double-check for any updates.

Income Classification

Classifying your income is important. Crypto earnings can be considered capital gains or regular income.

The classification affects how much tax you’ll owe. Be precise to avoid complications later.

Foreign Investments

If you hold foreign investments, you must report them. Not doing so can lead to severe penalties.

Bali’s tax authorities are stringent about foreign asset reporting.

In Summary

In conclusion, don’t overlook these key points:

- Accurate tax forms: Keep detailed records.

- Meet reporting deadlines: Avoid penalties.

- Classify income correctly: Guarantee proper taxation.

Proper reporting keeps you compliant and stress-free. Stay organized, and you’ll navigate Bali’s crypto tax landscape smoothly.

Tax Planning Strategies

Crafting an effective tax plan can save you a lot of money. Let’s explore how.

Deductible Expenses

Keep track of your deductible expenses. These can lower your taxable income.

Expenses related to your crypto investments, like software or transaction fees, might qualify. Always keep receipts and documentation.

Capital Gains

Understand how capital gains work. If you hold your crypto for over a year, you might qualify for lower tax rates.

Plan when you sell to take advantage of this. Timing can make a big difference.

Tax Credits

Look into available tax credits. Some investments or activities may qualify you for credits.

These can directly reduce your tax bill. Always explore what’s available to you.

Offshore Accounts

Offshore accounts can be part of your strategy. They might offer tax benefits.

However, they come with strict reporting requirements. Make sure you comply with all regulations.

Financial Planning

Good financial planning is key.

Consult a tax advisor familiar with crypto taxes in Bali. They can help you navigate the complexities and optimize your tax strategy.

Frequently Asked Questions

How Can Crypto Investors Find Local Tax Advisors in Bali?

To find local tax advisors in Bali, use online platforms and financial forums. Tap into expat communities and attend networking events. Leverage local resources to get recommendations and insights from those already traversing the tax landscape.

Are There Any Tax Incentives for Cryptocurrency Investments in Bali?

Yes, there are tax benefits for cryptocurrency investments in Bali. The regulatory environment supports favorable investment opportunities. Local exchanges boost the economic impact, making it an attractive option for investors seeking growth.

What Are the Penalties for Failing to Report Crypto Earnings in Bali?

Imagine a storm brewing. If you ignore your reporting obligations, tax evasion consequences hit hard. Fines and penalties can be severe. Employ tax compliance strategies to avoid legal repercussions. Stay informed and compliant to avoid trouble.

How Do Bali’s Crypto Tax Laws Compare to Other Countries in Southeast Asia?

Bali regulations have stricter tax rates compared to some Southeast Asian countries. You’ll find the investment environment less flexible. Compliance requirements are stringent, promoting financial transparency. In contrast, other nations may offer more lenient policies.

Can Tourists Use Cryptocurrencies Without Tax Implications in Bali?

Imagine Bali as a digital marketplace. Tourists can’t expect tax-free transactions. Local regulations govern cryptocurrency adoption. Digital payments by tourists must follow these rules. Always check tourist guidelines to verify compliance with local tax laws.

Conclusion

To conclude, managing crypto taxes in Bali isn’t just important—it’s a life-or-death mission for your wallet!

You’ve got to understand Indonesia’s tax laws, classify your assets correctly, and report every detail with precision.

Don’t cut corners!

Keep those records as if your financial future depends on it—because it does.

Consult a tax pro if you want to sleep easy.

Compliance isn’t optional, it’s essential. Get it right, or face the wrath of tax penalties!