Ledgible is a crypto tax and accounting solution created by the pros at Verady with tax professionals, accounting firms, and crypto companies in mind but it also helps consumers to file their own taxes. Let’s take a ride as we carry out our Ledgible Review in the most expository manner possible in this write-up as we get ready for tax season.

The Ledgible platform is used by financial institutions, businesses, and accounting firms all over the world for crypto taxation, crypto tax reporting doable accounting, and crypto auditing of assets.

The top companies in the sector such as Blockchain, Thomson Reuters, Intuit, Celo, and so on have partnered with Ledgible. Users will find it simpler to connect their data to the financial systems they have been using as a result. Data from Ledgible is obtained directly from the source, and it is protected by industry-standard security measures and a number of protocols to guarantee data protection.

The most reputable brands in the industry, such leading accounting firms such as Silvergate, Anchorage, Tech Square Labs, ttvCapital, and seasoned individual crypto experts like Bo Shen, Frank Bishop collaborate with Ledgible. They have extensive knowledge of blockchain technology and financial technology and are a leading company in crypto accounting records and tax reporting.

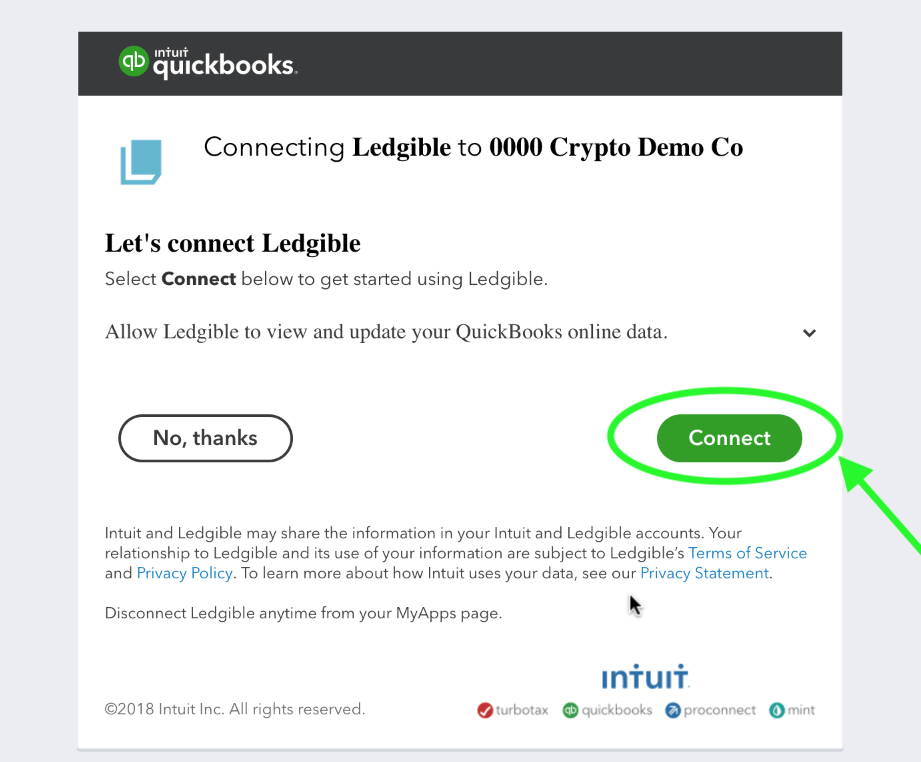

Additionally, it’s crucial to highlight the fact that Ledgible is presently the only blockchain accounting platform with approved connections for accounting software like QuickBooks Online and Xero accounting. Ledgible uses these capabilities, and some of the most well-known financial accounting systems and tax crypto companies do too. Ledgible has extensive integrations that allow you to import supported exchanges and cryptocurrency wallets directly. If there are any gaps, you can fill them in by using the platform’s sophisticated upload and crypto transactions entry tool.

Their engineering and support teams contribute their knowledge to the development of their products and systems as well as to industry participation and leadership with groups including the AICPA, GDF, and the Wall Street Blockchain Alliance which are leading the financial process innovation.

Looking for a Ledgible coupon code or discount code?

While Ledgible doesn’t currently offer any promo codes, I recommend checking out CoinLedger for your crypto tax needs. CoinLedger provides a user-friendly platform that makes tax reporting easier, and by using my referral link here, you can enjoy an exclusive discount code. Simply follow the link and apply the promo code CRYPTOTAX10 at checkout to save on your purchase. Make tax season smoother and more affordable with CoinLedger’s powerful tools!

What is Ledgible?

Ledgible is a professional crypto tax tool, a professional-first cryptocurrency tax platform that offers cryptocurrency tax and accounting software for accountants, tax experts, consumers, companies, and other organizations. Ledgible has the ability to ascertain crypto obligations and transmit that information to the accounting and tax software you already employ. Ledgible’s data is obtained directly from the source, and it is protected by enterprise-grade SOC 1 & 2 security as well as a number of protocols to guarantee data security.

How Does Ledgible Work?

This exceptional crypto accounting wizard enables crypto users to track, monitor, and report crypto assets across their portfolio from a single platform, greatly simplifying working with financial assets report blockchain transaction data. It’s fantastic since it offers accurate and consistent statistics on crypto assets and crypto transaction data. The latest blockchain technology and conventional accounting and financial tools are connected via Ledgible making tax reporting easy.

Client Management

Your first page after logging into Ledgible Crypto Tax Pro is called the Client Management dashboard. By clicking on the company logo (or Client’s option) on the left of the main menu, you may return to this dashboard from any page.

You can perform the following tasks using this dashboard:

- Add new customers/clients

- View your customer/client accounts’ current status.

- View your customer/client accounts’ present payment status.

- Create and maintain customer/client accounts.

- Create and download documents and reports.

- Edit customer/client information.

- Delete previous customers/clients.

Manage Team

By selecting the “Team” tab in the top menu, you can reach the Manage Team dashboard. From here you can manage or add other tax preparers from your firm to the platform once you select the tab.

You can do the following while in this dashboard:

- Increase the team’s size.

- Resend/ recall an email invitation to a team member.

- Copy the invite link and send it to a teammate to share directly.

- Unwanted members can be removed if you are the account admin.

Client Reports

The client’s Report Dashboard is the third tap on the top menu, Reports.

The management actions that can be taken here include:

- Create various reports, including tax forms, for your clients.

- Make files that can be imported into commonly used tax and accounting software.

- Reports and files that have already been requested can be downloaded and detailed.

Ledgible Features

The potential volume of data stored in various wallets and exchanges makes processing cryptocurrency transactions and crypto data difficult. By examining all of this data and introducing features that can make account transactions simpler, Ledgible came up with a solution to this problem.

A few of the key Ledgible features are:

- Export transactions.

- Real-time customer/client collaboration.

- Tax Form generation.

- Tax Form harvesting.

- Wallet Integration.

- Classifying taxable income, capital gains, or gifts.

- Wallet transfers and exchanger gifts are matched automatically.

- Calculating charges for a variety of wallets and exchanges to minimize tax and optimize capital gains.

- By utilizing Ledgible, professionals may create comprehensive future plans for their clients that take advantage of tax advice and planning perspectives.

- Summarisation of earnings.

Countries Supported

Since Ledgible is established in the US, most of its customers reside there. As long as your jurisdiction uses one of the following tax methods, Ledgible tax agency should be suitable for use:

- FIFO (First-In-First-Out)

- LIFO (Last-In-First-Out)

- HIFO (Highest-In-First-Out)

Compatible Integrations

Numerous interfaces with significant blockchains, cryptocurrency exchanges, and accounting platforms are supported by the Ledgible Accounting Platform and Crypto Tax.

You can feel confident that they will handle your data according to industry-leading standards because all of the Ledgible Platform products, in addition to supporting blockchain and cryptocurrency integrations, have undergone independent SOC 1 & 2 audits.

In addition, Ledgible’s Cryptocurrency Enterprise Accounting platform is the only crypto accounting platform that offers approved connectors for both the Xero accounting and QuickBooks Online platforms. Additionally, all of the popular consumer and professional tax preparation software, including TurboTax, UltraTax CS, Tax Act, CCH Axcess, and others, is integrated with Ledgible tax solutions.

A few of the 200plus exchanges supported are Binance, BitcoinToYou, Abra, B2BX, 1BTCXE, Allcoin, ATFX, ACX, Airswap, 3XBit, AAX, Allbit, Altilly, BitBank, Bitforex, Bitstamp, Blockchain, CoinsBank, BTC Markets, Buda, Coincheck, Coinbase, and so on.

Supported Wallets

Ledger, Trezor, and Bitgo are a few of the popular hardware and custodial wallets that are supported.

Product Features

Even the most talented accountants may find it difficult to understand cryptocurrency assets and digital asset transactions in general. The non-organized data that might be found in various exchanges and wallets make processing cryptocurrency transactions challenging. Additionally, as more chains emerge in the Bitcoin market, the transaction procedure becomes more complex. Ledgible found a solution to this issue by examining the data and introducing features that can streamline account transfers. In other words, it gives customers the ability to track, report, and manage crypto holdings from a consolidated platform.

Principal Ledgible products and their characteristics include:

Ledgible Crypto Tax Pro

Ledgible Crypto Tax Pro was created as a tax professional-first software, which implies that while they do provide options for DIY tax filers, their systems were created from the base to support CPAs, tax experts, and accountants in understanding and managing crypto tax accounting purposes. Due to the Ledgible crypto platform’s seamless integration with all popular professional tax software, clients can quickly set up Bitcoin handling for their tax business.

Use the only full tax tracking tool created for tax and accounting professionals to streamline your process for cryptocurrency taxes. Ledgible enables companies to link their customer’s/clients’ portfolios, compute gains and losses automatically, and accurately record cryptocurrency transactions. Ledgible offers automation of crypto activity in a structured, traditional format and directly integrates with all popular professional tax and accounting software companies. This makes it simpler for businesses to manage tax reporting and portfolios including crypto advisory, reporting, and tax planning.

Key features for accounting professionals seeking are:

- Automated Reporting

- Client and Team Management

- Complete Fee Accounting

- Transaction Matching

- Current Year Planning

- Native Integrations

- AICPA SOC1 & 2 Audited Tax Software

Corporate Tax Software

Some Key features include:

- Electronic Filing

- Compliance Management

- Tax Planning

- Data Verification

- Data Import

- Data Export

Tax Practice Management

Some Key features include:

- Workflow Management

- Billing and Invoicing

- Document Management

- Tax forms/filing

- Customer/Client Management

- Date Tracking

Ledgible Pricing

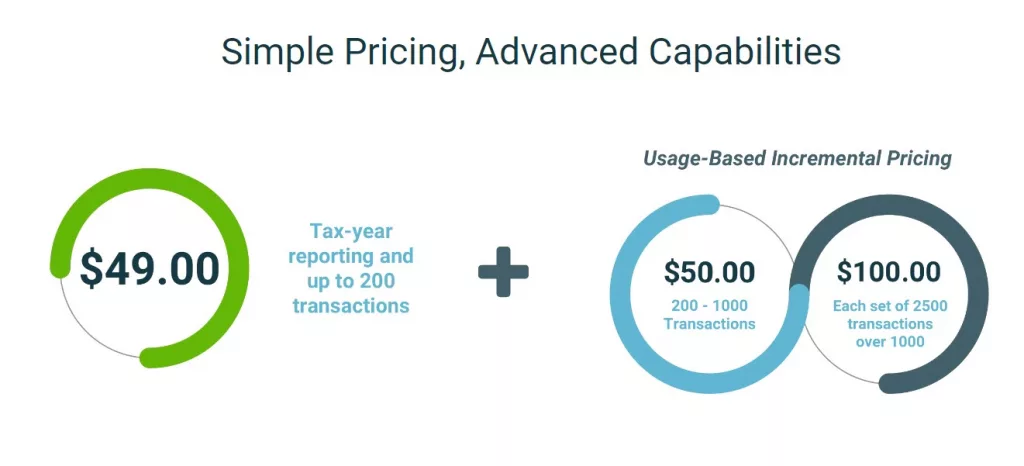

For each application, the Ledgible Crypto Tax & Accounting Platform offers transparent upfront price structures. Ledgible tax platform features simple base pricing and transaction tiers that are well-defined. It is crucial to be aware that the pricing structure for business, professional and institutional use, and consumer taxes is different.

Monthly fees for Enterprise Accounting customers are determined by predicted consumption, but their guaranteed support staff will work with clients to address any unique requirements they may have for their crypto accounting solution.

Professional and Consumer Tax

The pricing structure for customers scales as more transactions are made for personal service. Due to the cumulative nature of transaction expenses, only what is necessary is paid for.

For tax year reporting and transactions up to 200, $49 is charged.

A usage-based incremental pricing approach is employed once the 200 transaction cap has been exceeded.

- A client is charged $50 for 200 – 1000 transactions

- The charge is $100 for subsequent 2500 transactions after the first 1000 transactions.

Also, tax preparer experts can use Ledigble Crypto Tax Pro, which offers both free and premium features. Customers are billed separately based on each client’s crypto taxes, or tax preparers can handle billing to reflect the higher value or higher quality of their tax report services. For particular needs, there are also specialized pricing and billing arrangements available.

Enterprise Accounting

For businesses and organizations, the Ledgible Enterprise Crypto Accounting program was created from the basics to integrate activities related to Bitcoin and digital assets.

The size and operational goals of businesses and institutions influence the type of crypto accounting used. Ledgible provides special, tailored pricing as a result for each business or organization.

Factors such as account users, exchange connections, wallets, transaction volumes, and general ledger integrations are the indicators of account costs.

Key features for Accounting Users are:

- Advanced Roles and Permissions

- Wide range of reporting options

- Wide range of use cases

- Counter-Party Mapping

Ledgible Security and Safety

The Ledgible entire toolkit has undergone AICPA SOC 1 & 2 auditing. It indicates that their instruments pass a number of independent assessments and meet or surpass the data security criteria set by the accounting firms.

Many of the leading FinTech and cryptocurrency businesses worldwide use Ledgible to manage their cryptocurrency data. Their strict and uncompromising protocols when it comes to security and privacy have made them crypto assets managers of choice for managing data.

They offer superior user data security because of the outstanding safeguards implemented. In order to evaluate their systems and incorporate ongoing security monitoring into their operations, they hired professional auditors. Ledgible is one of just a few companies worldwide that has been audited and accredited to the SOC1 and SOC2 standards for financial reporting of crypto asset data because we hold both of those certifications.

Ledgible operates with read-only keys and is not an exchange; as such, it doesn’t conduct any trading activities. Ledgible serves as an intermediary between conventional finance and cryptocurrency. Ledgible offers enterprise-level security to tax and accounting professionals, as well as their clients.

Ledgible Customer Service

Ledgible has an uncomplicated contact page that is available to both current and prospective clients. Users can contact the Ledgible support team for further information about the company’s tax and account solutions. Ledgible will get in touch with you immediately once you provide your email address and contact details. The fact that they are one of the few options offering live crypto tax support for all users, as opposed to outsourced services or bots, makes them stand out.

It is crucial to keep in mind that Ledgible does not now offer users a support phone number or email address.

Ledgible offers a News and Learning Hub where users may learn more about the company, as well as related topics like crypto tax and accounting subjects. They also host a blog where they write, inform and educate the general public on trending and technical topics on cryptocurrency and related fields.

Favorable Reviews can be read online, including TrustPilot Ledgible Reviews.

Alternatives to Ledgible

Koinly, Zenledger, Taxbit, CoinLedger, TokenTax and Cointracker are a few other crypto tax tools that are comparable to Ledigble. Similar to Ledgible, these platforms create comprehensive tax reports with all the relevant information. Even though there are some parallels, Ledgible stands apart from its other crypto tax tool rivals with a primary focus on institutions and professionals rather than individual crypto investors.

Check out our full Koinly reviews here.

Additionally, it’s crucial to highlight the fact that Ledgible is presently the only blockchain accounting platform with approved connections like QuickBooks Online and Xero accounting.

Ledgible Review: User Advantages

The advantages that Ledgible provides to its users are extensive. Ledgible can help you, whether you trade on the newest platforms, deal in non-fungible tokens (NFTs), or engage in a lot of decentralized finance (DeFi).

The following includes some of the more prominent advantages:

Price flexibility: Ledgible provides customers with tremendous price freedom by letting taxpayers and consumers pay according to the volume of successful transactions they perform.

Advanced reporting: Ledgible offers a wide range of reports to consolidate with tax preparation software by taking advantage of its independent audited software and advanced data aggregation capability deployed by tax professionals’ software.

Managing books & businesses using cryptocurrency is made easier with Ledgible software. From asset balances to gain/loss reporting, from OFX Reports to Exchange Orders, Ledgible provides a wide selection of reports to accommodate all scenarios.

Robust Crypto tax reporting and Portfolio Dashboard: Users may simply follow cryptocurrency activities throughout the year using Ledgible’s dashboard, which offers a simple location to keep track of all your cryptocurrency holdings in one place.

Transaction matching: When aggregating different cryptocurrency transaction data, the majority of tax products fall short. Ledgible’s innovative solutions let you track assets with only requires minimal manual intervention and transparently as they travel between exchanges and wallets.

Real-time tracking: Through their asset table, Ledgible Accounting enables clients to track the data associated with their digital assets over time. To obtain precise portfolio tracking and pricing data for all assets on the chosen date, choose from any earlier or more recent date.

Ledgible Review: FAQs

How does my subscription cancellation affect things?

For their personalized monthly plans, there are no obligations. Once your membership has begun, you can cancel it at any moment, and you can retrieve all of your data at any time. If you chose an annual subscription, your refund will be calculated based on the Monthly (non-discounted) pricing for the months you used the accounting platforms.

Crypto tax: What is a cryptocurrency taxable event?

Trade or sale of a digital asset is typically a taxable event in the context of cryptocurrencies. Trading or exchanging a cryptocurrency asset for money or another cryptocurrency is a taxable event. It is also taxable when cryptocurrency is exchanged for goods or services.

Is there a Ledgible App?

There is presently only a desktop version of Ledgible.

Can I Try Ledgible Free of Charge?

Yes- users can sign up and try out Ledgible Crypto Tax Tracker Free, you can then pay for your tax reports during tax season if required services tax due.

Final Thoughts

In the cryptocurrency world, the Ledgible platform continues to perform. It is one of the first crypto platforms to have addressed specific issues with tax reporting, given detailed financial assets reports, and made the accounting process and procedure for crypto-assets simpler in larger enterprises. It has several distinctive properties, and businesses may undoubtedly benefit from it.

For individuals, there are many alternatives with similar features. However, CoinLedger excels with its user-friendly interface and cost-effective pricing. Plus, their customer service is exceptional, offering knowledgeable and supportive assistance that sets them apart from the competition.

Enjoyed our Ledgible Review? Here are some other reviews you might want to check out:

Ledgible

- Easy To Use?

- Cost

- Time Needed