Latest News

- dYdX & Chaos Labs Launch $20M Trading Competition

- Bipartisan Crypto Bill To Fight Illegal Blockchain Activity Reintroduced in U.S. House

- DYDX Price Pumps 7% After Buyback Announcement Sparks Investor Optimism

- dYdX Foundation CEO Charles d’Haussy on Buybacks, Staking, and Ecosystem Growth

Current Price

The current price of DYDX is $0.59378

Introduction

In the rapidly evolving landscape of decentralized finance, Dydx emerges as a notable contender, distinguished by its advanced trading capabilities and robust infrastructure.

As a platform that integrates margin trading, lending, and borrowing within a Layer-2 framework, it aims to enhance user experience through faster transactions and lower fees.

However, the true potential of Dydx lies in its unique features and the implications of its native token, DYDX.

The following exploration will reveal key insights into how Dydx stands against its competitors and what the future may hold for this promising platform.

Quick Overview

- Dydx offers advanced trading features like margin trading and perpetual contracts within a decentralized framework, appealing to experienced traders.

- The platform utilizes a Layer-2 scaling solution on Ethereum, enhancing transaction speed and reducing gas fees for users.

- Dydx employs a unique order book model, providing deeper liquidity and allowing for limit and market order placements.

- Rigorous security measures, including smart contract audits and cold storage, ensure user funds are protected from online threats.

- The Dydx Token (DYDX) facilitates governance participation, staking rewards, and trading incentives, enhancing user engagement and ecosystem stability.

Overview of Dydx Platform

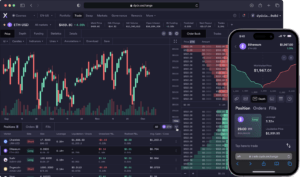

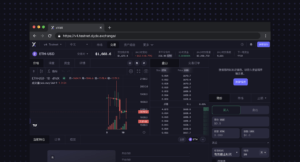

The Dydx platform stands out in the decentralized finance (DeFi) landscape by offering users advanced trading features typically associated with centralized exchanges.

It integrates a sophisticated layer-2 scaling solution built on Ethereum, which enhances transaction speed and reduces gas fees, addressing common limitations within the Ethereum network. This infrastructure allows for efficient execution of trades and provides users with the ability to conduct margin trading, lending, and borrowing within a decentralized framework.

Dydx supports a variety of trading pairs and leverages an order book model, which provides deeper liquidity compared to traditional automated market makers (AMMs). This enables traders to place limit orders, enhancing their control over trade execution.

Additionally, the platform employs a robust risk management system that incorporates liquidation mechanisms to protect against excessive losses.

Security is paramount, and Dydx utilizes smart contracts that are subject to rigorous audits, ensuring a secure trading environment.

The platform also emphasizes user privacy and control, allowing traders to maintain custody of their assets while engaging in various financial activities.

Understanding Dydx Token

Dydx Token (DYDX) serves as a pivotal component of the Dydx ecosystem, enabling users to engage in governance, staking, and trading incentives within the platform. The token operates on the Ethereum blockchain, leveraging its robust infrastructure to facilitate decentralized finance (DeFi) functionalities.

DYDX holders can participate in governance decisions, influencing the platform’s future developments and protocol adjustments through voting mechanisms.

The staking aspect of DYDX allows users to lock their tokens to earn rewards, promoting long-term engagement and stability within the ecosystem. This incentivization aligns user interests with the platform’s performance, encouraging a flourishing community.

Additionally, the token is integral to the trading incentives offered by Dydx, as it can be used to reduce fees and enhance user experience on the exchange.

Moreover, the supply dynamics of DYDX, including mechanisms for token burns and emissions, are designed to create a balanced economic model that supports both liquidity and valuation over time.

As the DeFi landscape continues to evolve, the role of DYDX will likely adapt, reflecting the broader trends within this sector while maintaining its core functionalities that underpin the Dydx platform.

Key Features of Dydx

A thorough understanding of Dydx Token (DYDX) highlights its importance within the broader Dydx ecosystem, but the platform itself offers a suite of features that enhance the user experience and operational efficiency.

Central to Dydx’s appeal is its decentralized trading model, which empowers users by facilitating peer-to-peer transactions without intermediaries. This model not only reduces reliance on traditional financial institutions but also mitigates counterparty risk.

The platform integrates advanced order types such as limit, market, and stop orders, providing traders with flexibility in executing their strategies. Additionally, Dydx supports perpetual contracts, allowing users to trade with leverage while managing their risk exposure effectively. The margin trading feature enables users to borrow funds, amplifying potential returns on investment.

Moreover, the Dydx protocol employs a Layer 2 scaling solution, enhancing transaction speeds and reducing gas fees, which are critical in maintaining an efficient trading environment.

The user interface is designed for intuitive navigation, catering to both novice and experienced traders. Collectively, these key features establish Dydx as a robust platform, poised to meet the evolving demands of the decentralized finance (DeFi) landscape.

Benefits for Traders

Traders on the Dydx platform benefit from advanced trading features that enhance their market strategies and execution capabilities.

Additionally, the low fees associated with transactions provide a significant incentive, allowing traders to maximize their profitability.

These advantages contribute to a more efficient trading environment, making Dydx a competitive choice for active market participants.

Advanced Trading Features

The advanced trading features offered by Dydx greatly enhance the capabilities of users in the cryptocurrency market. The platform provides a thorough suite of tools designed for both novice and experienced traders. One of the standout features is the ability to engage in decentralized margin trading, which allows users to leverage their positions. This feature is critical for traders aiming to amplify their potential returns, albeit with increased risk.

Additionally, Dydx supports limit and market orders, providing flexibility in execution strategies. Traders can set specific price points to buy or sell assets, ensuring that they can capitalize on market fluctuations without the need for constant monitoring.

The platform’s advanced charting tools further facilitate technical analysis, offering users insights into market trends and helping them make informed trading decisions.

Moreover, Dydx integrates with various decentralized finance (DeFi) protocols, allowing for seamless asset management and increased liquidity options. This interconnectedness enhances the trading experience by providing users with access to a broader range of assets and investment strategies.

Low Fees Incentive

Low trading fees serve as a significant incentive for users on the Dydx platform, fostering an environment conducive to strategic investment. By minimizing transaction costs, Dydx allows traders to execute high-frequency trades and engage in various strategies without the burden of excessive fees. This is particularly advantageous for algorithmic traders who rely on tight margins and rapid execution.

The fee structure on Dydx is designed to be competitive within the decentralized finance (DeFi) space. Users benefit from a tiered system where lower fees are applied as trading volumes increase, encouraging higher activity levels. In addition, with no hidden charges or unexpected fees, traders can make informed decisions based on transparent cost structures.

This low-fee incentive also enhances user engagement and retention. As traders save on costs, they are more likely to reinvest those savings into additional trades, potentially increasing their overall returns.

Additionally, lower fees may attract a diverse user base, from retail investors to professional traders, thereby promoting liquidity and market depth on the platform. Overall, Dydx’s commitment to low trading fees aligns with its goal of providing a user-friendly and efficient trading experience.

Comparison With Competitors

In evaluating Dydx within the broader landscape of cryptocurrency trading platforms, several key factors emerge that differentiate it from its competitors. Dydx operates as a decentralized derivatives exchange, emphasizing a unique combination of on-chain settlement and order book functionality. This contrasts with centralized exchanges like Binance and Coinbase, which function under a different operational paradigm, primarily relying on customer trust and centralized liquidity pools.

One notable aspect is Dydx’s focus on advanced trading features, such as perpetual contracts and margin trading, which are not universally available on all decentralized platforms. This positions Dydx as a more sophisticated option for experienced traders seeking leverage.

Additionally, the platform’s integration of layer-2 solutions aims to enhance scalability and reduce transaction fees, a common pain point for users of Ethereum-based applications.

When compared to other decentralized exchanges like Uniswap or SushiSwap, Dydx offers a more structured trading environment, appealing to users who prioritize advanced trading tools over simple token swaps.

Security and Trustworthiness

Guaranteeing robust security and trustworthiness is paramount for any cryptocurrency trading platform, and Dydx adopts several measures to safeguard user assets and data. The platform employs a decentralized architecture, which mitigates single points of failure.

Utilizing smart contracts on the Ethereum blockchain, Dydx guarantees transparency in transactions and enhances security by minimizing reliance on centralized intermediaries.

Dydx also incorporates rigorous security protocols, such as multi-signature wallets and two-factor authentication (2FA), which fortify user accounts against unauthorized access.

The implementation of cold storage for a significant portion of user funds further reduces exposure to online threats, providing an extra layer of protection against hacking attempts.

Additionally, the platform undergoes regular security audits conducted by third-party firms to identify potential vulnerabilities and guarantee compliance with industry standards.

Dydx’s commitment to transparency is further reflected in its public disclosure of audit results, fostering trust among users.

Future Prospects and Developments

The future prospects for dYdX are shaped by a series of anticipated features that aim to enhance user experience and functionality.

Market adoption trends suggest a growing interest in decentralized finance solutions, which could further bolster dYdX’s position in the ecosystem.

Additionally, the potential for integration with other platforms may facilitate increased liquidity and broaden the user base, driving overall growth.

Upcoming Features Overview

As Dydx continues to evolve, several upcoming features are poised to enhance its functionality and user experience. These developments aim to solidify Dydx’s position in the decentralized finance (DeFi) landscape by addressing user needs and integrating advanced capabilities.

Key features on the horizon include:

- Expanded Asset Support: Introduction of additional cryptocurrencies and trading pairs, allowing for a more diverse trading portfolio.

- Improved User Interface: A revamped interface aimed at increasing user engagement and simplifying navigation for both novice and experienced traders.

- Advanced Order Types: Implementation of new order types such as conditional and trailing stop orders, providing traders with enhanced control over their strategies.

- Layer 2 Solutions: Integration of Layer 2 scaling solutions to improve transaction speeds and reduce gas fees, thereby optimizing the trading experience.

- Educational Resources: Development of extensive educational tools and resources to empower users in understanding complex trading strategies and market dynamics.

These forthcoming features not only align with Dydx’s commitment to innovation but also reflect a strategic response to the rapidly changing demands of the DeFi ecosystem, positioning the platform for sustained growth and user retention.

Market Adoption Trends

Market adoption trends for Dydx indicate a promising trajectory as decentralized finance continues to gain traction among both retail and institutional investors.

Analysis of user engagement metrics reveals a steady increase in transaction volumes and active user accounts, underscoring a growing confidence in Dydx’s capabilities as a decentralized trading platform.

The rise of decentralized exchanges (DEXs) has been pivotal in shaping the market landscape, with Dydx positioning itself as a leader in this sector.

Its innovative features, including perpetual contracts and margin trading, cater to the evolving needs of sophisticated traders, thereby attracting a diverse user base.

Additionally, the platform’s emphasis on security and user experience enhances its appeal, fostering a robust community around its ecosystem.

Institutional interest is also on the rise, driven by the increasing acceptance of cryptocurrencies and the need for more sophisticated trading options.

As regulatory frameworks continue to evolve, Dydx is poised to leverage these changes, potentially increasing its market share.

Integration With Other Platforms

Integration with other platforms is a key area of focus for Dydx, as it aims to enhance its functionality and broaden its user base within the decentralized finance ecosystem. This strategic direction not only facilitates interoperability but also promotes liquidity and user engagement across various decentralized applications (dApps).

Dydx is exploring several integration opportunities, which may include:

- Cross-platform compatibility: Enabling seamless trading across different DeFi protocols.

- Partnerships with wallets: Facilitating user access through popular cryptocurrency wallets.

- Liquidity pools: Collaborating with other platforms to enhance liquidity provisions.

- Oracles integration: Utilizing decentralized oracles for accurate price feeds and risk management.

- Governance collaboration: Engaging with other networks to strengthen governance models and community involvement.

These integrations are vital for Dydx’s growth, as they will help solidify its position in the competitive DeFi landscape.

By fostering robust connections with other platforms, Dydx can leverage shared resources and user bases, ultimately enhancing its service offerings.

Future development in this area will likely focus on optimizing user experience and expanding the range of financial products available to users, ensuring that Dydx remains at the forefront of innovation within the decentralized finance sector.

Frequently Asked Questions

How Can I Access the Dydx Platform?

To access the dYdX platform, users must create an account on the official website, complete the necessary identity verification processes, and guarantee they have a compatible cryptocurrency wallet to facilitate trading activities effectively.

What Cryptocurrencies Are Supported on Dydx?

The Dydx platform supports a range of cryptocurrencies, including but not limited to Ethereum, Bitcoin, and various ERC-20 tokens. This diverse selection facilitates trading and liquidity, catering to a wide array of user preferences.

Are There Any Fees for Using Dydx?

Utilizing a decentralized trading platform typically incurs various fees, including transaction fees, withdrawal fees, and possible trading fees. It is essential to review the platform’s specific fee structure for thorough understanding and cost assessment.

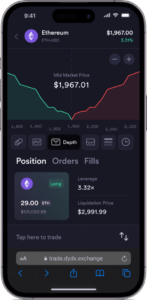

Can I Use Dydx on Mobile Devices?

Yes, Dydx can be accessed on mobile devices through compatible web browsers. However, a dedicated mobile application is currently not available, making the user experience dependent on the mobile browser’s performance and interface capabilities.

How Do I Withdraw Funds From Dydx?

To withdraw funds from a decentralized platform, navigate to the wallet interface, select the desired assets, and initiate a transfer. Make certain you have sufficient gas fees and confirm the transaction details before finalizing the withdrawal.

Wrapping Up

To sum up, Dydx stands out as a formidable player in the decentralized finance landscape, offering an advanced trading experience characterized by its order book model, margin trading, and robust lending options.

The Dydx Token serves not only as a governance tool but also enhances user engagement within its ecosystem.

With a focus on security and continuous development, Dydx is well-positioned for future growth, appealing to both novice and experienced traders seeking efficient and reliable trading solutions.