Coinledger Pricing, Plans, & Tax Features

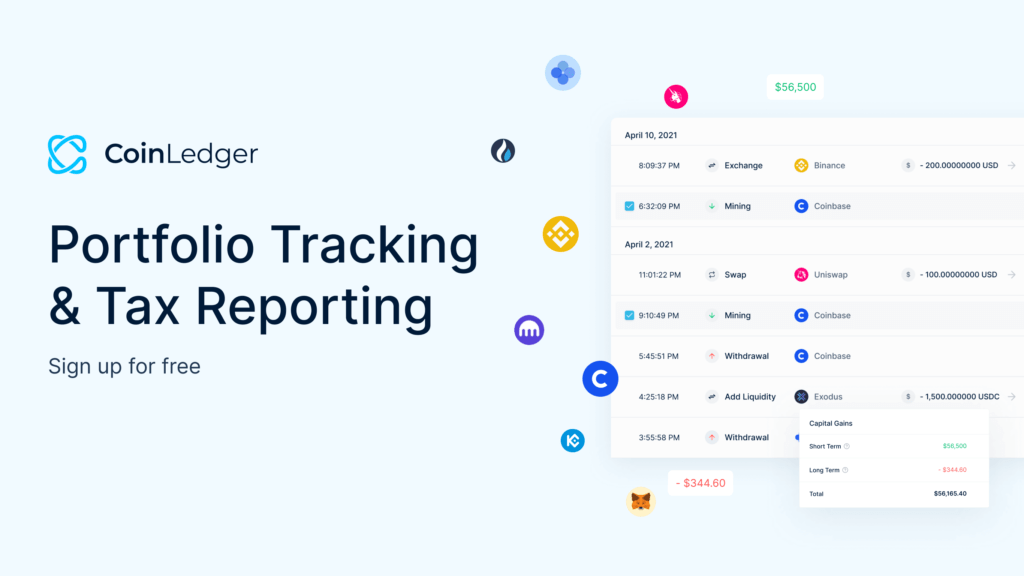

One of the most popular tax filing programs for crypto enthusiasts is CoinLedger.io (previously called CryptoTrader.Tax) which aims to save crypto investors time when filing taxes. We’re providing a thorough analysis of CoinLedger’s tax reporting software to assist you in determining whether it’s the ideal tool for you to generate your crypto tax reports. We hope you find this CoinLedger Review helpful.

Get 10% Off CoinLedger with Our Exclusive Promo Code!

Looking for the best CoinLedger promo code or discount? Use code CRYPTOTAX10 when you sign up through our special link to save 10% on your CoinLedger subscription. CoinLedger simplifies your crypto tax filing with seamless integrations, accurate reports, and easy-to-use features. Don’t miss out on this top CoinLedger referral code to save on one of the leading crypto tax software solutions. Click now, apply the discount code, and start managing your crypto taxes effortlessly!

Most governments consider cryptocurrency an asset subject to taxes and crypto users often find themselves in a difficult position when calculating their owed liabilities across a portfolio of multiple wallets and crypto exchanges.

That’s where software like CoinLedger comes into play! In a matter of minutes, the platform will import your crypto transactions from all exchanges and wallets so they’re correctly classified according to the government standards set forth by the country you reside within. After this time, you can view your whole portfolio of assets on one simple-to-read dashboard. Including viewing your gains and losses and tax reports which can be automatically downloaded by either yourself a tax professional (if using personal accounting) or a tax accountant/tax filing expert.

Read more of this CoinLedger Review to learn all about this top crypto-taxation software solution and how it can assist you in managing your cryptocurrency investments.

What is CoinLedger (previously CryptoTrader.Tax)?

2018 saw the launch of CoinLedger, then known as CryptoTrader.Tax. Its three co-founders had previously developed automated trading programs to profit from price arbitrage on cryptocurrency exchanges. After struggling to discover tools to assist them in automating their crypto tax reporting, they created CryptoTrader.Tax.

The software integrates with all cryptocurrency exchanges, allowing users to import their transaction history immediately via API or users can manually enter or submit their transactions as CSV files which ensures that the platform can integrate with any crypto platform.

Once you’ve connected all your wallets and reviewed transactions you can create comprehensive tax reports utilizing the submitted data and export data to your favorite tax filing software. In the beginning, CryptoTrader.Tax integrated with TurboTax, a tax preparation program favored by many but since then integrations with TaxSlayer, TaxACT, and H&R Block have also been added.

With a single unified view of all the holdings (across all exchanges and wallets), CryptoTrader.Tax allows you to manage your cryptocurrency portfolio, including viewing your losses and gains. Tax Loss Harvesting Tool helps you spot opportunities to crystalize your losses and create tax-saving opportunities across your portfolio.

Users can also find certified crypto tax accountants in the platform’s directory.

Here’s a really great video about the CoinLedger work” for those that want to dig deeper;

How does CryptoTrader.Tax work?

Suppose you’re a cryptocurrency user who conducts transactions on various exchanges and wallets. It can be difficult to navigate through several platforms and manually enter the information on your tax forms when it comes time to report the transactions to tax authorities.

However, you can easily integrate all your transactions including your mining, staking, airdrops import trades, and forks. from across your whole portfolio into CryptoTrader.Tax, immediately creating the necessary tax forms.

CryptoTrader.Tax supports all Exchanges, NFTs, DeFi, and 10,000+ Cryptocurrencies and for the majority, you can automatically import your transactions via API. But if API import isn’t available for the wallet you want to connect then you can simply download your wallet transactions and upload them via CSV.

You can submit your tax forms to the appropriate authorities by sending them straight to TaxACT, TaxSlayer, TurboTax, or H&R Block after you’ve generated them.

Traders can download and utilize the forms anywhere if they use a CPA or an alternate platform to file their crypto taxes.

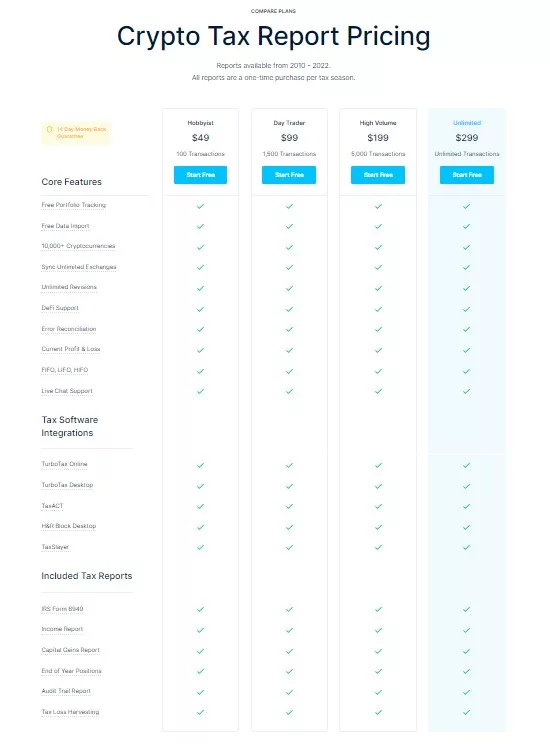

CoinLedger Pricing: Cost and Pricing Plans

CoinLedger, crypto tax report pricing is affordable for everyone. Unlike many other crypto tax platforms, all plans share the same features, support, platform integrations, and a variety of reporting options.

The determining factor in deciding which plan to choose is the number of transactions across your crypto portfolio.

How much does CoinLedger cost?

- Hobbyist tier (costs $49 annually): You can import or manually input/upload up to 100 transactions with the $49/year Hobbyist tier. This plan is appropriate for cryptocurrency users with a minimal number of transactions infrequently as the cap is fairly low.

- Day Trader (costs $99 annually): The 1,500 transaction cap on the $99 per year Day Trader tier. As the name implies, it’s appropriate for users who regularly transact in cryptocurrencies.

- High Volume (costs $159 annually): The High Volume tier, which costs $159 yearly, may accommodate up to 5,000 transactions. It’s perfect for individuals who frequently transact.

- Unlimited Transactions (costs $299 annually): There is no cap on how many transactions you can manually enter or import with the Unlimited tier, which costs $299 annually. This package is most appropriate for full- or daytime traders who do many transactions that add up to significant sums.

CoinLedger’s pricing also offers a full money-back guarantee for all purchases within 14 calendar days of your purchase so if you are not satisfied with the tax report, you can get your money back. CoinLedger’s tax software pricing is fair, relative to the competition, so you can be sure you’re not overpaying for their services.

So if you’re looking for an easy way to calculate your taxes on cryptocurrency transactions, CoinLedger is a great option.

CryptoTrader.Tax Review of Integrations

As tax season approaches, many crypto investors scramble to figure out how to report their gains. CryptoTrader.Tax Review is your solution for getting a complete picture of your portfolio, viewing your gains and losses, and producing the relevant reports in a matter of minutes.

It has integrations with centralized and decentralized exchanges, wallets, and cryptocurrency tax software. These connections are powered by APIs and are what allow the import of your trading data from a crypto exchange into one place so you don’t have to do it manually!

CryptoTrader.Tax has also added support for tracking lost or stolen coins, making it easier to report crypto losses.

Whether you’re just getting started in the world of crypto tax calculations and reporting or you’re a seasoned pro, CryptoTrader.Tax is the perfect solution for you to calculate and report the figure to pay taxes.

Tax Software

Four tax preparation programs software: TurboTax, TaxSlayer, TaxACT, and H&R Block, are connected with CryptoTrader.Tax. Thanks to the connection, you may seamlessly trade data between any of these platforms for the preparation of American income tax returns and CoinLedger.

CryptoTrader.Tax will use transactional data to provide cryptocurrency tax reports for you. The reports can then be uploaded to a platform like TurboTax, TaxACT, or TaxSlayer.

The data on the tax reports and the format of the tax software are automatically matched. For instance, you can download and upload to TaxACT the file that details all of your cryptocurrency earnings and losses.

TaxACT will auto-extract the relevant information into its data columns since the formats match. The procedure is the same and seamless for TaxSlayer, TurboTax, and H&R Block.

This feature relieves you of the burden of manually calculating the tax liabilities and entering them into the tax filing software.

Exchanges

The majority of centralized crypto exchanges, including well-known major exchanges ones like Coinbase, Binance, Bitfinex, KuCoin, Kraken, etc., integrate with CryptoTrader.Tax API.

DeFi API integrations are increasing too with Uniswap, SushiSwap, and PancakeSwap

You can choose from all major exchanges and platforms you trade on and enter a valid Read Only Access API secret and API key into your CryptoTrader.Tax dashboard. With all these credentials, CryptoTrader.Tax can read your transaction data directly, saving you the time it would have taken you to enter it manually.

CryptoTrader.Tax APIs make it easy for users to import Read Only transaction data and determine their tax obligations.

NFT

Blockchain-based cryptographic records, known as non-fungible tokens (NFTs), are impossible for anyone to replicate. Any digital format is acceptable for the record, but art is its main application.

Since NFTs are produced, traded, purchased, and sold, they are considered taxable assets. There are two options if you wish to import the NFT transaction data into CryptoTrader.Tax: an API or a wallet address.

Only one NFT market, OpenSea, offers API connectivity. If you utilize OpenSea, you can link your accounts to and automatically import the transaction data, just like you would with a crypto exchange.

Otherwise, CryptoTrader.Tax will import the NFT transactions with only one click if you supply the wallet address (on supported blockchains).

This tax software will analyze your NFT trading history and determine your short- and long-term losses or gains based on the difference between the price you paid to mint or purchase an NFT and the price you received when you sold it.

DeFi

Decentralized Finance”DeFi” platforms are peer-to-peer markets where users transact with one another directly without the use of a custodian or third-party middleman.

Defi has dominated the cryptocurrency industry, and some users may need a tool like CryptoTrader.Tax to assist them in managing their taxes.

Uniswap, dYdX, SushiSwap, and other Defi platforms offer APIs that let other apps access their data. You can create an API key to import your transaction data and grant CryptoTrader.Tax “Read-Only” access.

If your DeFi platform doesn’t have CryptoTrader.Tax API connectivity, you can collect transaction data using a CSV file or your public wallet address.

How do you Upload Transaction Data using a CSV File?

- Go to the DeFi platform.

- To retrieve your transaction history, look for the appropriate button.

- Download the transaction history as a CSV file for the specified time frame.

- To CryptoTrader.Tax, upload the CSV file.

How do you Upload Transaction Data via a Wallet Address?

- The public wallet address can be retrieved via the Defi exchange.

- Click Add account and choose the blockchain that your Defi exchange is based on from your CryptoTrader.Tax dashboard.

- Give CryptoTrader.Tax the wallet address, which will import the transaction data without delay.

CryptoTrader.Tax integrates with both base-level blockchains and the dApps built on top of them. The following blockchains are supported:

CryptoTrader.Tax Cryptocurrency Tax Services

CryptoTrader.Tax understands that dealing with crypto taxes can be a headache. They offer crypto tax services and tax reporting software which allows you to easily and accurately file your crypto taxes come tax season. So whether you’re a crypto beginner or a seasoned pro, CryptoTrader.Tax can help you with all your crypto tax platforms and needs.

Portfolio Tracking

Like most people, you probably have your crypto assets spread across different wallets, crypto exchanges, and blockchains. Keeping track of the total value of your assets can be a challenge, but it’s important to know how your portfolio is performing.

Fortunately, CryptoTrader.Tax is an effective portfolio-tracking tool that makes tracking your cost basis easy, so you can see how your investment is growing. As a result, CryptoTrader.Tax is an indispensable tool for any serious crypto investor.

Tax Loss Harvesting

Tax loss harvesting is a deliberate act of selling some investments at a loss to offset gains you’ve realized from other investments. American taxpayers can offset up to $3,000 per year from regular income, but there’s no limit for offsetting capital gains, which you get from cryptocurrency trading. Using CryptoTrader.Tax is much easier than manually poring through your transaction history to compute unrealized losses.

Rather than waiting until the end of the tax year and scrambling to figure out which trades resulted in capital gains and losses. This tax report makes it easy to see which transactions resulted in gains or losses so that you can make informed decisions about whether or not to sell specific assets as you go through the year.

Using CryptoTrader.Tax, you can be sure you’re getting the most accurate information about your cryptocurrency holdings and you can make informed decisions about when to sell specific assets to reduce your tax bill.

Invite Tax Professionals

Paying taxes is one of the most important responsibilities of any individual or business. However, preparing tax reports can be a complex and time-consuming process, particularly for those with a high volume of transactions.

As a result, some users hire certified accountants and tax professionals to help them with their taxes.

CoinLedger makes it easy for users to grant their hired tax professionals access to their tax reports. This way, the professionals can make the needed edits and ensure that the tax reports are accurate

CoinLedger Crypto Tax Reports

CoinLedger is a platform that allows you to quickly and easily report your cryptocurrency transactions for tax purposes.

It digs into your transaction history, classifies the transactions, and reports them on the appropriate tax form. This saves you the time and effort of doing it manually.

The tax reports that CoinLedger generates are listed below, along with information on their use.

- Audit Trail Report: An exhaustive summary of all your cryptocurrency transactions for verification. The IRS or a comparable local body may verify your tax declarations upon request.

- IRS Form 8949: Tax form used by citizens and residents of the United States to report investment capital gains and losses.

- Long-and-Term Gains Report: A report of short- and long-term capital gains as determined by your tax jurisdiction is known as a long-and-short-term gains tax report.

- Crypto Income Report: A record that lists your cryptocurrency income is called a cryptocurrency income report.

- Tax Loss Harvesting: The report that lists your cryptocurrency holdings with the highest potential for tax savings due to unrealized losses.

CoinLedger Alternatives

CoinLedger is an affordable online crypto tax platform, and its free plan is a great way for users to test out its features before subscribing to a paid plan.

However, there are other crypto tax platforms out there to help you file taxes in crypto world including Koinly, ZenLedger, Ledgible, TurboTax and Token Tax.

Check out our review of Koinly here.

Overall, the advantages of the other three platforms are minimal and one feature we do appreciate is their 14 Money Back Guarantee which we’ve not seen from other Cryptocurrency Tax Management Software.

International Tax Reporting

CoinLedger can generate your crypto gains, losses, and income reports in any fiat currency. These same profit and loss reports can then be used to file international tax reports for the country you reside in.

Frequently Asked Questions (FAQs)

How do you work out your crypto tax liabilities?

The point at which crypto is taxed and the rate at which you’ll pay tax varies per country.

When you set up your account with CryptoTrader.Tax you will enter the country to which you pay tax in. CryptoTrader.Tax can then identify each taxable transaction and calculates your crypto income and capital gains and losses provides tax reports for your locality and shows your tax due.

Is CoinLedger safe & secure?

CoinLedger leverages market-leading security practices to make sure your crypto trading data stays safe.

Exchange integrations require an API connection or a transaction history file to be uploaded. During API imports, CoinLedger requires Read-Only permissions and at no point has access to users’ funds or private keys.

During file imports, CoinLedger only reads the relevant crypto transactions history into memory before discarding the file and personal information is never saved into their database.

Finally, you have the option to manage your data including deleting everything from the account, including trades, transactions, and connections to exchange account.

Can I Try CoinLedger For Free?

Yes, you can register on CoinLedger for free, import your transaction history, analyze your losses and calculate capital gains elsewhere, and manage your portfolio of cryptocurrencies. A free account also allows you to preview your tax forms, but you must choose and purchase a plan to download any reports.

Anyone interested in learning more about crypto taxes and how to file their taxes on crypto assets can sign up for a free account with CoinLedger. With a free account, users will have access to all of the features of the crypto tax platform, including the ability to generate international tax reports and relevant tax forms.

In addition, users can view their tax reports in real-time, making it easy to stay up-to-date on their tax obligations. The free account comes with no commitment, so users can cancel anytime if they decide that CoinLedger is not right for them.

Is CryptoTrader.Tax support good?

The support team is very responsive no matter the plan you purchase. You can contact them for quick responding customer support 24/7 via email with any questions you might have. You can also find assistance via their help center which also has helpful articles and user guides.

Does CryptoTrader.Tax work with TurboTax?

They’ve TurboTax so once you’ve generated your tax reports you can import them directly into TurboTax with the click of a button! It really is that simple but here’s a video that explains more.

CoinLedger Reviews

They are consistently one of the highest-rated crypto tax software providers on Trustpilot with a rating of 4.8 from 592 reviews by users at the time of writing this review. CoinLedger Reviews regularly praise its support team’s help and easy-to-use platform and are considered the best crypto tax reporting software by many users.

Contact CoinLedger

CryptoTrader Tax Review: Conclusion

CryptoTrader.Tax offers user-friendly crypto tax calculating software which has to date helped over 300,000+ crypto investors to complete accurate cryptocurrency tax returns.

It supports all exchanges, NFTs, DeFi, and 10000+ Cryptocurrencies and offers hassle-free seamless integration of all major exchanges and DeFi Protocols via API saving you time.

They provide a fair pricing model, relative to its competitors; with plans from just $49, but also features a free plan to help you test out the waters and unlike many of its competitors gives a 14 Day Full Money Back Guarantee.

Save time and generate your Tax Report In Under 20 Minutes with CryptoTrader.Tax.

Here are some other reviews you might enjoy;

CoinLedger (ex. CryptoTrader.Tax) Review 2024

-

Easy To Use?

-

Cost

-

Time Needed