As you explore the world of cryptocurrency trading, you’ve likely encountered the challenges of mastering complex strategies and keeping up with market fluctuations. PrimeXBT’s Covesting feature offers a solution that can transform your trading experience.

By allowing you to mirror the moves of successful traders, you’ll gain access to proven strategies without the steep learning curve.

But how do you choose the right traders to follow, and what risks should you consider?

Understanding the nuances of this powerful tool can make the difference between lacklustre results and professional-level returns. Let’s uncover the secrets to leveraging Covesting for maximum benefit.

Also, don’t miss our full PrimeXBT review to find out more about trading on this platform.

Quick Overview

- Select traders based on profit percentage, risk score, equity, and trading history for optimal results.

- Diversify investments across multiple strategy managers to spread risk and maximize potential returns.

- Utilize PrimeXBT’s risk management tools to set stop-loss limits and automate risk control.

- Regularly monitor and review copied trades, adjusting allocations based on performance and market conditions.

- Implement dynamic allocation strategies and use advanced filters to find managers with consistent performance and low drawdowns.

Understanding PrimeXBT’s Covesting Feature

The Covesting feature on PrimeXBT is a game-changing tool for both novice and experienced traders. It allows you to copy the trades of successful traders, known as strategy managers, in real-time. This innovative approach to trading enables you to leverage the expertise of top performers while maintaining control over your investments.

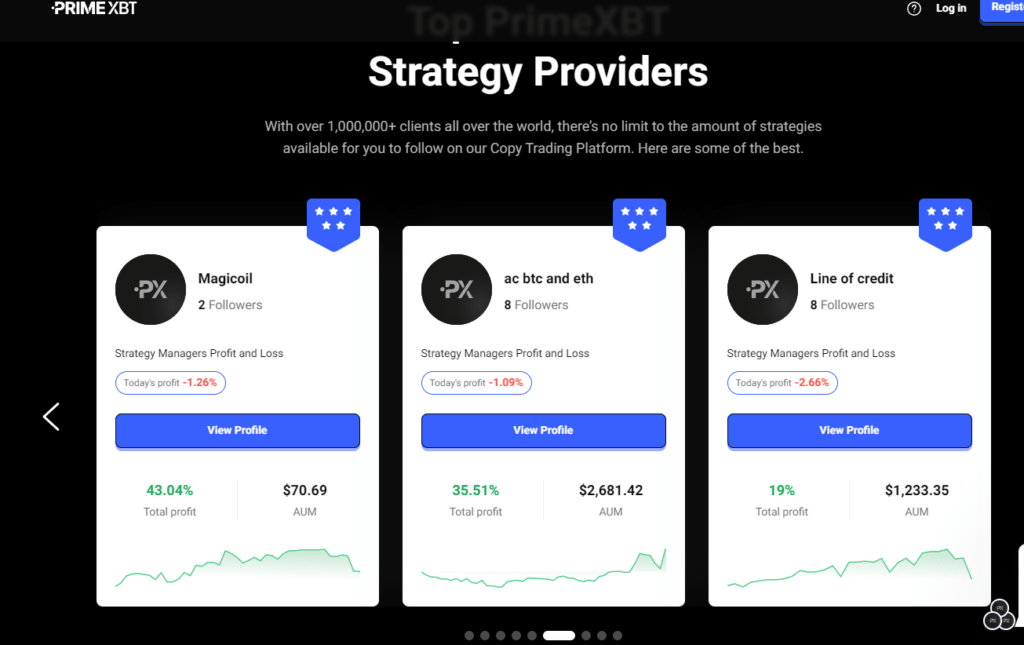

To use Covesting, you’ll first need to create a PrimeXBT account and deposit funds. Once set up, you can browse through a list of strategy managers, each with detailed performance metrics, risk scores, and trading histories. You’ll be able to assess their trading styles and success rates before deciding whom to follow.

When you choose to copy a strategy manager, your account will automatically mimic their trades proportionally to your allocated funds. You can follow multiple strategies simultaneously, diversifying your portfolio and spreading risk. The platform offers real-time updates on your copied trades, allowing you to monitor performance closely.

Covesting also incentivizes strategy managers to perform well, as they earn success fees based on their followers’ profits. This aligns their interests with yours, creating a mutually beneficial ecosystem for all participants.

Ready to open an account? Make sure you get the best sign-up bonus with this PrimeXBT referral code.

Benefits of Copy Trading

Copy trading offers numerous advantages for investors of all experience levels. As a novice trader, you’ll gain exposure to proven strategies without the steep learning curve. You can observe successful traders’ decisions in real-time, accelerating your understanding of market dynamics and risk management techniques. This hands-on learning experience can be far more valuable than theoretical knowledge alone.

For experienced traders, copy trading provides a way to diversify your portfolio and potentially increase returns. You can allocate a portion of your capital to multiple strategies, spreading risk across different trading styles and assets. It’s also an excellent opportunity to benchmark your performance against top traders and identify areas for improvement.

Time-strapped investors benefit from the passive nature of copy trading. You don’t need to constantly monitor markets or execute trades manually. This frees up your time for other pursuits while still participating in financial markets.

Additionally, copy trading can help you access markets or instruments you mightn’t be familiar with, expanding your investment horizons. By leveraging the expertise of successful traders, you can potentially achieve better results than you’d on your own.

Selecting Top-Performing Traders

While copy trading offers numerous benefits, its success hinges on one key factor: choosing the right traders to follow. PrimeXBT’s Covesting feature provides you with a wealth of information to make informed decisions about which traders to copy.

When selecting top-performing traders, you’ll want to evaluate several key metrics:

- Profit percentage: Look for traders with consistent, high returns over time.

- Risk score: This indicates a trader’s risk tolerance. Choose one that aligns with your own.

- Equity: Higher equity often suggests more experience and skin in the game.

- Trading history: Analyze their past performance for stability and growth.

Don’t just focus on the highest returns; assess the trader’s strategy and risk management. Look for traders who’ve weathered market volatility and maintained steady profits.

It’s also wise to diversify by following multiple traders with different strategies.

Risk Management Strategies

Although copy trading can be profitable, it’s crucial to implement effective risk management strategies to protect your capital. Start by diversifying your investments across multiple traders to spread risk.

Don’t put all your eggs in one basket, no matter how impressive a trader’s performance may seem. Set strict stop-loss limits for each position to cap potential losses. You can do this by allocating a fixed percentage of your total capital to each trade or setting a maximum drawdown limit.

Consider using PrimeXBT’s built-in risk management tools to automate this process. Monitor your copied trades regularly and be prepared to exit positions if market conditions change unfavorably.

Don’t hesitate to unfollow a trader if their performance declines or their strategy no longer aligns with your goals. Adjust your investment amounts based on your risk tolerance and the trader’s historical performance.

Start with smaller amounts and gradually increase your investment as you gain confidence in the trader’s abilities.

Optimizing Your Copy Trading Portfolio

Building on effective risk management, the next step is to optimize your copy trading portfolio for maximum returns. Start by diversifying your investments across multiple strategies and traders. This approach spreads risk and increases your chances of consistent profits.

Regularly review your portfolio’s performance and adjust your allocations accordingly.

When selecting traders to copy, focus on those with:

- Consistent long-term performance

- A trading style that aligns with your risk tolerance

- Transparent communication about their strategies

- A proven track record during various market conditions

Don’t be swayed by short-term gains alone. Look for traders who demonstrate discipline and stick to their strategies even during market volatility.

It’s also wise to allocate different percentages of your capital to various traders based on their performance and risk levels.

Keep an eye on correlation between the strategies you’re copying. If multiple traders are using similar approaches, you might be inadvertently increasing your risk exposure.

Regularly rebalance your portfolio to maintain your desired risk-reward ratio and capitalize on emerging opportunities in the market.

Advanced Covesting Techniques

For those who’ve mastered the basics of Covesting, it’s time to explore advanced techniques. Start by diversifying your portfolio across multiple strategy managers. This approach spreads risk and capitalizes on various trading styles. Don’t just focus on top performers; look for consistent, steady gains over time.

Utilize PrimeXBT’s advanced filters to find managers with specific characteristics, such as low drawdowns or consistent profits during market downturns. Pay attention to the correlation between different strategies you’re following to guarantee true diversification.

Consider implementing a dynamic allocation strategy. Regularly review and adjust your allocations based on performance, market conditions, and your risk tolerance. Set up stop-losses for individual strategy managers to protect your capital.

Take advantage of PrimeXBT’s API to automate your Covesting activities. Create custom alerts for specific events, like sudden drops in a manager’s performance or significant changes in their trading approach.

Lastly, don’t neglect your own education. Analyze successful strategy managers’ trades and try to understand their decision-making process. This knowledge will help you make more informed choices and potentially develop your own successful trading strategies in the future.

Frequently Asked Questions

Is There a Minimum Deposit Required to Start Copy Trading on Primexbt?

Yes, there’s a minimum deposit required to start copy trading on PrimeXBT. You’ll need to fund your account with at least $100 to begin. This allows you to explore and copy various trading strategies effectively.

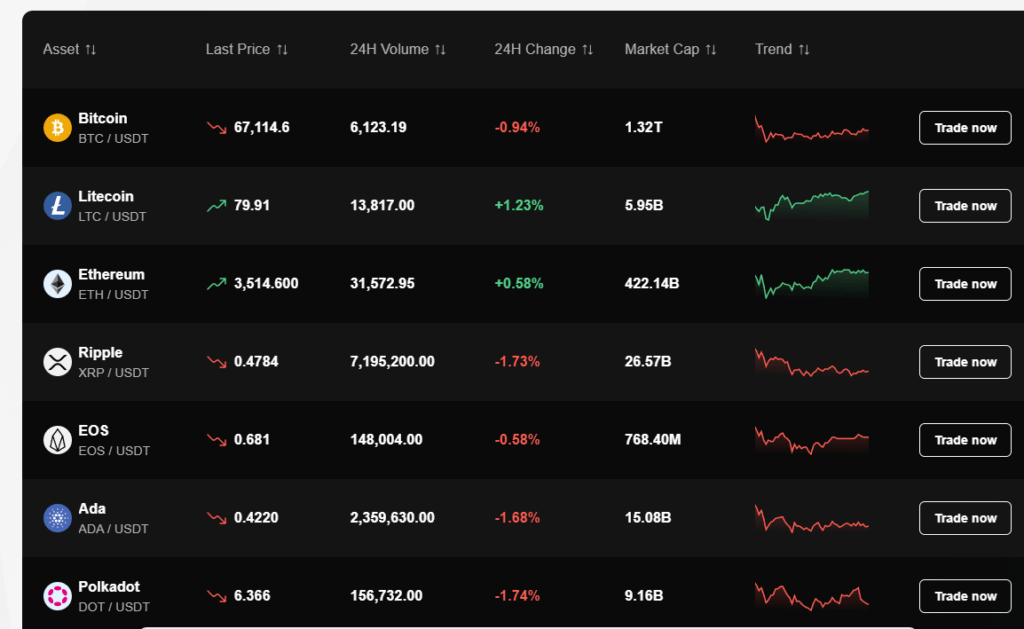

Can I Copy Trade Cryptocurrency Pairs Exclusively on the Covesting Platform?

Yes, you can exclusively copy trade cryptocurrency pairs on the Covesting platform. You’ll find a variety of crypto strategies to choose from. Simply select the ones that focus solely on cryptocurrency pairs to start copying their trades.

How Often Are the Trader Rankings Updated on Primexbt’s Covesting Leaderboard?

You’ll see trader rankings on PrimeXBT’s Covesting leaderboard update in real-time. They’re constantly refreshed, reflecting current performance. You can track changes as they happen, giving you up-to-the-minute insights into top-performing strategies and traders.

Are There Any Fees Associated With Copying Traders on Primexbt?

Yes, there are fees when you copy traders on PrimeXBT. You’ll pay a success fee to the strategy manager for profitable trades. Additionally, you’ll incur standard trading fees for each trade executed in your account.

Can I Communicate Directly With the Traders I’m Copying on Primexbt?

You can’t communicate directly with traders you’re copying on PrimeXBT. The platform maintains trader anonymity to protect their strategies. However, you can view their performance, trading history, and risk metrics to make informed decisions.

Wrapping Up

You’ve now got the tools to copy trade like a pro with PrimeXBT’s Covesting feature. By carefully selecting top-performing traders, managing your risk, and optimizing your portfolio, you’ll be well on your way to potentially lucrative returns. Don’t forget to stay informed and adjust your strategy as needed. With Covesting, you’re tapping into the expertise of successful traders while maintaining control of your investments. Start copy trading today and elevate your trading game!

Copy Trade PrimeXBT

-

Easy To Use?

-

Cost

-

Profitability

-

Time Needed