Latest News

- Coinbase and PayPal Expand Alliance to Turbocharge PYUSD, Challenge Stablecoin Giants

- Coinbase Joins Forces With Paypal to Supercharge Crypto Payments

- Coinbase Partners With PayPal To Waive Fees on PYUSD and Explore New Crypto Payment Use Cases

- Coinbase Expands Partnership with PayPal to Promote PYUSD Stablecoin

The introduction of PayPal USD (PYUSD) marks a significant development in the domain of digital currencies, particularly as it aims to combine the reliability of the U.S. dollar with the innovative potential of blockchain technology.

This stablecoin is positioned to enhance transaction efficiency within the PayPal ecosystem and facilitate cross-border payments.

However, while it presents notable advantages, including security and compliance, it is not without its challenges.

As we examine PYUSD more closely, it becomes essential to reflect on both its benefits and the potential limitations that may influence its adoption and effectiveness in the broader financial landscape.

Quick Overview

- PayPal USD (PYUSD) is a stablecoin pegged to the U.S. dollar, ensuring stability for transactions within the PayPal ecosystem.

- It offers enhanced security and transparency through blockchain technology, with continuous monitoring and user education on security practices.

- PYUSD facilitates faster cross-border transactions and integrates with PayPal’s merchant network, enhancing acceptance for everyday purchases.

- Users can acquire PYUSD via direct purchase through PayPal or supported exchanges, and can earn rewards through staking mechanisms.

- Potential drawbacks include centralization concerns and regulatory risks, which may affect liquidity and broader adoption among merchants and users.

Overview of PayPal USD

Introducing a new digital asset, PayPal USD aims to bridge traditional finance with the evolving landscape of cryptocurrency. As a stablecoin, PYUSD is designed to maintain a consistent value, aligning itself with the U.S. dollar to mitigate the volatility often associated with cryptocurrencies. This initiative reflects PayPal’s commitment to integrating digital currencies into mainstream financial services, providing users with a familiar and secure medium of exchange.

PayPal USD is expected to facilitate seamless transactions within the PayPal ecosystem, enabling users to send and receive funds, make purchases, and engage in remittances with enhanced efficiency. The introduction of PYUSD is a strategic move, positioning PayPal as a frontrunner in the digital financial space, especially as consumer interest in cryptocurrencies continues to grow.

Moreover, PayPal’s infrastructure leverages its extensive user base, potentially accelerating the adoption of digital currencies. By offering a regulated and reliable stablecoin, PayPal aims to cater to both novice and experienced users, fostering an environment that encourages exploration of digital assets while providing the assurance of stability.

This approach may pave the way for greater acceptance of cryptocurrencies in everyday transactions.

Key Features of PYUSD

PayPal USD encompasses several key features that enhance its functionality and appeal within the digital currency landscape. One of the most significant characteristics is its pegged value to the U.S. dollar, ensuring stability in transactions by minimizing volatility typically associated with cryptocurrencies. This peg allows users to transact with confidence, knowing that the value of their holdings remains consistent.

Another important feature is the ability to seamlessly integrate with PayPal’s existing ecosystem, allowing users to send, receive, and store PYUSD alongside traditional currencies. This integration not only streamlines the user experience but also facilitates easy conversion between PYUSD and other fiat currencies.

Additionally, PYUSD leverages blockchain technology to enhance security and transparency in transactions. Each transaction is recorded on a distributed ledger, providing an immutable record that can be audited and verified, thereby fostering trust among users.

Benefits of Using PYUSD

Frequently, users find that utilizing PayPal USD (PYUSD) offers numerous advantages that set it apart from traditional payment methods and cryptocurrencies. One of the most significant benefits is the inherent stability of PYUSD, pegged to the US dollar, which minimizes volatility and provides users with a reliable medium of exchange. This stability appeals particularly to merchants and consumers who seek to avoid the unpredictable price fluctuations often associated with digital currencies.

Additionally, PYUSD leverages PayPal’s robust infrastructure, enabling seamless transactions across the platform. Users can easily send, receive, and store PYUSD within their existing PayPal accounts, simplifying the process and reducing barriers for both new and experienced users. Enhanced security features inherent in the PayPal ecosystem further bolster user confidence, as transactions benefit from established fraud protection measures.

Moreover, PYUSD facilitates faster cross-border transactions compared to traditional banking systems, making it an attractive option for international payments. The integration of PYUSD into PayPal’s extensive merchant network also enables users to make purchases at a wide array of online retailers, enhancing the utility of digital assets.

How to Acquire PYUSD

Acquiring PayPal USD (PYUSD) can be achieved through several avenues, including direct purchases from a PayPal wallet, utilizing supported exchanges and platforms, and earning PYUSD via staking mechanisms.

Each method offers unique advantages, catering to different user preferences and investment strategies.

Understanding these options is essential for effectively integrating PYUSD into your financial portfolio.

Buying From Paypal Wallet

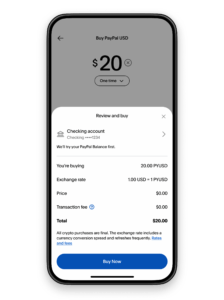

To obtain PayPal USD (PYUSD) through your PayPal wallet, users must first guarantee their accounts are properly set up to facilitate cryptocurrency transactions. This entails linking a verified bank account or card and enabling cryptocurrency trading features within the user settings.

Once these prerequisites are met, users can easily navigate to the cryptocurrency section of their PayPal wallet.

Purchasing PYUSD is straightforward. Users should select the option to buy cryptocurrency, where they can find PYUSD listed among other digital currencies. After selecting PYUSD, users can specify the amount they wish to purchase, taking into account the current market valuation.

PayPal facilitates the transaction by converting the chosen fiat amount into PYUSD, with fees transparently displayed prior to confirmation.

It is essential for users to be aware of any applicable transaction fees, as these can vary and impact the overall cost of acquiring PYUSD. Additionally, users should monitor market conditions, as cryptocurrency values can fluctuate markedly.

With the transaction complete, the PYUSD will be credited to the user’s PayPal wallet, ready for use in various applications within the PayPal ecosystem.

Supported Exchanges and Platforms

Various platforms and exchanges facilitate the acquisition of PayPal USD (PYUSD), providing users with multiple avenues to obtain this digital currency. As a stablecoin, PYUSD is designed to maintain a 1:1 peg with the US dollar, making it an attractive option for users seeking stability in their cryptocurrency holdings.

To acquire PYUSD, users can directly purchase it through the PayPal platform, leveraging their existing PayPal wallet. This integration simplifies the process for those already using PayPal for transactions, guaranteeing a seamless experience.

Additionally, users may find PYUSD available on several cryptocurrency exchanges, which allows for trading against other cryptocurrencies or fiat currencies.

It’s essential to evaluate the fees and security features of these platforms when choosing where to acquire PYUSD. Major exchanges may offer competitive rates, but users should also assess the liquidity and trading volume of PYUSD on each platform to guarantee efficient transactions.

Some platforms may also provide mobile applications, enhancing accessibility for users on the go. Overall, the variety of supported exchanges and platforms enhances the versatility of PYUSD, catering to a wide range of user preferences and needs.

Earning PYUSD Through Staking

Staking offers an innovative method for users to earn PayPal USD (PYUSD) while simultaneously participating in the broader cryptocurrency ecosystem. This process involves locking a certain amount of PYUSD in a staking platform, allowing users to contribute to the network’s security and functionality. In return, participants receive rewards, typically in the form of additional PYUSD, which can enhance overall returns.

To begin staking PYUSD, users must first acquire the currency through supported exchanges or platforms. Once obtained, they can select a reputable staking service that aligns with their risk tolerance and desired returns. Factors to evaluate include the staking yield, lock-up periods, and platform fees.

Upon choosing a platform, users deposit their PYUSD into the staking pool and start earning rewards based on the amount staked and the duration of participation.

It is essential to remain aware of market conditions and potential risks associated with staking, as these can impact the overall profitability.

Security Measures in Place

Security is a paramount concern for digital payment platforms, and PayPal USD implements a robust array of measures to safeguard user transactions and data. At the core of its security framework is end-to-end encryption, which guarantees that sensitive information is protected during transmission. This encryption, coupled with advanced tokenization techniques, minimizes the risks associated with data breaches and unauthorized access.

Additionally, PayPal USD employs multi-factor authentication (MFA) as a critical layer of security, requiring users to verify their identity through multiple methods before accessing their accounts or completing transactions. This greatly reduces the likelihood of account takeover incidents.

Regular security audits and compliance with industry standards further reinforce PayPal USD’s commitment to security. The platform adheres to stringent regulatory requirements and is subject to oversight by financial authorities, guaranteeing that it meets high benchmarks for security and reliability.

User education is also prioritized; PayPal provides resources to help users recognize potential phishing attempts and best practices for maintaining account security.

Collectively, these measures position PayPal USD as a secure option for users seeking to engage in digital transactions with confidence.

Comparison With Other Stablecoins

In comparing PayPal USD with other stablecoins, it is essential to examine the stability mechanisms employed by each to understand their resilience in volatile markets.

Additionally, evaluating market adoption rates reveals insights into consumer trust and usability across different platforms.

This analysis will highlight PayPal USD’s positioning relative to its competitors in the stablecoin landscape.

Stability Mechanisms Analyzed

Analyzing the stability mechanisms of PayPal USD reveals significant differences when compared to other prominent stablecoins in the market. Unlike traditional stablecoins such as Tether (USDT) or USD Coin (USDC), which primarily maintain their peg to the U.S. dollar through a backing of reserves and regular audits, PayPal USD employs a distinct strategy.

PYUSD is designed to leverage the extensive infrastructure of PayPal, integrating its vast user base and transaction capabilities to enhance liquidity and stability.

Furthermore, while many stablecoins rely heavily on fiat reserves held in banks, PayPal USD may utilize a combination of on-chain and off-chain assets, which can provide additional flexibility in maintaining its value stability. This approach allows for quicker response to market fluctuations compared to other stablecoins that may experience delays in liquidity access due to traditional banking processes.

In addition, PayPal’s established reputation and regulatory compliance efforts may offer a level of trust that newer stablecoins struggle to achieve, potentially attracting more users seeking stability in their digital transactions.

Market Adoption Comparison

When evaluating market adoption, PayPal USD stands out against traditional stablecoins like Tether (USDT) and USD Coin (USDC) due to its integration within the PayPal ecosystem. This integration allows PYUSD to leverage PayPal’s extensive user base, facilitating immediate access for millions of users to engage with cryptocurrency in a familiar environment.

In contrast, USDT and USDC primarily target cryptocurrency exchanges and traders, potentially limiting their mainstream adoption.

Additionally, PayPal’s established reputation as a trusted payment processor enhances the credibility of PYUSD. Users may feel more secure using a stablecoin tied to a well-known brand, which could accelerate adoption among individuals and businesses alike.

Moreover, PYUSD’s ability to facilitate transactions across PayPal’s extensive network, including e-commerce platforms, positions it as a practical alternative for everyday transactions.

In comparison, USDT and USDC have faced scrutiny regarding their reserves and transparency, which may hinder wider acceptance among risk-averse consumers.

While USDT remains the dominant stablecoin by market capitalization, PYUSD’s unique advantages may help it carve out a significant niche in the competitive stablecoin landscape, especially among users seeking seamless integration with traditional finance.

Potential Drawbacks of PYUSD

While PayPal USD (PYUSD) presents various advantages, it is essential to contemplate its potential drawbacks. One significant concern is its reliance on the PayPal ecosystem, which may limit its usability compared to other stablecoins that operate on more decentralized platforms.

As PYUSD is tethered to a centralized institution, users might face issues related to transparency and trust, particularly regarding the management of reserves and regulatory compliance.

Additionally, the liquidity of PYUSD could be a concern. While PayPal has a substantial user base, the adoption of PYUSD among merchants and exchanges remains uncertain. Limited liquidity may hinder transactions and increase volatility, contrary to the stability typically expected from a stablecoin.

Moreover, regulatory scrutiny surrounding digital currencies can pose risks. As governments worldwide continue to tighten regulations on cryptocurrencies, PYUSD may face challenges in maintaining compliance, which could affect its widespread acceptance and usability.

Use Cases for PayPal USD

PayPal USD (PYUSD) offers a range of practical applications that can enhance the digital payment landscape. As a stablecoin, PYUSD provides a reliable means of transaction that mitigates the volatility commonly associated with cryptocurrencies. This stability makes it particularly useful for everyday purchases, allowing consumers to transact with confidence.

One prominent use case is remittances. PYUSD can facilitate cross-border transactions at lower fees and faster speeds compared to traditional banking methods. This efficiency is appealing for individuals who rely on sending money internationally.

In addition, PYUSD serves as a bridge between the traditional financial system and the cryptocurrency market. Investors can convert their holdings into PYUSD to preserve value during market fluctuations, while still maintaining a connection to digital assets.

E-commerce platforms can also benefit from integrating PYUSD, enabling seamless transactions for consumers who prefer using digital currencies.

Moreover, businesses can leverage PYUSD for payroll solutions, providing employees with a modern payment option that aligns with the growing trend of digital finance.

Future Outlook for PYUSD

The future outlook for PayPal USD (PYUSD) appears promising, driven by the increasing demand for stable digital currencies in a rapidly evolving financial ecosystem. As consumers and businesses seek more reliable payment solutions, PYUSD is well-positioned to leverage the widespread adoption of digital wallets and online transactions.

PayPal’s established user base and infrastructure provide a solid foundation for PYUSD to gain traction among both individual users and merchants.

Moreover, regulatory clarity surrounding stablecoins is gradually improving, which could enhance the legitimacy and acceptance of PYUSD. As governments and financial institutions develop frameworks for digital assets, PYUSD may benefit from increased trust and usage in mainstream commerce.

Additionally, the growing trend of decentralized finance (DeFi) offers potential for innovative applications of PYUSD, facilitating cross-border transactions and enhancing liquidity. Partnerships with other fintech platforms could further expand its use cases, making PYUSD a competitive player in the stablecoin market.

However, potential challenges, such as regulatory hurdles and competition from other stablecoins, remain.

Frequently Asked Questions

Who Created Paypal USD and When Was It Launched?

PayPal USD was created by PayPal, a leading digital payment platform. It was officially launched in August 2023 as a stablecoin, aimed at facilitating efficient transactions within the cryptocurrency ecosystem while maintaining regulatory compliance.

Is PYUSD Regulated by Any Financial Authorities?

The regulatory status of any digital currency, including PYUSD, typically depends on jurisdictional frameworks. Generally, digital currencies are scrutinized by financial authorities to guarantee compliance with anti-money laundering and consumer protection regulations.

Can PYUSD Be Used for International Transactions?

International transactions can be facilitated using digital currencies, offering advantages such as lower fees and faster processing times. However, the availability and regulatory framework may vary by jurisdiction, impacting usability for cross-border transactions.

Are There Fees Associated With Converting PYUSD to Other Currencies?

Converting digital currencies typically incurs fees, which may vary based on the platform and market conditions. It is essential for users to consult the specific terms and conditions regarding conversion fees to understand potential costs.

What Wallets Support Paypal USD Storage?

Various digital wallets support the storage of cryptocurrencies, including PayPal USD. Notable examples include MetaMask, Trust Wallet, and Coinbase Wallet, which offer users secure environments for managing their digital assets and facilitating transactions efficiently.

Wrapping Up

PayPal USD (PYUSD) presents a significant advancement in the stablecoin sector, particularly within the PayPal ecosystem.

Its integration offers enhanced transaction efficiency and a viable alternative for cross-border payments.

While concerns regarding centralization and liquidity may arise, the benefits of security and regulatory compliance position PYUSD favorably in the evolving landscape of digital currencies.

Continued development and user adoption may further solidify its role in bridging traditional finance with cryptocurrency, fostering broader acceptance and usability.