Looking for a Robinhood referral code? You’re in the right place! Imagine earning free stocks worth up to $225 just by signing up and sharing your experience with others. With Robinhood’s referral program, you and your friends can both benefit from this fantastic opportunity.

Not only can you kickstart your investing journey with a bonus, but you can also maximize your rewards by sharing your unique referral link. Whether you’re new to trading or an experienced investor, this guide will show you how to make the most of Robinhood’s referral program and start building your portfolio today.

Quick Overview

- Sign up with a referral code to earn free stocks valued between $3 and $225.

- Both you and the referrer receive free shares upon successful account setup and deposit.

- Earn up to $1,500 in free stock annually through shared referral links.

- Free shares can be sold after three trading days and funds withdrawn after 30 days.

- The referral program enhances your investment portfolio with commission-free trading and real-time market data.

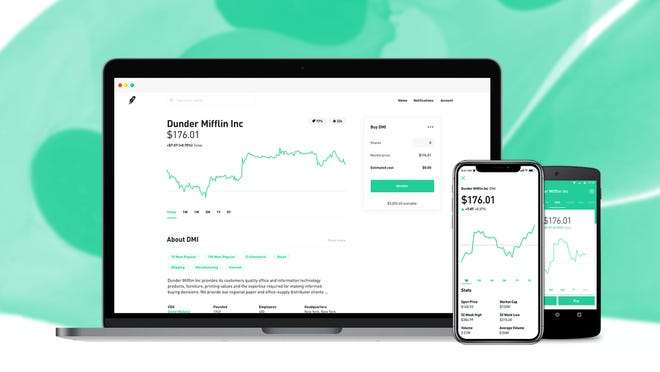

How to Get Started with Robinhood

Getting started with Robinhood is straightforward and rewarding, especially if you use a referral link.

First, sign up using a Robinhood referral code to be eligible for free stocks. The process requires you to open an account and link a bank account. No deposit or transaction is necessary to earn the bonus, but linking a bank account is essential.

Once eligible, you’ll receive free fractional shares valued between $3 to $225, with most receiving $3 to $10 in free stock. You can sell these shares after three trading days, but remember, the funds can’t be withdrawn until 30 days after they’re credited.

Immerse yourself in investing effortlessly with the Robinhood referral program and watch your portfolio grow.

How the Robinhood Referral Program Works

Robinhood’s referral program is a simple and effective way for you to earn free stocks. Each Robinhood user gets a unique Robinhood referral link to share with friends and family.

When someone signs up for a Robinhood account using your referral link, both you and the new customer will receive free shares worth $3 to $225. This referral program allows you to earn up to $1,500 in free stock annually.

With Robinhood, you can enjoy free stock trading without worrying about transaction fees. Plus, access to real-time market data helps you make informed decisions.

Simply start by sharing your referral link, and enjoy the benefits of trading stocks with no added costs while introducing others to a robust investment platform.

Maximizing Your Free Stock Rewards

Understanding how the Robinhood referral program works is just the beginning.

To maximize your free stock rewards, start by sharing your unique Robinhood referral link with friends and family. When your eligible friends open a brokerage account and deposit money, you can earn up to $1,500 in free stock each calendar year.

For every friend who accepts an invite using your referral link, deposits $1,000 or more, and holds or invests their deposits, you’ll receive a reward. These referrals can result in a free share or even a cash reward.

Understanding the Value of Your Free Stock

With your free stock reward in hand, it’s essential to understand its true value. On Robinhood, the value of your free stock can range from $3 to $225. Here’s what you need to know:

- Claim and Invest: After claiming your free stock, you can invest it in one of the 20 stocks provided by Robinhood. You can also opt for fractional shares to diversify.

- Selling Rules: You can sell your stock after three trading days. However, the money from the sale can’t be withdrawn from your Robinhood account until 30 days have passed.

- Value Assessment: Evaluate your stock’s potential growth. Consider whether to hold it longer or sell it as soon as possible.

Understanding these points guarantees you maximize the benefits of your referral reward.

Tips for Using Your Robinhood Account

Now that you know the value of your free stock, it’s time to explore some tips for getting the most out of your Robinhood account.

Consider upgrading to Robinhood Gold for a monthly fee to access after-hours trading, bigger instant deposits, and enhanced market data.

With commission-free trading, you can trade stocks, ETFs, options, and cryptocurrencies without extra costs.

Don’t forget to link your bank account to qualify for the free stock promotion.

Leverage the refer friends feature for additional rewards.

Market makers help guarantee your trades are executed efficiently.

Following these tips will help you maximize your experience and take full advantage of what Robinhood offers.

Is Robinhood Right for You?

Considering Robinhood’s features, you might wonder if it’s the right brokerage platform for you.

Robinhood offers commission-free trading, making it an appealing choice if you’re budget-conscious. You can trade stocks, options, ETFs, and select cryptocurrencies without worrying about transaction fees.

Here’s what you should consider:

- Account Types: Robinhood provides both traditional brokerage accounts and IRA accounts, giving you flexibility.

- Referral Program: You can refer friends to Robinhood and earn rewards, boosting your investment potential.

- Robinhood Gold: For a monthly fee, you get access to a Robinhood Gold card, offering premium features like margin trading and after-hours transactions.

Getting Started with Free Stock Trading

Jumping into the world of free stock trading on Robinhood is a breeze, taking less than 3 minutes to set up an account. As a new user, you can quickly start trading with just a $1 deposit.

Begin by linking your debit card or bank account to add funds. Robinhood’s program allows you to trade stocks, ETFs, options, and cryptocurrencies commission-free.

To sweeten the deal, use a referral code during sign-up to receive free stock, giving you a head start in the market. Hands-on experience is invaluable, and Robinhood provides an ideal platform for diving into trading without hefty fees.

You’ll be trading in no time, making the most of this innovative cash management and trading tool.

Frequently Asked Questions

Can I Use Multiple Referral Codes To Sign Up For Robinhood?

You can’t use multiple referral codes when signing up. Robinhood only allows one referral code per new account. Just pick the best one available to you, and you’ll be all set to start investing!

What Happens If My Referred Friend Already Has A Robinhood Account?

If your referred friend already has an account, they can’t sign up again using your referral link. Encourage them to refer others instead. This way, they can still benefit from the referral program by inviting new users.

How Long Does It Take To Receive the Referral Bonus?

You’ll usually receive the referral bonus within a few days after your friend successfully signs up and meets all the requirements. Keep an eye on your account; notifications will alert you when the bonus is granted.

Are There Any Hidden Fees Associated With The Referral Program?

You’re wondering about hidden fees with the referral program. There aren’t any hidden fees. However, you should check for other potential costs associated with your account or trading activities that may apply.

Can I Withdraw The Free Stock Immediately After Receiving It?

You can’t withdraw the free stock immediately after receiving it. You’ll need to wait at least three trading days for the stock to settle in your account before selling it and then withdrawing the funds.

Wrapping Up

Unleash the potential of commission-free trading with Robinhood and its referral program. By sharing your unique code, you and your friends can earn valuable free stocks, boosting your investment portfolio. Take advantage of this opportunity to maximize your rewards and explore the market with real-time data. Whether you’re new to trading or an experienced investor, Robinhood’s user-friendly platform is designed to meet your needs. Start trading smarter and see how far you can go!

Robinhood Referral

-

Easy To Use?

-

Cost

-

Profitability

-

Time Needed