In this TokenTax Review, we’ll provide all the information you’ll need to make an informed decision as to whether this is the best cryptocurrency tax software for your tax management needs.

TokenTax’s crypto tax software provides a comprehensive suite of services for crypto investors. It enables users to easily calculate their crypto tax liabilities, by connecting their accounts from the most popular crypto exchanges and tracking transactions throughout the year.

Get 5% Off with Our Exclusive TokenTax Promo Code – Save on Your Crypto Tax Filing!

Unlock 5% Off TokenTax with Our Exclusive Discount Code! Looking for the best TokenTax discount code, TokenTax promo code, or TokenTax referral code? Use code SECRET_5 when signing up through our affiliate link to enjoy a 5% discount on your TokenTax subscription. Whether you’re new to crypto or a frequent trader, TokenTax offers top-notch features to simplify your tax reporting. Don’t miss out on this opportunity to use the best code for TokenTax and enhance your crypto tax management. Click the link, apply the promo code, and start optimizing your tax process today!

The software automatically generates customized crypto tax forms such as IRS Form 8949 and is compatible with the #1 best-selling tax preparation software TurboTax; allowing users to file quickly and accurately.

Here’s a short explanation of how TokenTax works;

TokenTax Review: Who is Token Tax?

Founded in 2017, TokenTax is the leading cryptocurrency tax software available on the market today. The company offers a suite of tools to help individuals and businesses track and report their cryptocurrency profits and losses.

TokenTax has helped thousands of users file their taxes with the IRS (as well as tax authorities around the world), and the company has become the go-to choice for those looking for a simple and streamlined way to manage their crypto taxes.

Where are they based?

TokenTax is a New York-based company that serves clients in every country of the world.

Whether you’re based in the US, UK, Europe, South Africa, Australia, or any other country, TokenTax can calculate capital gains/losses and tax liabilities, and automatically generates your relevant tax forms.

Crypto Taxes

TokenTax is committed to helping users navigate the complex world of cryptocurrency taxation, and the company offers a variety of resources to help users stay compliant with the law.

They don’t just offer tax software but also have an experienced team of tax experts, who will manually check your transactions and tax statements before it’s submitted.

In addition to its tax software, it also offers a range of educational materials, including blog posts, NFT tax guides and DeFi tax guides.

Whether you’re a seasoned crypto trader or just getting started, TokenTax is the perfect solution for your needs.

How TokenTax Works

As a cryptocurrency investor, you face a unique set of challenges when it comes to filing your taxes. Not only do you need to track your ROIs from each trade, but you also need to report your earnings in a way that complies with your jurisdiction’s complex regulations.

TokenTax’s platform makes it easy to track your trades and calculate your tax liability. Just connect your wallets and crypto exchange, and TokenTax will generate a complete record of your trading activity.

You can then use this information to file your taxes with confidence, knowing that you’ve accurately reported all of your earnings. And because Token Tax is updated regularly, you can be sure that you’re always compliant with the latest rules.

What Are The Key Features?

TokenTax software provides a range of features.

It helps users with:

- Connecting to crypto exchanges, such as Coinbase and Binance, so all transactions are automatically tracked in one place.

- Automatically generating optimized tax forms saves a lot of time.

- Calculating capital gains and losses on sales and trades, allowing users to accurately report their cryptocurrency profits and losses when filing taxes.

- Tax loss harvesting to optimize deductions and reduce the amount owed.

- Customized reports for different types of crypto activities, such as mining or staking rewards, enabling investors to easily track their taxable events throughout the year.

- Comprehensive support from tax professionals who can provide personalized advice based on individual needs.

All of these features simplify and streamline the crypto tax filing process, enabling investors to easily track transactions and accurately.

Getting started with TokenTax

Getting started with TokenTax is easy. Just sign up for an account and connect your wallet or crypto exchange via API.

The API will review your crypto transactions data and the algorithms will automatically calculate your gains and losses for every trade. You can also now import data about your trade history from select crypto exchanges. And if you have any questions, the team of tax professionals is there to help.

Benefits of using TokenTax

TokenTax’s range of features makes it easy to stay compliant with tax laws. For example, the software can generate different tax forms that are required for capital gains reporting.

It also offers support for a wide range of crypto exchanges and wallets, making it a convenient solution for investors who hold multiple types of digital assets.

Moreover, the software has unique tools that make it easy to track your portfolio performance and assess your tax liability.

As a result, TokenTax is an essential tool for any cryptocurrency investor who doesn’t want to dupe their local tax authorities by not filing taxes.

In the next section of this Tokentax review, we scrutinize the benefits of using their tax software platform:

- Intuitive and powerful crypto tax software

Anyone who has ever done their taxes will know how complicated and time-consuming the process can be. Now, add in the fact that you have to keep track of all your cryptocurrency transactions, and it can seem like an impossible task.

But it doesn’t have to be!

With TokenTax you can file your returns in a jiffy.

The software is intuitive, so you can automatically import your data via API or by uploading a CSV file that stores all your transactions from the exchanges and wallets which you have signed up for. The software then calculates taxes and generates the required forms.

- Integrations with protocols, wallets, and exchanges

One of the best things about TokenTax is that it always looks to find ways for users to file their taxes easily. That’s why it has some of the latest integrations with leading exchanges, protocols, and wallets in the space.

Now, you can automatically import your transaction data from Coinbase, Binance, Kucoin, Ethereum wallets, and more.

This will make it easier than ever to stay on top of your crypto taxes and ensure that you are properly reporting your gains and losses.

- Reconciliation teams and expert accounting

Cryptocurrency can be confusing and overwhelming for many, especially when it comes to taxes.

Token Tax understands this concern. To avoid this confusion, it has developed a team of crypto tax experts, who can help you with all your crypto accounting and reconciliation needs.

Whether you’re a beginner or a veteran, the team can help you figure out what you need to do to fulfil the requirements of the IRS/ HMRC /ATO/ CRA, etc., and follow its laws.

Whenever you are in trouble, you will find an expert willing to work with you to understand your unique situation and create a plan that works in your favour.

- Knowledge about DeFi, NFT, and crypto

As the world of cryptocurrency and blockchain technology continues to evolve, so too do the taxes associated with these assets.

TokenTax is a step in the right direction to make complications easier for its user. It provides enough information about crypto investors and detailed guides on everything from DeFi to NFTs.

With TokenTax, you can be sure that you’re getting the most up-to-date and accurate information on how to report your crypto taxes. It’s a trustworthy guide that can help you understand the nuances of preparing your returns.

- Real-time reports and automated forms

TokenTax offers a streamlined experience with automated forms and real-time reporting.

Once you start using the software, you will understand how easy it is to file your annual returns. In fact, it will become your go-to tool whenever you want to know anything about crypto taxes and how to file them.

Those who have already used the software say that they use TokenTax to check their transactions and also calculate their ROIs. The software does everything on your behalf.

If you have any questions, the customer support team is always there to help. This is a revolutionary software that has changed the way users can file their taxes.

- Supports Margin Trading

With TokenTax, you can reconcile even the most advanced crypto activities like margin trading, borrowing, lending, and other crypto trading data.

Their experienced team of crypto tax specialists are here to help you navigate complex on-chain transactions and make sure your taxes are filed correctly.

- Tax Loss Harvesting

The Tax Loss Harvesting feature is a powerful tool that helps users maximize their tax benefits by generating losses to offset gains.

By automatically tracking your transactions and market performance, TokenTax identifies opportunities for you to strategically sell digital assets at specific times to take advantage of capital losses; reducing your tax burden.

This helps to reduce your tax bill and keep more money in your pocket.

Here’s a really great video for those that want to dig deeper;

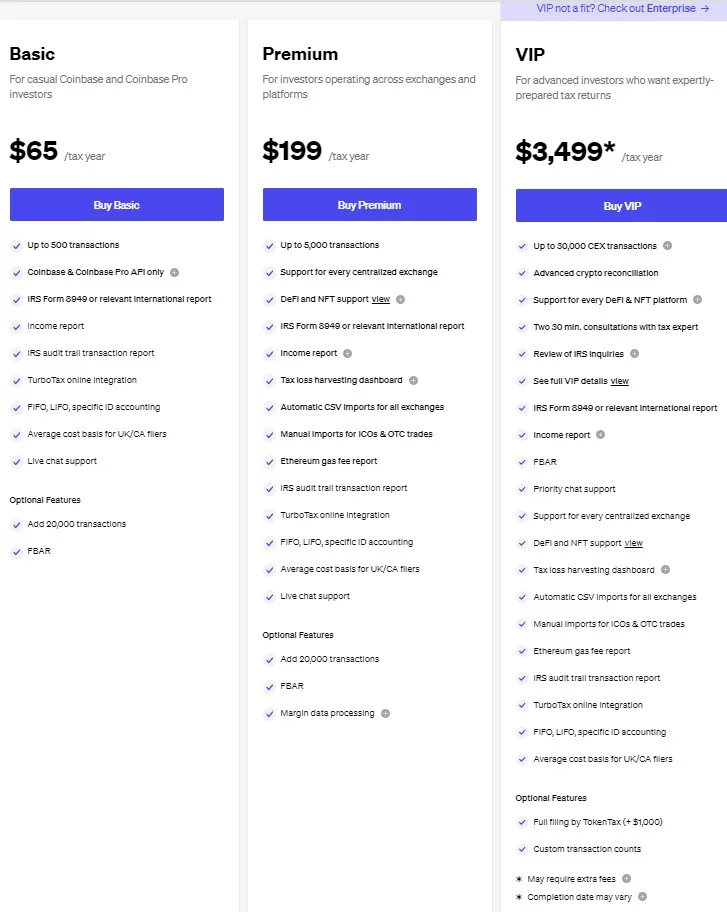

TokenTax Cost: Plans & Pricing

Depending on the level of your trading, TokenTax has a plan and pricing that will fit your needs and your desired level of service.

There are 4 different levels of membership for using TokenTax and a notable benefit is all come with live chat support.

TokenTax pricing starts at just $65/per year for the Basic Plan and up to $3499/per year for the VIP Plan- below is a review of the features of each.

Basic $65 / tax year

This plan is suitable for Coinbase and Coinbase Pro Casual Investors and includes the following:

- Up to 500 transactions

- Coinbase & Coinbase Pro API only– if you have wallets on other exchanges this is not the right plan for you.

- IRS audit trail transaction report

- Income Report

- IRS Tax Form 8949 or relevant International Report

- TurboTax tax filing software integration

- FIFO, LIFO, specific ID accounting

- Average cost basis for UK/CA filers

- Live chat support

- Optional FBAR- US applicable only

Premium $199/ tax year

This plan is ideal for investors operating across multiple exchanges and platforms with under 5,000 transactions.

- Up to 5,000 transactions

- Support for all centralized exchanges

- DeFi and NFT support.

- Tax loss harvesting dashboard

- Automatic CSV imports for all exchanges

- Manual imports for ICOs & OTC trades

- Ethereum gas fee report

- IRS audit trail transaction report

- Income report IRS Form 8949 or relevant International Report

- TurboTax filing software integration

- FIFO, LIFO, specific ID accounting

- Average cost basis for UK/CA filers

- Live chat support

- Optional FBAR- US applicable only

VIP Plan $3499/ tax year

This premium plan is really comprehensive and is ideal for advanced investors who are seeking an expertly prepared return. This is the plan I chose for calculating tax liabilities and liabilities for my business.

It includes all of the above features from the Pro Plan and the extras listed below

- Up to 30,000 CEX transactions

- Advanced crypto reconciliation

- Support for every DeFi & NFT platform

- Two 30-minute consultations with a tax professional

- IRS audit assistance

- Priority chat support

TokenTax Alternatives?

TokenTax is an excellent crypto tax service and a full-service accounting firm, however, there are other full tax filing services and software alternatives available.

In the next section of our Tokentax review, let’s see how TokenTax Compare to other leading cryptocurrency tax software:

TokenTax vs Koinly

Koinly is a comprehensive portfolio tracking and tax reporting platform for cryptocurrencies. It can connect to multiple exchanges and wallets. Koinly also has features such as automated import of trading history, portfolio performance tracking, advanced analytics, custom reports, a full tax dashboard, and more.

Find out more about Koinly in our Koinly tax software review.

TokenTax vs CoinLedger

CoinLedger is another great alternative. This software allows users to track their cryptocurrency transaction data from any crypto exchange or wallet in real time, including profits/losses for each transaction.

CoinLedger also includes tools for calculating capital gains taxes based on the IRS’s cost-basis methodologies. Finally, users can generate custom reports and export them to PDF or CSV files.

Check out our detailed Coinledger review here.

TokenTax vs Zenledger

Zenledger is a popular crypto tax software service for tracking cryptocurrency investments and generating capital gains tax reports. It supports most exchanges and wallets, including Coinbase, Binance, Gemini etc.

The software also has features such as automated import of trading history, portfolio performance tracking, cost basis calculation methods, and more.

Additionally, users can access their data from the dashboard in any given period and generate customized reports.

Overall, the advantages of the other tax service are minimal, so you can freely choose between any of these contenders.

TokenTax offers an excellent software solution by providing users with all of the key features they need to calculate their crypto taxes at an affordable price.

Read our detailed Zenledger review here.

TokenTax Online Reviews

Token Tax has established itself as one of the premier crypto tax software providers on Trustpilot with a top-notch review rating of Excellent from 125 users.

Many customers have left reviews praising and recommending TokenTax for its VIP service, user-friendly platform, and overall positive experience – you’ll be hard-pressed to find many negative reviews about TokenTax!

Taxes on Crypto Margin Trading

Taxes on crypto margin trading can be complex, but TokenTax makes it easier. Crypto investors who trade on margin have to report their gains and losses from the activity separately from other trades in their portfolio.

This means that taxes must be split out for each position on margin exchanges, including costs for fees, commissions, and even interest paid. To make matters more complicated, not all countries treat crypto margin trading the same way when it comes to tax obligations.

TokenTax supports crypto traders to navigate these tricky waters by providing accurate calculations and reports based on your jurisdiction’s tax laws. With this platform, all margin exchanges are supported and you can easily track all of your crypto margin trades and transactions, calculate any capital gains or losses due from those trades, and generate relevant documents like Form 8949 for easy filing.

Plus, TokenTax also offers an audit trail report that captures all of your crypto trading activity over the course of the year.

TokenTax Reviews: Enterprises

TokenTax is an enterprise-level crypto tax software designed to help companies of all sizes and industries manage their annual returns.

They provide comprehensive support for corporate crypto users, offering a suite of features including automatic imports import trades from major cryptocurrency exchanges, and full integration with the IRS 1099 reporting rules.

The platform helps businesses streamline their crypto tax processes by providing automated data import from more than 20 different exchanges and wallets, including Coinbase Pro and Kraken.

Data is automatically mapped to individual tax forms and categorized according to the IRS’s crypto tax treatment.

Another feature is the Tax Loss Harvesting (TLH) tool which helps businesses offset taxable gains, along with custom calculations for company-specific scenarios such as employee compensation in cryptocurrency or other complex payments.

Finally, companies can rest assured that their data is secure with two-factor authentication, regular backups, and bank-level encryption.

TokenTax Enterprise helps streamline the process of filing corporate taxes by automating tedious tasks like calculating cost basis and tracking coin trades.

The platform allows users to import transaction history from major exchanges and wallets with just a few clicks while offering powerful features such as Tax Loss Harvesting (TLH), automated 1099 reporting, advanced analytics, and more.

With TokenTax Enterprise, businesses can save time and money on their crypto taxes and reduce the risk of costly compliance errors.

Crypto Tax Reports and Forms

TokenTax helps crypto investors and crypto traders generate compliant reports.

Whether you have a few on-chain transactions or thousands, TokenTax can accommodate all trading activity from multiple exchanges and wallets.

Each report includes an audit trail analysis of your blockchain transactions as well as easy-to-understand visualizations that explain the breakdown of traded assets and capital gains/losses in each category.

After importing crypto tax data and reviewing it, a full summary tax return is produced including the following forms:

- Audit Trail Report: TokenTax provides crypto investors with an audit trail report that captures all their activity over the course of a tax year. This report includes in-depth detail on blockchain trading, including quantities and prices for each transaction. The audit trail report is available in CSV format.

- Form 8949: By leveraging your trade data, TokenTax is able to complete IRS Form 8949 for you with ease, producing compatible versions that can be used with tax filing software. Furthermore, it can be used with TurboTax and TaxAct to file your tax returns.

- Mining and Staking Income Report: Witness your income from mining, staking, airdrops, and beyond accumulate in real-time—as well as its monetary value.

- ETH Gas Fee Report: Lower your capital gains by taking advantage of Ethereum gas fee deductions and track those opportunities with this convenient report.

- International Gain / Loss Report: TokenTax works for international traders, no matter where you live, they can generate comprehensive capital gains and losses report that fits your individual requirements.

- FBAR Highest Yearly Balances: The FBAR is a U.S.-based reporting tool used to notify FinCEN of international financial accounts that exceed $10,000. Refresh daily, this report will provide you with the maximum balance held in your foreign account throughout this past year.

All the forms are available as a CSV file, or in PDF and TXF format for instant filing with the IRS. TokenTax software also offers reporting for crypto miners and crypto businesses.

FAQs

Q: How does TokenTax work?

A: TokenTax connects to your exchanges and wallets after you make your payment and register on the platform. It will then import your transaction history. From there, it will calculate your gains and losses and generate a comprehensive report that you can file with your taxes. It also provides year-round support so you can always get help when you need it.

Q: How do you work out your tax liabilities?

Taxation of crypto varies from one country to another, which makes it difficult for crypto traders and investors. Fortunately, TokenTax makes this easier by allowing users to set up an account with their locality in mind. After that’s done, the platform identifies each taxable event and calculates the taxes due while also providing documents relevant to your jurisdiction so you know exactly what’s owed!

Q: How much does TokenTax cost?

A: Plans start at $65 per year (Basic Plan) and allow you to reconcile up to 500 transactions. It has several other plans, such as the Premium Plan which costs $199 per year for 5,000 transactions, Pro Plan which costs $799 a year for up to 20,000 transactions, and the VIP plan which costs $3,499 and offers up to 30,000 CEX transactions. There are currently no plans with unlimited transactions.

Further detail on the features of each plan can be found above.

Q: Is TokenTax Legit?

A: Yes, it’s a legitimate crypto tax software and accounting firm, trusted by millions of users around the world.

Q: Does Token Tax have an app?

Yes, both IOS and Android apps are available for download from the App Store or Google Play store.

Q: TokenTax price- how can I pay?

A: TokenTax accepts payment via Card Or Crypto. Enabling payment via Crypto is a cool feature and seems unique to TokenTax with most other platforms we’ve reviewed accepting fiat payment only.

Q: Is TokenTax secure?

A: Yes! TokenTax uses TLS encryption to keep your data safe. It never shares your data with any third party unless required by law.

Q: What if you go beyond the maximum limit of your transactions?

A: All plans have the option to add additional transaction data by paying a small amount.

Q: Is TokenTax Free?

A: No, TokenTax is not free. You can trial the software but you won’t be able to produce any of the tax reports. Check out our FREE CRYPTO TAX SOFTWARE post for Free options.

Q: Does TokenTax work with TurboTax?

A: Yes, TokenTax can be used to securely transfer your crypto tax reports directly into TurboTax and other services.

Q: Is TokenTax Support Good?

A: The TokenTax Team offers priority support to their users. The support staff are available 24/7 to answer any questions you have about crypto taxes and crypto accounting, as well as provide assistance with tax filing.

You can reach the team for advice or help in setting up accounts, getting an overview of crypto taxation laws, and understanding crypto accounting from a tax expert.

Useful Links

Is TokenTax Worth It?

TokenTax is undoubtedly one of the simplest ways to file your cryptocurrency taxes. It automates the entire process, from importing data about your transactions to calculating your profits, losses, and ROI. Plus, it offers 24/7 support so you can always get help whenever necessary. This makes it one of the best tax software platforms available right now. Use it to simplify your tax filing procedure!

This post contains affiliate links. If you use these links, we may earn a commission.

Enjoyed our TokenTax Review? Here are some other reviews you might want to check out: