Taxes can be confusing and time-consuming, especially regarding cryptocurrency investments. The solution? TaxBit– a comprehensive accounting and crypto tax software designed specifically to meet the needs of cryptocurrency investors.

TaxBit simplifies and automates the process of calculating, filing, and reporting digital asset gains and losses. Making taxes simpler than ever before for crypto traders. In this TaxBit Review, we’ll provide an overview of the software and its features as well as discuss the benefits of using TaxBit for cryptocurrency tax management.

TaxBit Promo Code & 2024 Update

With TaxBit now shifting its focus to enterprise tax solutions, accounting, and the public sector, we’ve found that individual crypto investors might benefit more from Koinly’s tailored services. For those seeking a streamlined and efficient way to manage personal crypto taxes, we highly recommend Koinly. Koinly offers excellent support for individual users, with intuitive features and integrations designed specifically for personal crypto tax filing. Plus, you can enjoy a 10% discount using our exclusive promo code CRYPTOTAX10. Click the link below to take advantage of this offer and start simplifying your crypto tax reporting today!

Overview

TaxBit is a popular choice for businesses and tax attorneys for cryptocurrency tax management. The software provides a comprehensive solution that helps you keep up with the ever-changing nature of crypto taxation laws for whichever internal revenue service you need to report to (including IRS, HMRC, Federal Ministry of Finance, Canada Revenue Agency etc).

Users can easily calculate taxes due from their transactions, generate custom reports, track gains/losses in almost real time, and more.

Additionally, TaxBit has advanced elements like automated income recognition & reporting for international capital gains tax compliance and streamlined portfolio reconciliation with exchanges.

TaxBit’s intuitive user interface makes it easy to understand and navigate complex tax rules so you can take control of your cryptocurrency taxes with confidence.

How Does It work?

TaxBit is designed to make filing taxes on cryptocurrency investments easy and efficient. It works by automatically calculating your taxable gain or loss based on the information it has access to.

TaxBit’s tax engine is built with advanced algorithms and sophisticated logic to accurately calculate crypto taxes. The tax engine allows users to easily track their crypto transactions, manage the cost basis of their crypto assets and reconcile trades.

With its automated calculations, TaxBit simplifies the process of preparing taxes and eliminates manual errors from the equation.

Once you’ve reviewed the data, you can generate custom reports with all of the necessary forms for filing, such as IRS Form 8949 or Schedule D.

The software also helps to simplify the process of recognizing and reporting income for international capital gains tax compliance by integrating with leading accounting & finance solutions such as Quickbooks and Xero. This integration ensures accuracy when it comes to filing taxes due from digital assets, allowing investors to save time in the long run.

Make Your Life Easier This Tax Season With A Free Account!

Best Features

Here are some of the best features of TaxBit that we will cover in this TaxBit review;

TaxBit for the Individual

Are you looking for a comprehensive solution to help manage your cryptocurrency taxes? TaxBit is the answer. With an easy-to-use interface and advanced tools designed to streamline tax calculations and reporting, the TaxBit website provides users with a powerful tool for managing their assets.

TaxBit simplifies the process of calculating taxes due from transactions, tracking gains/losses in real-time, generating custom reports, and more.

Tax Loss Harvesting

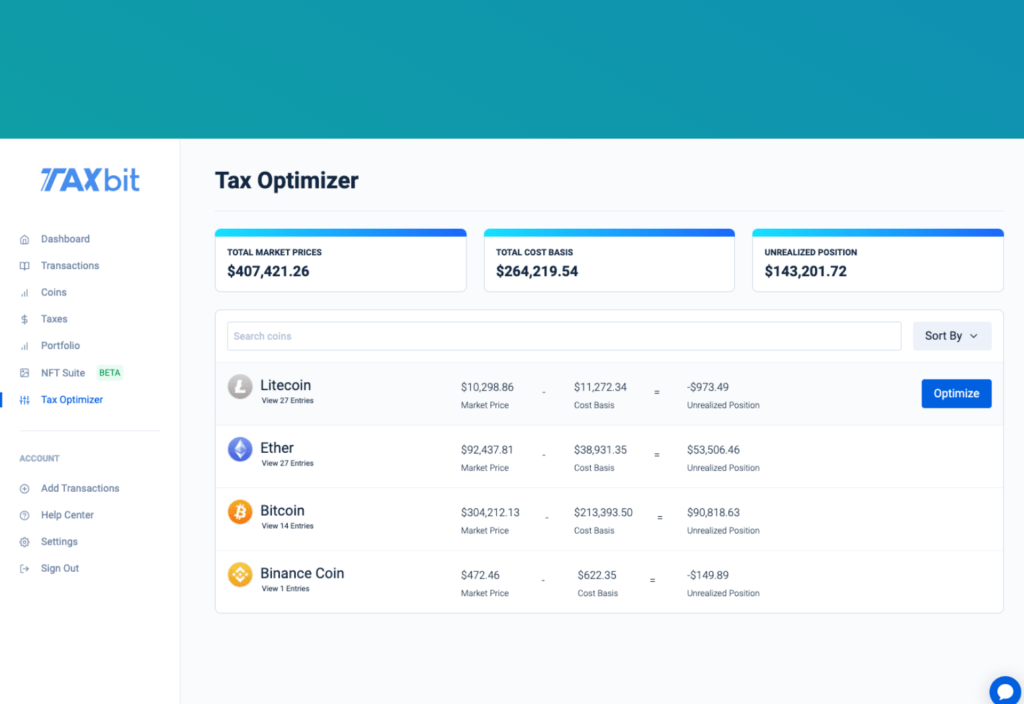

- TaxBit’s Tax Optimizer makes tax loss harvesting and tax optimization easier by helping users identify when it is best to sell investments based on their specific situation.

Tax Loss Harvesting is a process where investors sell investments at a loss to offset taxes due to other investments that are sold at a gain in the same year. This feature is only available for TaxBit Plus and Pro users.

TaxBit for Enterprise Clients

- TaxBit provides enterprise-grade tax and accounting solutions for businesses that are looking to streamline their requirements. The software automates the calculation and reporting process so tax attorneys can save time and focus on other important tasks. TaxBit also integrates with leading accounting & finance solutions such as Quickbooks and Xero for accurate filing of taxes due from digital assets.

TaxBit for Government

- TaxBit helps governments proactively embrace digital technology in a compliant manner. Assisting countries to become more efficient in their compliance efforts with automated tax reporting capabilities that make it easier to keep track of cryptocurrency transactions & ensure compliance with current regulations.

TaxBit Tax Center

- The Tax Center from TaxBit is the perfect place to go for tax information, advice, and guidance. The Tax Center contains a wealth of resources to help users stay informed on the latest tax rules, get tips & tricks for filing their taxes with ease and confidence, and access helpful tools like calculators & other forms.

TaxBit Resources

- TaxBit also provides a range of resources to help users get the most out of their digital investments. From tutorials and walkthroughs on how to use the TaxBit software to keep up with the latest news in crypto tax regulations and compliance, TaxBit’s library has something for everyone.

Is It Good for Beginners?

Yes, TaxBit is great for beginners who are looking to get started with tracking their portfolios and filing taxes.

This crypto tax service simplifies the process of filing taxes on investments by automatically calculating your taxable gain or loss based on the information it has access to. It then generates custom reports with all of the necessary forms for filing, making it easy for beginners to stay compliant with their taxes.

Tax Forms

TaxBit platform provides free tax forms for individual crypto traders and businesses, which can be downloaded directly from the Tax Center. These tax forms are customized to help make filing taxes easy and efficient.

The platform also offers detailed instructions on how to use the forms and manage cryptocurrency taxes with ease.

For those who would like more support in filing their taxes, TaxBit also offers and provides a live customer support chat feature where users can ask questions and receive assistance from a certified accountant or tax specialist.

What Exchanges are supported?

TaxBit has an extensive list of supported exchanges and wallets, making it easy to generate your tax forms. Through the Taxbit Network, you can access 1,500+ exchanges and 10,000+ wallets from a single platform.

Additionally, Taxbit provides integration with platforms for several industry-leading crypto trading platforms such as Coinbase Pro, Binance US, and Kraken.

The TaxBit API allows you to easily integrate your exchange data into the comprehensive tax calculation and reporting engine. This helps ensure compliance with IRS rules on Form 8949 (Sales and Other Dispositions of Capital Assets) and Schedule D (Capital Gains and Losses).

Here are some of the most popular exchanges supported:

Do They Support DeFi?

TaxBit’s Decentralized Finance (DeFi) tool allows crypto traders and investors to accurately calculate their crypto taxes for DeFi transactions involving ERC-20 tokens on the ETH network or BEP-20 tokens on the BSC network only.

This means is can be used for tracking transactions completed on protocols such as Uniswap.

The DeFI Tool automates the tracking and calculation of crypto gains, losses, and tax liabilities on DeFi but is currently limited to the above-mentioned tokens.

Taxbit Pricing – How Much Does It Cost?

TaxBit offers four different plans to meet the needs of individuals and enterprises.

- The Network Plan is FREE

- The Basic Plan costs $50/per year

- The Plus Plan costs $175/per year

- The Pro Plan costs $500/per year

Network Plan

A Free Plan which gives you the opportunity to test out the application and review your transactions from unlimited sources of data and includes email support.

There are no free tax forms with this plan but once you have reviewed the data you can then pay to upgrade your data plan to produce an appropriate report.

Basic Plan

The TaxBit Essential basic plan is an ideal choice for individuals looking for a tax solution for their digital assets. The basic plan costs just $50/year and includes unlimited transaction transactions, automated tax calculations, customer support via email & live chat, and access to a comprehensive compliance library.

Get started today with the Essential Plan!

Plus Plan

The Plus Plan is an ideal choice for individuals looking for a comprehensive tax solution. The plan costs $175/year and includes all the elements of the Basic Plan, plus advanced tools such as The Tax Optimizer; a tax loss harvesting, plus and a pro tool that highlights assets you could look to sell to decrease your tax liability.

Get started today with the Plus Plan!

Pro Plan

Lastly, the Pro Plan costs $500/ year and includes all the elements of Plus, Basic, and Network plus an in-house CPA review service to give users extra assurance when it comes time to file their taxes.

Powered by crypto tax expert CPAs that are exclusively dedicated to this Plan, you can rest easy knowing your documents will be thoroughly assessed by a CPA before filing them!

Additionally, the CPA is accessible should you have any questions or require further discussion about YOUR specific case.

Finally, this package includes world-class customer service that provides specialist and expedited support to service Pro Plan users.

Get started today with the Pro Plan!

How Do I Sign Up?

The sign-up process is easy and straightforward. All you have to do is visit the Taxbit website, select your plan, and create an account.

Once your account has been created, you will be prompted to input your exchange credentials so that TaxBit can access your portfolio on a read-only basis.

After your exchange credentials have been verified, you can start uploading your transaction history and generate all necessary tax forms.

Drawbacks

Some users have reported an occasional slow response time when submitting support tickets, so customer service may not always be up to par. Finally, there isn’t currently a mobile app which could be a drawback for some users.

How does it compare to other crypto tax software?

TaxBit is a comprehensive and cost-effective cryptocurrency tax software that enables individuals and businesses to easily generate their tax forms from over 1,500+ exchanges and 10,000+ wallets from a single platform.

When compared to its competitors, it’s clear that the software of Taxbit offers great value for those looking to stay compliant with cryptocurrency taxes. TaxBit’s Basic, Plus and Pro plans provide solutions for everyone from individuals to businesses. With its range of tools, international support, and competitive pricing, TaxBit is an excellent choice for anyone looking for a comprehensive cryptocurrency tax solution.

What is the best crypto tax tool?

All in all, TaxBit is one of the most comprehensive and cost-effective cryptocurrency tax software, however, there are options available on the market.

Taxbit vs Koinly

In comparison to Koinly, an online tax calculator offered by KoinTax LLC., both offer access to most exchanges and wallets via API integrations or manual uploads (Koinly limits to up to 10 crypto exchanges with their free plan). Koinly’s stand-out feature is its Mobile App which has good functionality compared to TaxBit which currently has no Mobile App. Koinly’s customer service is also world-class- expect a prompt and comprehensive response to any queries you raise.

Check out our full review of Koinly here.

TaxBit vs TokenTax

When compared to TokenTax, another software provider, both offer access to crypto exchanges and wallets via API integrations or manual uploads. TokenTax packages are marginally more expensive but they also offer more features.

Read our full TokenTax review by following the link.

TaxBit vs Cointracker

In comparison to Cointracker, an online tax calculator and portfolio tracker offered by Cointracker LLC., TaxBit is more comprehensive in terms of features and available plans. While both offer access to crypto exchanges and wallets via API integrations or manual uploads, the TaxBit platform offers access to more crypto exchanges wallets and wallets from a single platform. TradeWise is also proud to offer a 10% discount on paid plans with CoinTracker Crypto Tax Software.

Check out our full review of Cointracker here.

TaxBit vs Zenledger

When compared to Zenledger, a crypto accounting, and crypto tax software, TaxBit is more comprehensive in terms of features and available plans. While both offer access to crypto exchanges and wallets via API integrations or manual uploads, Zenledger has more API integrations and ways to contact their customer service support team.

Check out our full review of Zenledger here.

Overall, TaxBit is a good platform for individuals and businesses looking for comprehensive software but you’ll find this from many of its competitors too.

However, our stand-out platform is Koinly; it’s simple to use, cheaper, has bags of features and you’ll not find better customer service from their knowledgeable team.

How do I contact customer support?

There are multiple support channels for customers to contact their teams. You can reach out to them via email, social media platforms (Facebook, Twitter & Instagram), or chatbot.

They also offer a comprehensive knowledge base and FAQ page on their website to answer any tax-related queries you may have. Additionally, you can join their Telegram group to connect with their team and other crypto enthusiasts.

Finally, if you subscribe to the Professional plan, you’ll receive a free CPA review of your tax report. TaxBit Review by a CPA of your crypto tax report gives you added assurance that the calculations and filing are correct. This review helps to ensure accuracy and provides peace of mind for users.

Online Reviews

They’ve earned a stellar reputation among crypto enthusiasts, traders and professionals alike. With an average review rating of 4.5/5 on Trustpilot. In addition, it’s one of the highest-rated solutions on Reddit. You’ll struggle to find a negative TaxBit Review, with many users praising the range of features, intuitive user interface, international support, customer service, and competitive pricing.

If you’re looking for a platform that’s easy to use and provides comprehensive features at cost-effective prices with international support, it could be a good tool for you.

Try out a free plan today to get started!

FAQ’s

TaxBit Team- Who owns TaxBit?

The Company was founded by two brothers – Austin and Justin Woodward owned by Currency Tax LLC; the company is based in the U.S.

Where is TaxBit Located?

The company is based in Lehi, Utah.

Is TaxBit Safe?

TaxBit utilizes the highest level of security measures and encryption techniques to ensure user data is kept secure. Security is paramount with all crypto tax information processed in a secure environment and all communications encrypted with SSL/TLS.

TaxBit also follows security best practices for maintaining user security and privacy, such as not storing any personal crypto wallet information on their servers. Additionally, TaxBit is SOC 2 Type II certified, which ensures that the platform has all the necessary security measures in place.

What countries are supported?

They currently have services to support clients completing taxes in the U.S., Canada, Australia, and Europe.

Is there a TaxBit Mobile App?

No. There isn’t currently a mobile app.

Is TaxBit Free?

TaxBit offers free plans that allow crypto investors to get started with compliance and reporting. The free plans include a variety of features, such as the ability to automatically calculate, generate required crypto tax forms and reports, and access due dates.

Does TaxBit work with Coinbase?

Yes, it’s integrated with Coinbase, as well as over 1,500 crypto exchanges and 10,000 wallets.

Does TaxBit work with Binance?

Yes, it’s integrated with Binance, along with over 1,500 crypto exchanges and 10,000 wallets.

Does TaxBit report to IRS?

Yes, they are able to generate tax reports that are compliant with IRS regulations.

How to import TaxBit into TurboTax?

The software is able to export tax reports that are compatible with TurboTax. To import crypto data into TurboTax simply follow the instructions from the user guide.

Conclusion: Does TaxBit make tax filing easy in 2024?

Yes, TaxBit makes tax filing easy for individuals and businesses in 2024. With its intuitive user interface, comprehensive features, and international support. It provides the perfect crypto tax software solution that helps users to stay compliant with crypto taxes.

All in all, TaxBit is a good option but if you’re looking for tax software as an individual that is reliable, simple to use, cheaper, and comes with a Mobile App then look no further than Koinly

Enjoyed our TaxBit Review? Here are some other reviews you might want to check out: