As you explore the world of leverage trading on PrimeXBT, you’ll discover a double-edged sword that can either propel your trading success or lead to significant losses. This powerful tool allows you to amplify your market exposure, potentially multiplying your profits with a relatively small initial investment.

However, it’s vital to understand that the same mechanism can magnify your losses just as quickly.

Before you immerse yourself in the exciting yet risky world of leverage trading, you’ll need to grasp the intricacies of how it works, the platform’s features, and essential risk management strategies.

Are you prepared to reveal the potential of leverage trading?

Quick Overview

- PrimeXBT offers leverage up to 100x for cryptocurrencies and 1000x for other assets, amplifying potential gains and losses.

- Leverage trading on PrimeXBT allows users to control larger positions with smaller capital, increasing market exposure.

- Risks include substantial losses exceeding initial investments and potential margin calls leading to automatic liquidation.

- PrimeXBT provides advanced trading tools and a user-friendly interface to enhance strategy implementation and risk management.

- Implementing stop-loss orders and diversifying investments are crucial risk management strategies when leverage trading on PrimeXBT.

For more information about PrimeXBT be sure to check out our full PrimeXBT review here. Also, get an amazing PrimeXBT sign-up bonus here.

What Is Leverage Trading?

Nearly every trader has heard of leverage trading, but not everyone fully understands it. Leverage trading allows you to control a larger position in the market with a smaller amount of capital. It’s like borrowing money to increase your potential returns, but it also amplifies your potential losses.

When you use leverage, you’re fundamentally trading with more money than you have in your account. For example, if you have $1,000 and use 10x leverage, you can open a position worth $10,000. This means your profits (or losses) will be based on the $10,000 position, not just your initial $1,000.

Leverage is often expressed as a ratio, such as 1:10 or 1:100. The higher the ratio, the more leverage you’re using.

It’s significant to remember that while leverage can magnify your gains, it can also lead to substantial losses if the market moves against you. Many traders find leverage appealing because it allows them to potentially profit from small price movements and access larger market positions.

However, it’s vital to understand the risks involved and use leverage responsibly.

PrimeXBT Platform Overview

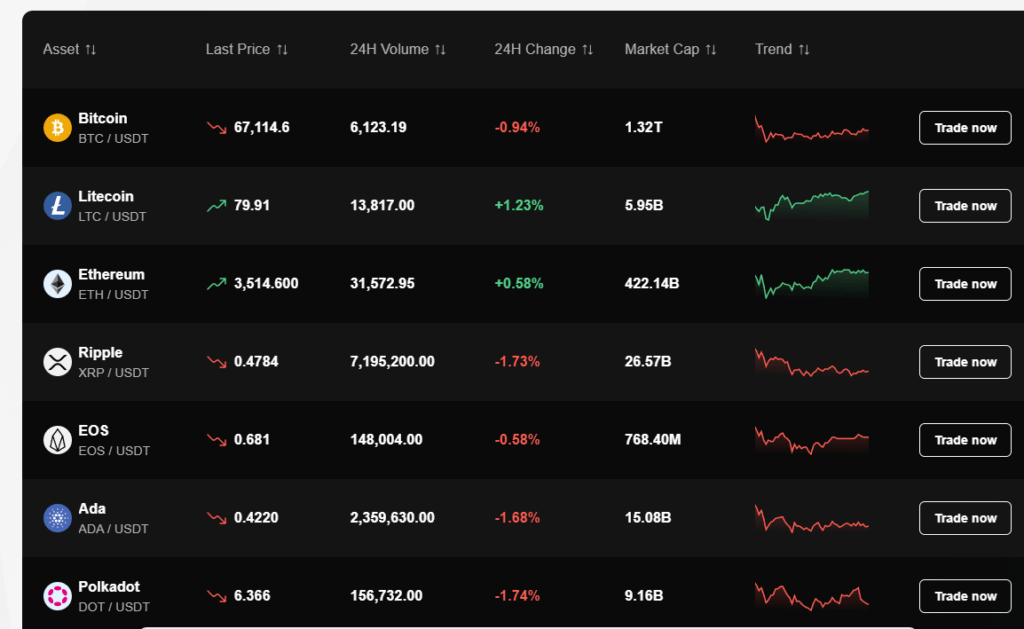

PrimeXBT frequently stands out as a popular choice for traders seeking a robust leverage trading platform. It offers a wide range of assets, including cryptocurrencies, forex, commodities, and stock indices. You’ll find leverage options up to 100x for crypto and 1000x for other markets, allowing you to amplify your potential gains (and losses).

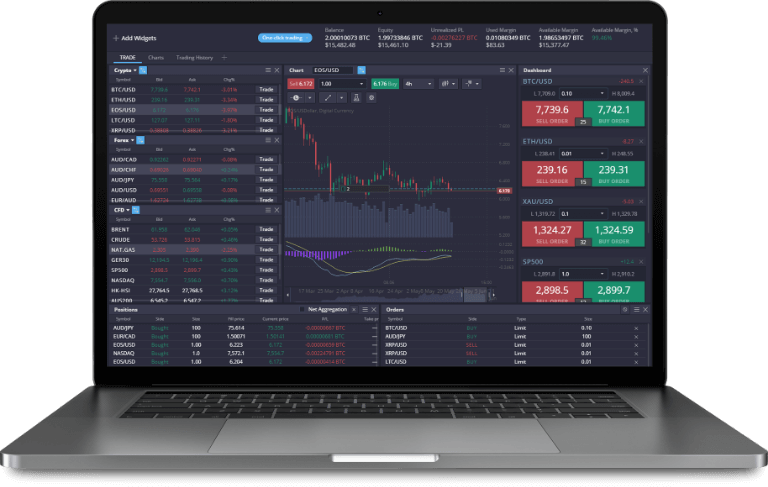

The platform’s user interface is designed for both novice and experienced traders, featuring customizable charts, multiple order types, and risk management tools. You can access PrimeXBT through web browsers or mobile apps, ensuring flexibility in your trading activities.

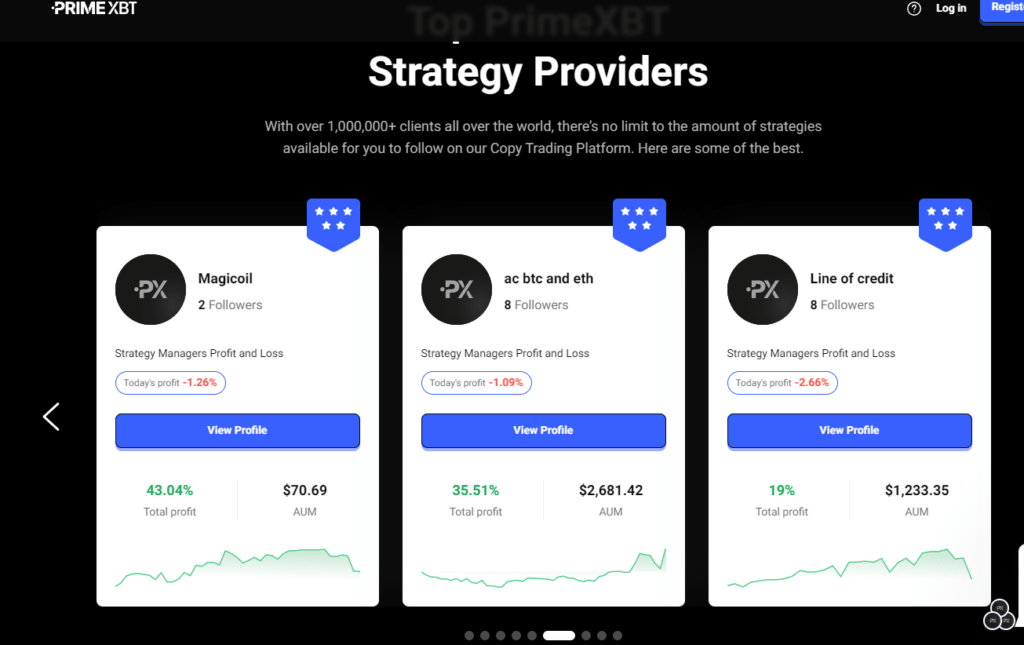

One of PrimeXBT’s unique features is its multi-asset trading capability, allowing you to diversify your portfolio within a single platform. It also offers a copy trading system called Covesting, where you can follow and replicate successful traders’ strategies.

Security is a priority on PrimeXBT, with features like two-factor authentication, address whitelisting, and cold storage for funds.

However, it’s essential to acknowledge that the platform isn’t regulated in many jurisdictions, which may be a concern for some traders. Always conduct your own research and understand the risks involved before trading on any platform.

Benefits of Leverage Trading

Leverage trading offers several compelling advantages for traders looking to maximize their potential returns. By using borrowed funds, you can amplify your market exposure and potentially increase your profits. This means you can take larger positions with a smaller initial investment, allowing you to capitalize on even minor price movements.

Another benefit is the ability to diversify your portfolio more effectively. With leverage, you can spread your capital across multiple assets or markets, reducing your overall risk exposure. This strategy can help you take advantage of various opportunities simultaneously.

Leverage trading also provides increased capital efficiency. You can free up funds for other investments or trading strategies while still maintaining significant market positions. This flexibility can be particularly useful in fast-moving markets where quick decisions are essential.

Furthermore, leverage can help you profit from both rising and falling markets through long and short positions. This versatility allows you to adapt to various market conditions and potentially generate returns regardless of overall market direction.

Lastly, leverage trading on platforms like PrimeXBT often comes with advanced trading tools and features, enabling you to implement sophisticated strategies and manage your risks more effectively.

Potential Risks and Pitfalls

While leverage trading offers numerous benefits, it’s important to understand the significant risks involved. The primary danger is the potential for substantial losses that can exceed your initial investment. When you trade with leverage, you’re fundamentally borrowing money to increase your position size. If the market moves against you, your losses are magnified, potentially wiping out your entire account balance.

Another risk is the possibility of margin calls. If your account equity falls below the required maintenance margin, you’ll need to deposit additional funds or face automatic liquidation of your positions. This can happen quickly in volatile markets, leaving you with little time to react.

Leverage can also amplify the effects of market volatility, leading to rapid price swings that may trigger stop-loss orders or force you out of positions prematurely. Additionally, the higher trading costs associated with leveraged positions can eat into your profits over time.

Emotional decision-making is another pitfall. The stress of managing larger positions can lead to impulsive trades and poor risk management. It’s vital to maintain discipline and adhere to your trading plan when using leverage.

Risk Management Strategies

Successful traders know that effective risk management is essential when using leverage. To protect your capital, you’ll need to implement several strategies.

First, always use stop-loss orders to limit potential losses. Set these at a level you’re comfortable with, considering your risk tolerance and market conditions.

Diversification is another vital strategy. Don’t put all your eggs in one basket; spread your investments across different assets to reduce overall risk.

Position sizing is equally important. Never risk more than a small percentage of your total capital on a single trade.

You should also consider using take-profit orders to lock in gains when your trade reaches a predetermined profit level. This helps prevent emotions from clouding your judgment.

Additionally, regularly monitor and adjust your leverage ratio based on market volatility and your trading performance.

Keep a trading journal to track your decisions and outcomes. This will help you identify patterns and improve your strategy over time.

Advanced Trading Techniques

Several advanced trading techniques can elevate your leverage trading game. One such technique is scalping, where you make numerous small trades throughout the day to capitalize on minor price movements. This requires quick decision-making and a keen eye for market trends.

Another strategy is arbitrage, which involves exploiting price differences between markets. You’ll need to act swiftly to take advantage of these discrepancies before they disappear.

Hedge trading is a risk management technique where you open positions in opposite directions to protect against potential losses. This can be especially useful in volatile markets.

Grid trading involves setting up multiple buy and sell orders at different price levels. It’s an automated approach that can help you profit from market fluctuations without constant monitoring.

Lastly, consider using algorithmic trading. You’ll create or use pre-programmed trading instructions to execute orders based on specific criteria like price, timing, or volume. This removes emotional decision-making and allows for faster, more efficient trades.

Frequently Asked Questions

How Does Primexbt’s Leverage Compare to Other Cryptocurrency Trading Platforms?

You’ll find PrimeXBT offers competitive leverage compared to other crypto platforms. It’s known for high leverage ratios, up to 100x on some assets. However, always compare specific rates and terms across multiple exchanges before trading.

Can I Use Leverage Trading for Both Long and Short Positions?

Yes, you can use leverage trading for both long and short positions. Whether you’re bullish or bearish, leverage allows you to amplify your potential profits. Remember, it also increases your risk, so trade carefully and manage your positions wisely.

What Are the Minimum and Maximum Leverage Ratios Available on Primexbt?

You’ll find PrimeXBT offers a wide range of leverage options. The minimum leverage ratio is 1:1, while the maximum can go up to 1:1000 for certain assets. Remember, higher leverage means greater potential profits and losses.

Does Primexbt Offer Demo Accounts for Practicing Leverage Trading?

Yes, PrimeXBT offers demo accounts for practicing leverage trading. You can use these accounts to test strategies and familiarize yourself with the platform’s features without risking real money. It’s a great way to gain confidence before trading live.

Are There Any Geographical Restrictions for Using Primexbt’s Leverage Trading Features?

Yes, there are geographical restrictions on PrimeXBT’s leverage trading. You can’t use it if you’re in the US, Canada, or certain other countries. Check their website for a full list of restricted regions.

Wrapping Up

You’ve now got a solid grasp of leverage trading on PrimeXBT. It’s a powerful tool that can amplify your profits, but don’t forget the risks. Always use stop-loss orders and diversify your portfolio to protect yourself. Remember, emotions can cloud your judgment, so stick to your strategy. With practice and careful risk management, you’ll be better equipped to navigate the volatile world of leverage trading. Keep learning and trading responsibly!

Leverage Trading

-

Easy To Use?

-

Cost

-

Profitability

-

Time Needed