Latest News

- Uniswap’s U.S. App Store ranking plummets amid declining trader activity

- Uniswap App Store Ranking Drops Amid Declining Metrics

- Uniswap’s app store ranking dives as user activity and trading volume decline

- Uniswap Achieves Record Quarterly Trading Volume in 2024

Welcome to our Uniswap review.

Uniswap (UNI) is one of the largest players in the decentralized finance (DeFi) landscape since its inception, offering users a novel approach to trading through its automated market maker (AMM) model.

By enabling liquidity provision and fostering a community-driven governance structure, Uniswap presents both opportunities and challenges for traders and liquidity providers alike.

However, as the platform continues to evolve, understanding the intricacies of its operations and potential pitfalls becomes essential.

What implications do these factors have for users traversing the complexities of decentralized trading?

Let’s get into this review to find out!

Quick Overview

- Uniswap is a decentralized exchange that utilizes an automated market maker (AMM) model for seamless trading without traditional order books.

- Users provide liquidity by depositing token pairs into pools, earning transaction fees while facing potential risks like impermanent loss.

- The UNI token serves as a governance token, allowing community members to participate in decision-making and protocol improvements.

- Uniswap promotes transparency by recording all transactions on the Ethereum blockchain, fostering trust and accountability within the platform.

- Despite advantages like permissionless trading, users should be aware of potential drawbacks, including transaction fee fluctuations and smart contract vulnerabilities.

Overview of Uniswap

Here is a great overview video all about Uniswap:

Uniswap, a decentralized exchange protocol built on the Ethereum blockchain, revolutionizes the way users trade cryptocurrencies by enabling automated liquidity provision through smart contracts. Launched in November 2018, Uniswap eliminates the need for traditional order books, instead utilizing an innovative automated market maker (AMM) model. This model allows users to trade directly from their wallets, enhancing security and reducing reliance on custodial services.

The core mechanism of Uniswap involves liquidity pools, where users can contribute their tokens to facilitate trading. In return, liquidity providers earn a percentage of the transaction fees generated from trades executed within their pools. This incentivizes liquidity provision and fosters a self-sustaining ecosystem.

Additionally, Uniswap’s open-source nature allows developers to build on its infrastructure, leading to a diverse array of applications and integrations within the decentralized finance (DeFi) space.

Uniswap has been instrumental in popularizing decentralized exchanges, attracting significant trading volume and user engagement. Its governance token, UNI, empowers holders to participate in essential decisions regarding the protocol’s future, thereby aligning the interests of the community with the platform’s development and sustainability.

How Uniswap Works

Uniswap operates on the principle of Automated Market Making (AMM), which eliminates the need for traditional order books by relying on smart contracts to facilitate trades.

Central to this process are liquidity pools, where users provide assets in exchange for liquidity tokens, enabling seamless transactions and price determination based on supply and demand.

This innovative mechanism not only enhances trading efficiency but also incentivizes liquidity providers through transaction fees and rewards.

Automated Market Making

The foundation of Uniswap’s functionality lies in its innovative automated market-making (AMM) model, which revolutionizes the traditional approach to trading by eliminating the need for order books.

In a conventional exchange, buyers and sellers negotiate prices and quantities, resulting in a centralized system that can be prone to inefficiencies and delays. Uniswap’s AMM, however, utilizes smart contracts to facilitate on-chain liquidity provision through an algorithmic pricing mechanism.

At the core of Uniswap’s AMM is the constant product formula, represented as x * y = k, where x and y are the quantities of two paired assets in a liquidity pool, and k is a constant. This model guarantees that any trade executed will adjust the ratio of the assets in the pool, dynamically influencing their prices based on supply and demand.

This decentralized approach allows users to trade directly from their wallets, enhancing user autonomy and minimizing counterparty risk. Additionally, it enables continuous trading without the limitations of traditional market hours.

As a result, Uniswap’s AMM not only democratizes access to liquidity but also fosters a more efficient trading environment that operates autonomously and transparently.

Liquidity Pool Mechanics

Liquidity pools are fundamental to the operation of Uniswap, serving as the backbone of its automated market-making ecosystem. Each liquidity pool consists of pairs of tokens, where users contribute equal values of both tokens to facilitate trading. This process is vital in establishing liquidity, allowing traders to execute transactions without relying on traditional order books.

Uniswap employs an innovative pricing mechanism known as constant product formula, which maintains the product of the quantities of the two tokens constant. As trades occur, the ratio of tokens in the pool changes, dynamically adjusting the price according to supply and demand. This decentralized model eliminates the need for intermediaries and provides users with direct access to liquidity.

Liquidity providers earn fees from trades that occur within their pools, incentivizing them to maintain their contributions. However, they also face risks, particularly impermanent loss, which arises when the price of tokens diverges greatly.

Understanding these mechanics is essential for participants, as they navigate the balance between potential earnings and associated risks within the Uniswap framework. Overall, the mechanics of liquidity pools are critical in enabling Uniswap’s functionality and fostering a vibrant decentralized trading environment.

Key Features of Uniswap

Uniswap operates as a decentralized trading protocol that facilitates peer-to-peer transactions without the need for intermediaries.

Central to its functionality are liquidity pools, which enable users to provide assets for trading, thereby enhancing market efficiency.

Additionally, the platform employs an automated market-making mechanism, allowing for seamless price determination and trade execution based on supply and demand dynamics.

Decentralized Trading Protocol

While many decentralized trading protocols have emerged in recent years, Uniswap distinguishes itself through its innovative automated market maker (AMM) model, which eliminates the need for traditional order books. This model allows users to trade directly against a liquidity pool rather than relying on buyers and sellers to match orders. By using a constant product formula, Uniswap guarantees that the product of the quantities of the two tokens in a pool remains constant, providing liquidity and pricing efficiency.

Another key feature of Uniswap is its permissionless nature, enabling anyone to create trading pairs and participate in the liquidity provision process. This democratization of access fosters a diverse ecosystem where users can trade a wide variety of tokens without intermediaries.

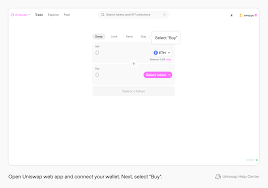

Uniswap’s user-friendly interface enhances the trading experience, allowing for seamless transactions with minimal complexity. Additionally, its integration with various wallets facilitates easy access for users, further promoting adoption among both novice and experienced traders.

Lastly, the protocol’s commitment to transparency and security is evident, as all transactions are executed on the Ethereum blockchain, allowing users to verify trades and liquidity positions in real-time. This combination of features positions Uniswap as a leader in decentralized trading.

Liquidity Pools Mechanism

At the heart of Uniswap’s functionality lies its liquidity pool mechanism, which plays a pivotal role in facilitating trades within the decentralized trading ecosystem. Unlike traditional exchanges that rely on order books, Uniswap employs an innovative approach where users, known as liquidity providers (LPs), deposit pairs of tokens into smart contracts to create liquidity pools.

These pools enable seamless transactions between various cryptocurrencies, allowing traders to execute trades without the need for a counterparty. The liquidity pools operate under the principle of automated pricing, utilizing a constant product formula. This means that the product of the quantities of the two tokens in the pool remains constant, enabling price adjustments based on supply and demand dynamics.

As traders swap one token for another, the ratio of tokens in the pool changes, thereby affecting the price. Additionally, liquidity providers are incentivized through trading fees generated from each transaction within the pool. This mechanism not only increases liquidity but also encourages participation from users, fostering a robust trading environment.

Automated Market Making

Leveraging the principles of automated market making (AMM), Uniswap revolutionizes the trading experience by eliminating the need for traditional market makers. In this decentralized framework, liquidity is provided by users who contribute tokens into liquidity pools, enabling seamless trading without the reliance on order books. This innovative approach guarantees that trading occurs directly against these pools, thereby increasing efficiency and reducing latency in transactions.

Uniswap operates on a constant product formula, maintaining a balance between the assets in a pool. This mechanism allows for price determination based on the ratio of the assets, guaranteeing that any trade will impact the price according to the size of the transaction. Consequently, larger trades may incur slippage, a factor that traders must consider.

The AMM model fosters greater accessibility, as anyone can become a liquidity provider, earning fees proportional to their contribution. This democratization of liquidity enhances market depth and promotes price stability.

Additionally, the transparent nature of smart contracts minimizes counterparty risk, a significant advantage over traditional exchanges. Overall, Uniswap’s AMM framework underscores a paradigm shift in decentralized finance, offering a robust alternative to conventional trading mechanisms.

Advantages of Using Uniswap

Uniswap offers several compelling advantages that make it a prominent choice in the decentralized finance (DeFi) landscape. One of its primary benefits is the ability to facilitate seamless and permissionless trading of tokens, eliminating the need for intermediaries. This decentralized model enhances user autonomy, allowing anyone to become a liquidity provider and earn fees by contributing their assets to liquidity pools.

Moreover, Uniswap employs an automated market-making (AMM) mechanism that guarantees liquidity is always available for traders, even in volatile markets. This contrasts sharply with traditional exchanges, which may experience slippage during periods of low liquidity. The platform’s user-friendly interface further attracts both novice and experienced traders, simplifying the process of swapping tokens.

Additionally, Uniswap’s governance model, which involves UNI token holders in decision-making processes, fosters a sense of community ownership and involvement. This decentralized governance allows for continuous improvement and adaptation to emerging market needs.

Potential Drawbacks of Uniswap

While Uniswap presents several advantages, it is not without its potential drawbacks that users should consider. One primary concern is the issue of impermanent loss, which occurs when liquidity providers experience a decrease in the value of their assets compared to simply holding them. This risk can greatly impact earnings for those participating in liquidity pools.

Moreover, transaction fees can fluctuate, especially during periods of high network congestion. Users may find themselves facing elevated costs when executing trades, which could deter smaller transactions or frequent trading.

Additionally, the platform’s reliance on smart contracts introduces vulnerability to bugs and exploits. While Uniswap has undergone extensive testing, the decentralized nature of the protocol means that any unforeseen issues can expose users to financial risks.

Lastly, the lack of regulatory oversight may lead to uncertainties for users. As governments and regulatory bodies continue to evaluate DeFi platforms, potential future regulations could impact the usability and legality of Uniswap.

- Impermanent loss affecting liquidity providers

- Fluctuating transaction fees during congestion

- Vulnerability to smart contract exploits

- Lack of regulatory oversight and potential uncertainties

Uniswap’s Tokenomics

Understanding the tokenomics of Uniswap is essential for evaluating its overall value proposition and functionality within the decentralized finance (DeFi) ecosystem. The UNI token serves multiple purposes, primarily functioning as a governance token that empowers holders to participate in the decision-making processes regarding the platform’s future. This includes voting on proposals for protocol upgrades, fee structures, and the allocation of development funds.

Initially, Uniswap allocated 1 billion UNI tokens, with a distribution strategy designed to engage various stakeholders. Approximately 60% of the total supply is distributed to the community, including liquidity providers, users, and team members, fostering a sense of ownership among participants.

This community-focused approach not only incentivizes participation but also aligns the interests of users and developers.

Moreover, Uniswap employs a deflationary mechanism through token burns and liquidity incentives, which can potentially enhance the value of the UNI token over time. As demand for the platform increases, the limited supply may further elevate its price dynamics.

Impact on DeFi Ecosystem

The influence of Uniswap on the decentralized finance (DeFi) ecosystem is profound, as it has introduced innovative mechanisms that have reshaped how users engage with digital assets.

By facilitating automated liquidity provision, Uniswap has democratized access to trading and investment opportunities, allowing users to participate without intermediaries. This shift has led to several significant impacts on the DeFi landscape:

- Increased Liquidity: Uniswap’s model encourages users to provide liquidity, resulting in deeper markets and reduced slippage for traders.

- Permissionless Access: Anyone with an Ethereum wallet can use Uniswap, eliminating barriers to entry that traditional financial systems impose.

- Price Discovery: The continuous trading of assets on Uniswap enables efficient price discovery, enhancing market transparency.

- Protocol Interoperability: Uniswap’s open-source nature allows it to integrate seamlessly with other DeFi protocols, fostering a collaborative ecosystem.

Frequently Asked Questions

What Wallets Are Compatible With Uniswap for Trading?

Various wallets are compatible for trading, including MetaMask, Trust Wallet, Coinbase Wallet, and Ledger. These wallets support Ethereum-based assets, providing users with secure access to decentralized exchanges and seamless transaction capabilities within the blockchain ecosystem.

Is Uniswap Suitable for Beginners in Cryptocurrency?

Uniswap can be suitable for beginners due to its user-friendly interface and decentralized nature. However, newcomers must understand liquidity pools, trading risks, and the importance of secure wallet management to navigate the platform effectively.

How Can I Earn Rewards Using Uniswap?

To earn rewards, users can provide liquidity by depositing tokens into liquidity pools, earning trading fees. Additionally, participating in yield farming or staking programs can yield further incentives, enhancing overall returns on their cryptocurrency investments.

What Security Measures Does Uniswap Implement for Users?

Uniswap implements several security measures, including smart contract audits, decentralized governance, and liquidity pool transparency. Additionally, users are encouraged to utilize secure wallets and practice safe trading habits to mitigate risks associated with decentralized finance platforms.

Can I Use Uniswap on Mobile Devices?

Yes, Uniswap can be accessed on mobile devices through various decentralized finance (DeFi) wallet applications that support Ethereum-based protocols. Users should verify their chosen wallet is secure and compatible for ideal trading experiences.

Wrapping Up

In conclusion, Uniswap app delivers a significant advancement in decentralized finance through its innovative automated market maker model.

By facilitating permissionless trading and community governance, it enhances liquidity access while allowing users to earn from liquidity provision.

Nonetheless, the protocol carries inherent risks such as impermanent loss.

Overall, Uniswap’s contributions to the DeFi ecosystem underscore its importance in reshaping traditional trading paradigms, even as challenges remain in its operational framework and user experience.