ACCOINTING.com Review

Accointing by Glassnode Crypto Tax Tool is the solution for your crypto tax tracking needs and filing. It’s a new way of managing your crypto portfolio; which allows you to track your crypto portfolio, produce tax reports and file your crypto taxes with ease. We hope you find this Accointing Review helpful.

Accointing has recently been acquired by Blockpit. If you’re thinking of signing up to Accointing then you would be better off registering directly with Blockpit to avoid the need to migrate over!

Save 15% with the Best Blockpit Promo Code – Exclusive Discount

Looking for the best Accointing or Blockpit promo code? Sign up using our exclusive link here to save 15% on Accointing, now part of the Blockpit family. Accointing offers top-notch crypto portfolio tracking and tax reporting solutions to streamline your crypto accounting. Don’t miss out on this special discount code for one of the leading crypto tax software tools—ideal for anyone searching for a reliable Blockpit or Accointing referral code. Register today and save on your crypto tax reports.

The process of tax filing, with its hassles and complexities, is something we’re all too familiar with but if you’ve invested in digital currencies like Bitcoin it can make this task more complex.

Tracking your crypto portfolio across multiple cryptocurrency exchanges and wallets can be time-consuming and the rules and regulations around crypto taxation are constantly changing, so it can take a lot of work to keep up and report your taxable crypto transactions accurately.

In this Accointing Review, we’ll delve deeper into the Pros and Cons of this crypto tax tool and how it can assist you in managing your cryptocurrency investments across both a portfolio tracker and multiple wallets and crypto exchanges.

TradeWise is also proud to offer a discount of up to $60 off select plans with Accointing Crypto Tax Software.

What is Accointing?

Accointing by Glassnode is a crypto portfolio management financial and tax reporting easy to platform that allows you to import, track and manage all your cryptocurrency transactions across your whole crypto portfolio. The service also generates comprehensive crypto tax reports for when it comes time to file crypto taxes, according to whichever jurisdiction you’re located!

What sets Accointing.com apart from other financial management tools we’ve tested is its ease of use. You can create your account in minutes, and there is no need to download or install any software.

It also offers a free plan; a great way for users to test out its features before subscribing to a paid plan.

Plus, they offer a wide range of tools and resources to help you; including guides for understanding Crypto Currencies and Country Specific Crypto Tax Regulation Information for many countries including USA, UK, Australia, EU, France, Germany and more.

Users can also find certified crypto tax accountants in the platform’s directory.

How Does It Work?

Crypto investors who transact on several exchanges and wallets can find tax season difficult to navigate through multiple platforms, manually inputting data and automatically entering the information onto tax forms when it comes time to report the transactions to your tax authority.

With Accointing you can instantly import all your crypto transactions, including mining, staking, airdrops, and forks onto one platform. This is done with ease, as the platform automatically imports via API for over 300 integrations but if API wallet import support isn’t available you can simply upload your crypto transactions via CSV.

You can then view all my crypto assets, and your transaction history and track your assets on one simple-to-read dashboard. Here you see all my cryptocurrencies and can also see how individual cryptocurrencies and your overall portfolio is performing including your gains and losses and of course view and generate your crypto tax reports.

We’ll take a look now at accounting’s pricing and core features in more detail.

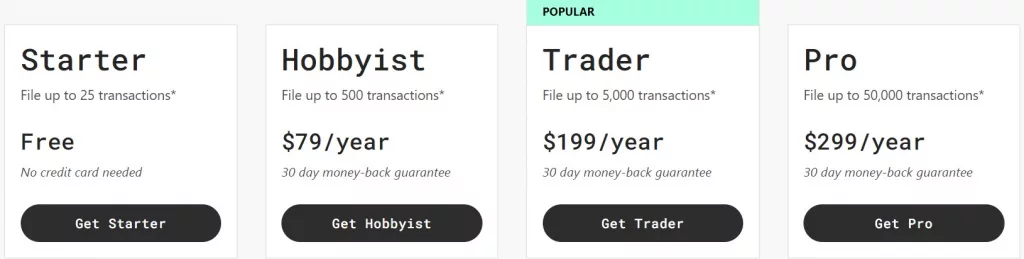

Accointing Pricing: Cost & Pricing Plans

Accointing offers 4 plans, including a Free Plan to suit the needs of all crypto traders. No matter the cost of the plan, each shares the same features. The determining factor in choosing a plan is the volume of transactions across your crypto portfolio. TradeWise is also proud to offer a discount of up to $60 off select plans with Accointing tax software.

How much does Accointing cost?

- Hobbyist (costs $79 annually): You can import or manually input/upload up to 500 crypto transactions with the $49/year Hobbyist plan. You can revise your data and print as many tax reports as needed for the year.

- Trader (costs $199 annually): You can import or manually input/upload up to 5000 crypto transactions with the $199/year Trader plan. You get unlimited revisions and can print as many reports as you need.

- Pro (costs $299 annually): You can file up to 50,000 crypto transactions with a Pro Plan which costs $299 annually. Again, you can revise your data and print as many crypto tax reports as needed for the year.

Compare with other FREE CRYPTO TAX SOFTWARE providers

Core Features

Portfolio Management Tool

Accointing has a cryptocurrency portfolio management tool that allows you to review your crypto investments quickly. One of its notable features, the Overview Tab, gives investors an idea about their overall performance within one specific period by highlighting all successful trades and giving them insight into where there can be improvements in future investment decisions.

The dashboard helps people analyze past performances, so they know what worked best for them while providing helpful resources like market charts.

Once you look at the day’s percentage change, you may examine your open positions and decide your next trading strategy. You can choose the cryptocurrency asset you wish to buy next using the asset allocation chart provided by Accointing.

Simply keeping track of the value and makeup of your portfolio regularly will allow you to develop the most lucrative trading approach. Accointing by Glassnode provides a Full Data Set to track each transaction you make meticulously.

Crypto Tax Calculator

Accointing by Glassnode provides an all-in-one, intuitive crypto tax calculator page that is designed to make the process of filing taxes easier for those who trade cryptocurrency. The page allows users to easily monitor and track their trading activities, calculate their taxable gains, and create full tax reports with just a few simple clicks.

Their tax calculator page is equipped with an automated market data analysis tool that continuously collects and processes income, gain/loss, and other important cryptocurrency trading information. This feature makes it easy for users to accurately identify the total taxable gains resulting from their trades. In addition, this feature can also be used to generate a detailed tax report full of all the transactions made throughout the year.

Crypto tracker

Keep tabs on your crypto investments, track profits, and monitor balances easily with their comprehensive crypto tracker page. Real-time updates provide a clear picture of how profitable or not your trading activities are. With an expansive list of supported crypto exchanges plus various additional features, you can be sure that this is the best source for monitoring all things cryptocurrency.

Accointing.com has created an all-encompassing crypto tax guide to help users effectively submit their cryptocurrency taxes with ease and accuracy. With this information at their fingertips, users have a better idea of when to buy or sell cryptocurrencies for maximum returns.

Crypto Tax Guide

Accointing.com provides a comprehensive crypto tax guide page that contains all the necessary information for users to accurately file their cryptocurrency taxes. This page offers step-by-step instructions on how to handle tax reports, calculate and report taxable gains, as well as detailed advice on other important topics related to filing your crypto taxes.

The Accointing crypto tax guide is designed to make it easy for users of all levels of expertise to understand crypto tax services and comply with applicable tax laws. It also includes helpful tips and tricks that can help users save time when filing their taxes.

Mobile App

Accointing also has a mobile app that makes it easy for users to keep track of their crypto trades and portfolios on-the-go. The app allows users to easily manage and monitor their crypto investments, as well as access Accointing’s other features such as the tax calculator and crypto tracker. With the mobile app, users will never have to worry about missing any important trading opportunities or news.

Tax Loss Harvesting: Trading Tax Optimizer (TTO)

The tax-loss harvesting tool, known as Trading Tax Optimizer (TTO) identifies opportunities to crystallize your losses and create tax savings across your crypto portfolio. Although it may sound complicated, it really isn’t with this free tax plan and loss harvesting tool which could help you save hundreds or even thousands in crypto tax obligations.

TTO makes it easy to see which crypto transactions resulted in either a gain or a loss. You can then make informed decisions about whether or not to sell specific assets as you go through the year to reduce your tax bill.

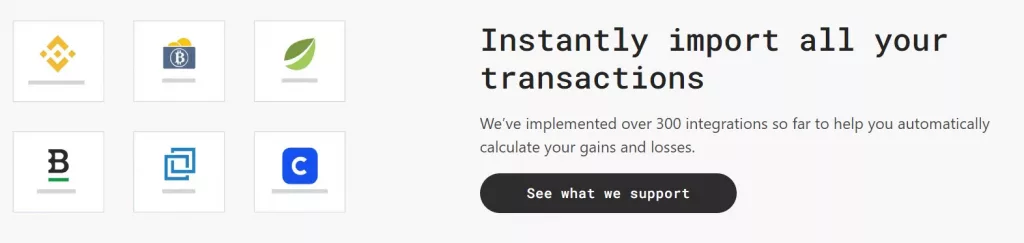

Integrations

Accointing has numerous integrations with centralized and decentralized exchanges, wallets, and cryptocurrency tax software.

Powered by APIs they allow accounting to automatically import your trading data from a crypto exchange, wallet, or platform all into one place so you don’t have to do it manually or via CSV manual spreadsheet imports; saving you time.

Their software supports any crypto exchange, wallet, blockchain, or service for portfolio tracking and calculating crypto taxes, with the majority you can connect via automatic API imports but if unavailable you can download a CSV file or manually import your transaction history.

The following blockchains are supported by Accointing :

- Avax

- Binance Chain

- Binance Smart Chain

- Bitcoin

- Bitcoin Cash

- Cardano

- Cronos

- Dash

- Decred

- DigiByte

- Dogecoin

- EOS

- Ethereum

- Ethereum Classic

- Fantom

- Horizen

- Komodo

- Kusama

- Lisk

- Litecoin

- NEO

- Nano

- Optimism

- Polkadot

- Polygon

- Ripple

- Stellar

- Tezos

- TRON

- VeChain

- ZCash

Crypto Tax Reports

Swiftly and easily report your cryptocurrency transactions for tax purposes with Accointing’s platform. In minutes it reviews your transaction history, classifies the crypto transactions, and reports them on the appropriate tax form. Saving you a huge amount of time and increasing accuracy vs manual review.

The following reports are generated by Accointing.com, we’ve also provided a summary of their use.

- Audit Trail Report: An exhaustive summary of all your cryptocurrency transactions for verification. The IRS or a comparable local body may verify your tax declarations upon request.

- IRS Form 8949: Tax form used by citizens and residents of the United States to report investment capital gains and losses.

- Long-and-Term Gains Report: A report of short-term and long-term capital gains as determined by your tax jurisdiction.

- Crypto Income Report: A record that lists your cryptocurrency income is called a cryptocurrency income report.

- Tax Loss Harvesting: The report that lists your cryptocurrency holdings with the highest potential for tax savings due to unrealized losses.

Importing Data

Accointing also offers an easy way for users to import their trading data from supported exchanges. This feature makes it easier for users to quickly and accurately calculate their taxable gains and generate a detailed report of all the transactions made throughout a tax year. It is important that users make sure that all the necessary information is imported correctly, as any discrepancies could lead to an incorrect calculation of taxable gains.

Here’s a short video showing how easy the process is;

How To Get Started

The Accointing service is designed to make it easier for users to accurately calculate and report their taxable gains. To use accounting, users simply need to create an account, connect the Accointing platform with their cryptocurrency trading exchanges, and start tracking and monitoring their investments using their features. That’s It!

Once users have connected their accounts, Accointing will start to track and monitor all of the users’ trades and generate a detailed report of the taxable gains.

Help & Support

Accointing offers a dedicated help and support page that provides users with all the information they need to get started. This page also includes answers to frequently asked questions and helpful tutorials that can guide users through their various features and functions.

Additionally, Accointing has an active customer service team available via email, chat, and telephone. The team is always available to answer any questions that users may have about their services or provide assistance with any technical issues.

Here are some other ways to get in contact with them;

Accointing Alternatives: Overview

Accointing by Glassnode offers an affordable crypto tax platform to users, and its free plan is a useful way for users to test out its own tax software integration before committing to a paid plan.

Alternative crypto tax platforms out there to make life easier include Koinly, ZenLedger, CoinLedger and TurboTax. For further reading, check out our post on 6 of the Best Crypto Tax Software.

The advantages of the other Cryptocurrency Tax Management Software are minimal; they will all help you to manage your crypto portfolio tracking, calculate your crypto taxes and produce detailed reports. It’s useful to trial any of their Free Plans to see which has the best integrations for your crypto portfolio management and which interface you find easier to view.

Compare Accointing Against Alternatives: In Depth

Compare Accointing vs. Koinly

There are a lot of different options out there when it comes to tracking your cryptocurrency investments. Accointing and Koinly are two of the most popular choices, and they both have a lot to offer investors.

Here’s a comparison of the two services:

Accointing has a free service that provides a comprehensive overview of your cryptocurrency portfolio. It connects to all major exchanges and wallets so that you can see all your holdings in one place.

In addition, it provides detailed analytics and reporting tools so that you can keep track of your performance over time.

Koinly is another popular option for tracking cryptocurrency investments. It also offers a comprehensive crypto portfolio overview and connects with all major crypto exchanges and wallets.

Koinly also offers a free plan with features, such as tax optimization tools and automatic transaction categorization.

Accointing and Koinly are great choices for tracking your cryptocurrency investments. They offer many similar features and connect to all wallets and exchanges for a similar price point.

For more details on Koinly see our detailed review of Koinly here.

Compare Accointing vs. Crypto Tax Calculator

Both Accointing and CryptoTaxCalculator are designed to help you calculate your crypto taxes. However, they take different approaches.

CryptoTaxCalculator is focused on providing a simple experience. You simply need to connect your exchanges and wallets, and the platform will do the rest.

This makes it a great option for those who don’t want to spend much time on their taxes.

Accointing, on the other hand, takes a more hands-on approach.

The platform gives you more control over your crypto tax report and tax calculations and even lets you create custom crypto tax reports. This can be helpful if you have complex crypto holdings or if you want to get a better understanding of your crypto taxes.

So, which platform is right for you?

That depends on your needs. If you’re looking for a simple and easy-to-use crypto compliance solution, then CryptoTaxCalculator is a great choice.

However, if you want more control over your accounting and more tools available, Accointing may be a better option. Ultimately, the best way to decide is to try both platforms and see which works better for you.

Compare Accointing vs. ZenLedger

Accointing and ZenLedger offer a range of features to make managing your crypto taxes easier. Both platforms allow you to import data from various exchanges and wallets and offer support for a wide range of currencies.

However, there are some differences between the two platforms.

Accointing offers a more user-friendly interface with an easy-to-use dashboard that makes it simple to track your progress.

ZenLedger, on the other hand, offers more detailed crypto tax reports and crypto tracking that may be better suited for more experienced users. Both Accointing and ZenLedger offer a free trial and the paid plans are comparable.

So which platform is right for you? Ultimately, the decision comes down to your personal preferences and needs. If you’re looking for an easy-to-use platform with a budget-friendly price tag, Accointing may be the best option for you.

If you need more advanced tax reports or are willing to pay possibly a little more for a top-quality platform, ZenLedger may be the better choice.

Read our detailed review of Zenledgere here.

Compare Accointing vs. Bitwave

If you’re looking for tax reporting software that offers customization and an easy-to-use online toolkit, you might want to consider Accointing.

With Accointing, you can create customized tax reports for your crypto assets. Plus, the entire online tax filing process is simple, which means you won’t have to worry about mailing your tax return or waiting in line at the post office. And if you ever have any questions about using the software, you can reach out to the support team for help.

Bitwave also offers an online tax filing service, but it doesn’t provide the same level of customization as Accointing.

Accointing is a good option to consider if you’re looking for both user-friendly and customizable tax reporting software.

Compare Accointing vs. CoinLedger

Both these services offer crypto tax reports for a cryptocurrency, but there are some key differences between them.

For one thing, Accointing offers a wider range of tax services than CoinLedger.

In addition to creating tax reports, they also offer consulting tax agency and planning and other crypto tax services too. This can be helpful if you need help with how to file your taxes on your cryptocurrency earnings.

CoinLedger is a bit simpler than accointing.com, but it’s also more affordable.

Ultimately, the best choice for you will depend on your specific needs.

For more details about Coinledger check out our detailed Coinledger review.

Compare Accointing vs. TokenTax

Tokentax is one of our favourite services here at Trade Wise. Both these services are very user-friendly and have a lot to offer investors.

Accointing is a very popular crypto wallet that allows you to store, manage, and track your cryptocurrency investments easily. It also has a built-in crypto portfolio tracker to see how your portfolio performs.

In addition, Accointing offers several other features, such as crypto industry news and analysis, price alerts, and a tax calculator.

TokenTax provides software that will help you automatically calculate your capital gains and losses for tax purposes. You can also use TokenTax to file your taxes directly with the IRS.

TokenTax offers various other services, such as tutorials and support, an event calendar, and a community forum.

To learn more about Tokentax, check out our detailed Tokentax review 2023 here.

Compare Accointing vs. TaxBit

Taxbit is another popular web3 tax software provider.

Accointing is a more robust solution that offers support for a wider range of crypto assets. It also integrates with various exchanges and wallets, making it a good choice for users with complex crypto portfolios.

In terms of pricing, Accointing is more expensive than TaxBit, but they do offer a free trial, so you can try out the platform before committing to it.

If you have a complex portfolio, Accointing by Glassnode is the better choice.

However, if you’re looking for a simple and affordable solution, TaxBit may be a better fit.

Continue reading about Taxbi in our full review of TaxBit.

Compare Accointing vs. Ledgible

Lastly, let’s compare Accointing to another popular service – Ledgible.

Ledgible is a cloud-based platform while Accointing is desktop-based. This means that Ledgible can be accessed using any device with an internet connection, allowing users to access their account data on the go.

Learn more about Ledgible in this Ledgible review.

Online Reviews

Accointing is highly rated and trusted by its users. Most Accointing reviews praise the platform for its ease of use, comprehensive features, and customer service support. A few reviewers have complained about technical issues and glitches but these complaints are overshadowed by the positive feedback from users.

Accointing has been consistently well-rated and praised by users on TrustPilot, with an overall score of 4.1 out of 5 stars.

Many reviews have praised Accointing for its comprehensive features and user-friendly interface, with users claiming it is the best platform they have come across for both tracking and tax on their cryptocurrency investments.

Additionally, many users have commented on the helpful and friendly customer service team, claiming their support is excellent and always available when needed.

Mobile App

Accointing has also been well-received on the Apple App Store, where it currently holds a 4.8 out of 5 stars rating.

Many users have commented on the app’s ease of use and comprehensive features, with some claiming it is one of the best cryptocurrency tracking apps available.

Google Play Store- Accointing by Glassnode

Accointing by Glassnode on the App Store

Frequently Asked Questions (FAQs)

In the final part of our Accointing review, we take a look at some of the frequently asked questions.

Can I Try Accointing For Free?

Yes- Accointings free plan is a helpful way for users to test out its features before committing to a paid plan.

Accointing: is it the highest-rated crypto tax software on Trustpilot?

There are numerous positive reviews to be found online for Accointing. They are one of the top-rated crypto tax software providers on Trustpilot with a rating of 4.1 from 75 reviews, at the time of writing this review.

There’s praise from many users for the accuracy of their crypto tracking tool and their support team.

What are considered non-taxable transactions?

Transfers between your own wallets and exchanges are not considered taxable transactions. Accointing will help you import all your transactions and identify these transfers between your own wallets and exchanges and match them so you don’t end up paying more in taxes.

Is Accointing support good?

Support can be found via their help center which also has helpful articles and user guides. If you can’t find an answer to your question here you can speak to them via their chat feature. Overall the support is very good with Accointing.

What Languages is Accointing Available in?

Accointing is available in multiple languages including English, Spanish, and German so you can use it regardless of your language and location.

Is Accointing suitable for beginners & pros?

Accointing can be used if you’re new to the crypto market and this is your first time paying crypto taxes on cryptocurrency trades or if you’re a seasoned pro. There are helpful user guides to get started and the support team is responsive should you require any additional support.

Is Accointing.com safe?

Yes, Accointing.com by Glassnode is a safe and secure platform that uses industry-standard encryption to protect its users’ data. The platform also undergoes regular third-party audits to ensure the safety and security of all user data.

Does Accointing work with TurboTax?

Once you have generated tax reports in Accointing, you can select to submit your crypto taxes via an online tool such as TurboTax, CashApp, or TaxAct.

There are easy-to-follow instructional videos via their YouTube channel including this one, which walks through how to submit with TurboTax for super fast tax filing.

Conclusion: The Best Crypto Tax Tool?

Accointing combines efficiency and creativity as a platform for managing cryptocurrency portfolios and filing taxes. It is a straightforward platform that both new and seasoned cryptocurrency traders can use to quickly and easily optimize their trading plans.

It facilitates the file tax return filing process online, of monitoring your crypto taxes and pricing and speeds up the creation of tax returns.

Remove the hassle and save time on tax reporting – generate your Tax Report In minutes with Accointing.

Try Accointing for FREE or Receive a Discount of Upto $60 off their Paid Plans

We hope you found our Accointing review helpful. Here are some other reviews you might enjoy;

Tokentax crypto tax software review 2023

Accointing (now Blockpit) Review 2024

-

Easy To Use?

-

Cost

-

Time Needed

Summary

Pro

- Makes crypto taxes much easier

- Huge time saver

- Easy to use

- Good for personal investors with low transaction volume.

- Useful Additional tools

Cons

- Not as good for corporate or very active crypto investors

- Less support than other crypto tax software providers