Latest News

- Raydium: Here’s why disciplined longs still back RAY’s run!

- 2 altcoins to buy for the end of April

- Raydium crypto: What key datasets say about a move to $2.8

- RAY surges 12% as Raydium takes on Pump.fun

Current Price

The current price of RAY is $2.14769

Introduction

Raydium has emerged as a notable player in the decentralized finance (DeFi) sector since its inception in 2021, leveraging the Solana blockchain to offer a unique automated market maker (AMM) experience.

By integrating Serum’s order book liquidity, Raydium enhances trading efficiency and provides users with a range of yield farming opportunities.

However, while its innovative features and user-friendly interface are appealing, potential participants must also consider the inherent risks associated with liquidity pools and market fluctuations.

Understanding these dynamics is essential for anyone looking to engage with Raydium effectively. What lies ahead for this platform remains an intriguing question.

Quick Overview

- Raydium is a hybrid automated market maker (AMM) that integrates with Serum DEX for enhanced liquidity and trading efficiency within the Solana ecosystem.

- It offers liquidity pools that incentivize users through yield farming opportunities, allowing them to earn RAY tokens and trading fee shares.

- Users can benefit from low transaction fees and high throughput, ensuring cost-effective trading experiences.

- The platform features a user-friendly interface, making it accessible for both novice and experienced traders.

- However, risks include volatility, impermanent loss, and potential smart contract vulnerabilities that users should consider before participating.

Overview of Raydium

Raydium (RAY) has emerged as a significant player in the decentralized finance (DeFi) space, particularly within the Solana ecosystem. Established in 2021, Raydium serves as an automated market maker (AMM) and liquidity provider, leveraging the high throughput and low transaction fees characteristic of Solana’s blockchain.

Its architecture is designed to enhance trading efficiency by integrating with the Serum decentralized exchange (DEX), allowing users to access order book liquidity while utilizing AMM functionality.

One of Raydium’s core innovations is its dual liquidity model, which facilitates both AMM and DEX trading environments. This model not only provides users with enhanced options for asset trading but also increases capital efficiency for liquidity providers.

In addition, the platform incorporates yield farming mechanisms, incentivizing users to stake their assets in return for rewards, thereby promoting active participation in the ecosystem.

As a result of its robust technical framework and strategic partnerships, Raydium has positioned itself as a crucial component of the Solana DeFi landscape, attracting a diverse array of users and liquidity to its platform.

This evolution reflects broader trends within the DeFi sector, highlighting the increasing importance of interoperability and user engagement.

Key Features of Raydium

Offering a blend of innovative features, Raydium stands out in the competitive DeFi landscape of Solana. One of its most significant attributes is the integration of an automated market maker (AMM) with an order book model. This hybrid approach allows for enhanced liquidity, enabling users to access both the efficiency of AMMs and the depth of traditional order books. As a result, this dual mechanism improves price discovery and reduces slippage during trades.

Another key feature is Raydium’s liquidity pools, which incentivize users to provide liquidity via yield farming opportunities. By staking their assets, users can earn RAY tokens, fostering a community-driven ecosystem.

Additionally, Raydium supports cross-platform functionality through its partnerships with other DeFi protocols, expanding its utility and reach within the Solana network.

Raydium also emphasizes user experience, offering a user-friendly interface that simplifies navigation for traders and liquidity providers alike. Moreover, its low transaction fees and high throughput capabilities, attributable to Solana’s scalable infrastructure, guarantee that users experience minimal latency and cost during trading activities.

Collectively, these features position Raydium as a formidable player in the DeFi sector, attracting both novice and experienced investors.

How Raydium Works

Raydium operates as an Automated Market Maker (AMM), utilizing unique mechanics to facilitate seamless trading within its ecosystem.

The platform’s liquidity pools play an essential role in ensuring sufficient capital for trades, while also providing users with opportunities for yield farming.

This combination of features allows Raydium to enhance liquidity and incentivize participation in the decentralized finance space.

Automated Market Maker Mechanics

Automated market makers (AMMs) have revolutionized the landscape of decentralized finance (DeFi) by enabling seamless trading without the need for traditional order books. Raydium operates as an AMM on the Solana blockchain, utilizing a unique mechanism that combines the benefits of liquidity pools with the speed and efficiency of Solana’s infrastructure.

At its core, Raydium leverages an algorithmic pricing model, which guarantees that asset prices are determined based on supply and demand dynamics within its liquidity pools.

In Raydium’s architecture, liquidity providers deposit pairs of tokens into these pools, which then facilitate trades directly between users. These trades rely on the constant product formula, guaranteeing that the product of the quantities of the two tokens remains constant, thereby maintaining liquidity. This design minimizes slippage and enhances user experience during trading.

Furthermore, Raydium integrates with Serum, a decentralized exchange (DEX) that employs an order book model, allowing users to access additional liquidity. This hybrid approach not only boosts trade execution efficiency but also attracts a diverse range of users, from casual traders to institutional investors, thereby enhancing the overall liquidity of the Raydium platform.

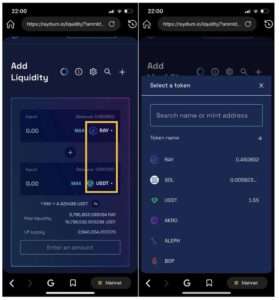

Liquidity Pool Functionality

Liquidity pools on Raydium serve as the backbone of its trading functionality, allowing users to engage in seamless transactions while providing liquidity to the market. These pools are composed of paired tokens, which users deposit to create liquidity for trading pairs.

By utilizing an Automated Market Maker (AMM) model, Raydium permits users to trade assets directly against these pools, eliminating the need for traditional order books and enhancing transaction efficiency.

Raydium employs a unique approach by integrating its liquidity pools with the Serum decentralized exchange, enabling users to access deeper liquidity and tighter spreads. This integration allows for efficient price discovery and minimizes slippage during trades.

Additionally, the protocol incentivizes liquidity provision by offering rewards in the form of RAY tokens, thereby encouraging users to contribute to the pools and maintain a healthy trading environment.

Moreover, the dynamic pricing mechanism employed by Raydium guarantees that the prices of the tokens in liquidity pools are continuously adjusted based on supply and demand. This feature not only enhances the trading experience but also bolsters the overall stability and reliability of the platform, making it an attractive option for both liquidity providers and traders.

Yield Farming Opportunities

How can users maximize their returns while participating in DeFi ecosystems? Yield farming on Raydium presents a compelling opportunity for investors seeking to enhance their returns through liquidity provision.

Raydium operates as an automated market maker (AMM) on the Solana blockchain, allowing users to stake their assets in liquidity pools. In return, participants earn RAY tokens and a share of the trading fees generated by the platform.

Yield farming on Raydium involves strategically selecting liquidity pairs that not only provide competitive annual percentage yields (APYs) but also consider factors such as impermanent loss and token volatility. Users can choose from various liquidity pools, each with distinct risk profiles and potential returns.

By diversifying their investments across multiple pools, users can mitigate risks associated with individual assets. Additionally, Raydium offers unique features such as the ability to borrow assets against staked tokens, further amplifying yield farming opportunities.

The integration with other DeFi protocols enhances liquidity and incentivizes participation. Consequently, by leveraging these tools and strategies within Raydium’s ecosystem, users can optimize their yield farming endeavors and achieve more substantial returns in the dynamic DeFi landscape.

Raydium Vs. Other AMMS

In the rapidly evolving landscape of decentralized finance (DeFi), Raydium distinguishes itself among automated market makers (AMMs) through its unique hybrid model that combines on-chain liquidity provision with the order book functionality of Serum.

This integration allows Raydium to offer enhanced liquidity and reduced slippage compared to traditional AMMs like Uniswap or SushiSwap, which rely solely on liquidity pools.

While conventional AMMs utilize constant product formulas for pricing, Raydium’s approach enables users to access deeper liquidity for trades, benefiting from the natural order book market structure.

This feature enhances capital efficiency and allows traders to execute larger transactions without greatly impacting prices.

Furthermore, Raydium’s dual model facilitates arbitrage opportunities between its platform and Serum, potentially leading to more favorable trading conditions.

In contrast, other AMMs may struggle with liquidity fragmentation, as users often have to navigate multiple platforms to find ideal trading pairs.

Benefits of Using Raydium

Although various decentralized finance platforms present appealing options for traders and liquidity providers, Raydium offers several distinct advantages that enhance the overall user experience. One of the most notable benefits is its integration with the Serum decentralized exchange, which allows for high-speed trading and access to order book liquidity. This unique architecture provides traders with improved execution prices and reduced slippage compared to traditional automated market makers (AMMs).

Additionally, Raydium boasts low transaction fees, a critical factor for users engaging in frequent trading or liquidity provision. The platform’s user-friendly interface simplifies the trading process, making it accessible for both novice and experienced users.

Moreover, Raydium supports liquidity pools that yield competitive returns through yield farming opportunities, incentivizing liquidity providers to contribute their assets.

Furthermore, the platform’s community governance model empowers RAY token holders to participate in decision-making processes, fostering a sense of ownership among users.

Risks and Considerations

While Raydium presents numerous advantages that appeal to traders and liquidity providers, it is important to also take into account the inherent risks associated with using the platform.

First and foremost, the decentralized finance (DeFi) landscape is notoriously volatile, and liquidity pools can experience significant fluctuations in value. This volatility can lead to impermanent loss, where liquidity providers might see a reduction in their overall returns compared to simply holding the assets.

Additionally, as with any DeFi platform, smart contract vulnerabilities pose a considerable risk. Although Raydium employs audits to mitigate these risks, no system is completely immune to exploitation or bugs.

Lastly, regulatory uncertainty in the cryptocurrency space can impact the operation of platforms like Raydium. Changes in regulations could affect liquidity, trading, and the availability of services.

Key risks to take into account include:

- Impermanent Loss: Potential loss of capital due to market fluctuations.

- Smart Contract Vulnerabilities: Risks associated with bugs or exploits in the platform’s code.

- Regulatory Changes: Uncertain legal landscape that could affect the platform’s functionality.

Understanding these risks is essential for informed decision-making in the DeFi ecosystem.

Future Prospects of Raydium

As the decentralized finance (DeFi) sector continues to evolve, Raydium’s future prospects appear promising, especially given its unique position within the Solana ecosystem.

Raydium serves as an automated market maker (AMM) and liquidity provider, which allows it to leverage Solana’s high throughput and low transaction costs. This efficiency positions Raydium to attract users seeking fast and affordable DeFi solutions.

Moreover, Raydium has established strategic partnerships and integrations with various projects within the Solana network, enhancing its utility and user base.

The platform’s dual functionality as a yield aggregator further diversifies its appeal, allowing users to optimize their returns through liquidity provision and staking.

However, competition remains fierce, with numerous AMMs and DeFi protocols emerging.

Raydium’s continued innovation in user experience, governance, and the development of new features will be critical in maintaining its market position.

Additionally, the broader acceptance of Solana as a leading blockchain could greatly amplify Raydium’s growth potential.

Frequently Asked Questions

What Is the Current Market Price of Raydium (Ray)?

The current market price of cryptocurrencies, including Raydium, fluctuates frequently due to market dynamics. For accurate pricing, consult reputable financial platforms or cryptocurrency exchanges that provide real-time data on market valuations and trading volumes.

How Can I Buy Raydium Tokens?

To purchase Raydium tokens, one must create an account on a cryptocurrency exchange supporting RAY, deposit funds, navigate to the trading section, select RAY, and execute a buy order, ensuring proper wallet management thereafter.

Is Raydium Available on Popular Exchanges?

Raydium tokens are listed on several prominent cryptocurrency exchanges, including Binance and FTX. Availability may vary based on regional regulations, so it is advisable to check local exchange options for purchasing and trading these tokens.

What Wallets Support Raydium (Ray) Tokens?

Numerous wallets support Raydium (RAY) tokens, including popular options such as Phantom, Sollet, and Ledger. These wallets offer varying features, ensuring users can securely store, manage, and interact with their RAY tokens effectively.

Can I Stake My Raydium Tokens for Rewards?

Yes, you can stake your tokens on platforms that support staking features. By participating in staking, users can earn rewards, which vary based on the platform’s parameters and overall network performance. Always consider associated risks.

Wrapping Up

To sum up, Raydium represents a significant advancement in the decentralized finance (DeFi) sector through its innovative dual liquidity model and integration with Serum’s order book.

The platform offers various benefits, including low transaction fees and yield farming opportunities, which enhance user engagement.

However, inherent risks such as impermanent loss and market volatility necessitate careful consideration by users.

The future of Raydium appears promising, contingent upon continued development and adaptation within the evolving DeFi landscape.