Welcome to my detailed Gorilla Trades review. I’ve been using this service for several years with great results and have put my experience into a short video (see below).

As I explain in the video, I’ve been buying stocks and shares for over 10 years now and have been searching for a professional trader who I can copy and simply profit from their expertise without having to spend hundreds of hours trawling through data and reading charts.

Take a look at Gorilla Trades now.

This is by far the best stock-picking service I have ever seen. In this video, I will explain why I like it so much. I’ll also be honest about some of the negatives so you can make an informed decision before buying.

Start Your FREE 30-Day Here –> Gorilla Trades.

Your free Gorilla Trades account does not require any form of deposit and you don’t need to enter your credit card details!

For 30 days you will receive ALL of the following benefits;

- ✓ Access To Members Only Website

- ✓ Daily Stock Picks

- ✓ Small-Cap Stock Picks

- ✓ Weekly Options Picks

- ✓ Free iPhone And Android App

- ✓ The Gorilla’s Ultimate Stock Picking Challenge

- ✓ Afternoon Market Update via Email

- ✓ Nightly Newsletter

- ✓ Real-Time Market Alerts via Text Message

If you’re looking for the best stock recommendations in 2023, you won’t find any place better than Gorilla Trades.

Join Gorilla Trades For FREE Today!

About Gorilla Trades

Gorilla Trades is a stock-picking service that provides investors with personalized stock picks to invest in. Their team of experienced financial professionals monitors the market daily and analyzes individual stocks in order to identify potential opportunities. They then create customized portfolios based on these stock picks, which are updated regularly to reflect changes in the market.

Investors can use the stock picks to research and decide which investments are best for them. Gorilla Trades has a subscription-based service that provides investors with access to their stock market picks and portfolios. Subscribers can use the service to trade on stocks recommended by Gorilla Trades or they can choose to follow their own strategies. The team at Gorilla Trades also provides subscribers with in-depth research and analysis to help them make informed investment decisions.

What Is Gorilla Trades Exact Trading Strategy?

Gorilla Trades has a proprietary stock screening service that allows them to find break-out stocks that have a high probability of trending upwards, locking in profits for members.

Gorilla Trades is a stock-picking service that allows users to make smarter, more informed decisions about their investments. The system utilizes proprietary algorithms to identify and analyze stocks with the highest potential for growth and profitability. With gorilla trades, investors can access a comprehensive list of stock picks that are frequently updated and tailored to the individual user’s needs and preferences.

Gorilla Trades’ strategy for stock picking involves analyzing stocks based on five core criteria: price, liquidity, volatility, fundamentals, and technicals. Price is an important factor as it helps to identify stocks that are currently undervalued but have strong potential for growth. Liquidity helps to determine how easily an investor can buy or sell a security. Volatility is used to measure the risk associated with any given stock. Fundamentals refer to a company’s financial performance, which can help investors determine if they would be wise to invest in its stock.

Finally, technicals refer to the analysis of a stock’s historical data, which can provide insight into the future performance of the security.

Looking for some juicy bonuses? Check out these referral codes to earn and save money!

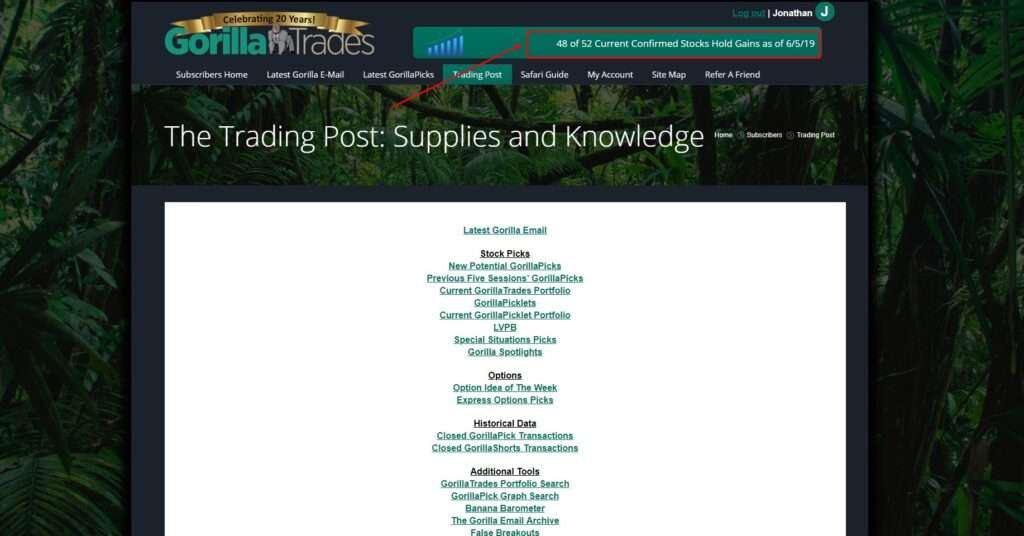

What Does Membership Include?

Gorilla Trades service is very good value for money. For a one-time annual subscription you can receive all of the following benefits and services;

- Done-for-you research – save yourself hundreds of hours of research time simply by following along and making the same investments as the Gorilla!

- Ample investment ideas – Daily stock picks, weekly stock Options pick, small-cap stock picks, short picks, and more!

- All information and open positions are available to see at a glance, including all of the buy and sell parameters for each investment

- Full trade details are shared publicly, including open level, stop loss level, and take profits.

- Regular notifications and updates – Afternoon market update and nightly newsletter

- Tutorials and support – education and training videos are provided plus extra support if you need it.

- Convenient on the go – never miss a notification or a trade with the handy Gorilla mobile app. Available on both iPhone IOS and Android.

- Highly profitable trades! 20 years of experience goes a long way.

- 5-star-rated service – This service has many glowing reviews and MANY testimonials from happy clients.

Join Gorilla Trades For FREE Today!

Gorilla Trades Past Performance

Gorilla Trades has a strong track record of success when it comes to stock picking. The company boasts an average yearly return rate of over 25%, which is nearly double the S&P 500’s long-term average. Additionally, gorilla trades has a data-driven approach to stock selection, using both quantitative and qualitative analysis to identify the best opportunities. This approach has proven successful in the past, with gorilla trades’ stock picks consistently outperforming the market averages by a wide margin.

How Gorilla Trades Works

Gorilla Trades’ platform is easy to use and provides users with a range of tools and resources to help them make informed decisions about their investments. The company’s website offers educational materials and guides, allowing new investors to learn the ins and outs of stock trading. Gorilla Trades also provides real-time alerts for successful trades, so users can stay up to date with the latest stock picks.

The gorilla trades platform also includes a comprehensive suite of trading tools, allowing investors to view and analyze stocks, set up alerts for potential opportunities, and manage their investments.

See how easy it is to use in this short video;

Who Is Ken Berman?

Ken Berman is the founder and CEO of Gorilla Trades. He has over 20 years of experience in the financial industry, having worked at leading investment firms such as Goldman Sachs and Morgan Stanley. Ken is also a highly experienced stock trader, having traded in various markets around the world. His expertise helps him identify potential opportunities in the stock market, which he then shares with Gorilla Trades subscribers. Ken has a passion for investing and his goal is to help individuals make smart decisions when it comes to their investments. He believes in providing investors with the tools and resources they need to succeed in the stock market.

Gorilla Trades Stock Options Picks

Gorilla Trades also offers its users access to a range of stock options picks. The company’s strategy involves thoroughly analyzing each option’s underlying assets and other factors to determine the best possible opportunities. Gorilla Trades evaluates technical indicators, fundamental analysis, price action analysis, and more to create a comprehensive list of potential stocks and options trades.

For those wanting to invest in stock options this signal service is ideal!

Tutorials And Support

Gorilla Trades also provides tutorials and support to help users get the most out of their platform. The company’s customer service team is available 24/7, offering assistance with any technical issues that may arise. They also offer a knowledge base with information about stock trading, as well as educational videos and articles for those just starting out.

Join Gorilla Trades For FREE Today!

What Are The Negative Aspects Of Gorilla Trades?

Overall, Gorilla Trades is a reliable and comprehensive stock-picking service. However, there are some drawbacks to consider before investing. Firstly, gorilla trades’ subscription fees can be expensive and may not be suitable for those with limited budgets.

Additionally, the company’s stock picks may not always be accurate and could lead to losses if not properly researched. Stock trading is risky, and high returns are certainly not guaranteed.

Market conditions also play a part in the profitability of their stock picks. Most of their picks are long (price go up) so if market conditions are not favourable then it can impact profits.

Gorilla Trades Competitors

Gorilla Trades is undeniably one of the best stock-picking services available, but it is not without competition. There are a number of other companies offering similar services, such as the Motley Fool and Seeking Alpha, which provide extensive analysis and advice on stocks and options.

Here is a comparison of some of these popular stock-picking services.

Gorilla Trades Vs Motley Fool

Gorilla Trades and Motley Fool are two of the most popular stock-picking services on the market. Both offer comprehensive platforms with a range of educational materials and tools to help investors make informed decisions.

Gorilla Trades’s platform is more comprehensive, offering more real-time alerts for potential trades. Their platform and signals are also easier to use and the annual cost is lower.

Motley Fool, on the other hand, is more comprehensive and they have a huge range of services. It can be quite overwhelming at times, and they also send out a lot of notifications and marketing materials to their users, which can become annoying.

Gorilla Trades Vs Seeking Alpha

Another popular stock-picking service is Seeking Alpha. Similar to gorilla trades, they provide a comprehensive platform with the tools and resources needed to make informed decisions about investing.

Seeking Alpha offers more educational materials than gorilla trades and their subscription fees are lower. However, Gorilla Trades’ platform has better real-time alerts for potential trades, making it easier to stay up to date with the latest stock picks.

Gorilla Trades Vs Vectorvest

Vectorvest is another popular stock-picking service. They provide a comprehensive platform with tools and resources to help investors make informed decisions about their investments.

Vectorvest offers a more comprehensive analysis than Gorilla Trades, but Gorilla Trades’ alerts are more reliable and timely. Additionally, gorilla trades’ subscription fees are lower, making it the most cost-effective option.

Best Stock Signals Service?

Gorilla Trades is an excellent stock-picking service for those looking for reliable and timely alerts. They provide a comprehensive platform with the tools and resources needed to make informed decisions about investing.

Their real-time alerts for potential trades are more reliable than other services, making it easier to stay up to date with the latest stock picks. Additionally, Gorilla Trades’ subscription fees are lower than other services and their educational materials are comprehensive for those just starting out.

Join Gorilla Trades For FREE Today!

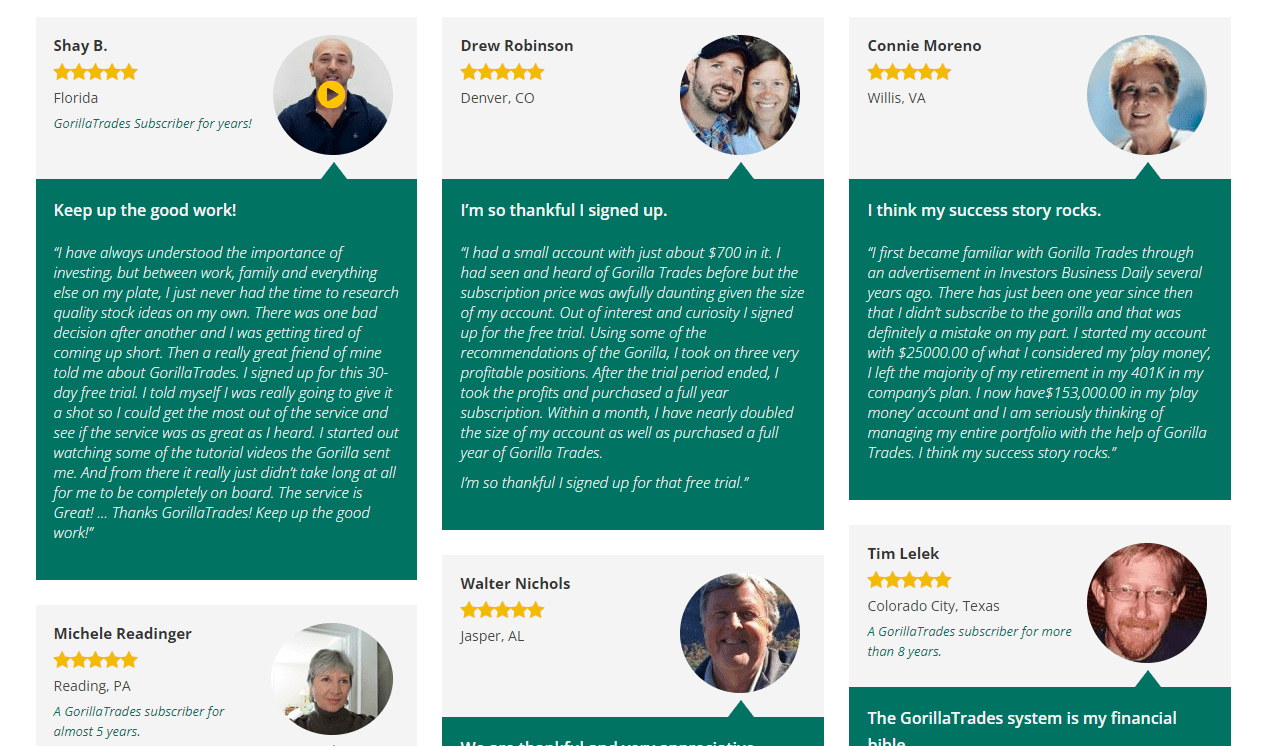

Gorilla Trades Reviews

Gorilla Trades has overwhelmingly positive reviews, with customers praising its easy-to-use platform and real-time alerts for potential trades. Customers also appreciate the comprehensive educational materials available, making it easier to understand stock trading concepts.

Trustpilot

Trustpilot gives Gorilla Trades an excellent overall rating of 4.8 out of 5 stars based on over 200 reviews. The majority of customers are extremely satisfied with the service and found it to be a helpful tool in their stock trading journey.

In Conclusion

Gorilla Trades is a comprehensive stock-picking service that is trusted by over 200,000 investors. They provide real-time alerts for potential trades, as well as comprehensive educational materials to help investors make informed decisions. The subscription fees are lower than other services and their educational materials are comprehensive for those just starting out. Gorilla Trades is an excellent choice for investors looking to get the most out of their stock trading journey.

Overall, Gorilla Trades is a reliable and comprehensive stock-picking service that has received many positive reviews from customers. Their real-time alerts for potential trades make it easier to stay up to date with the latest picks and their educational materials are comprehensive for those just starting out in the stock market.

Frequently Asked Questions

Here are some of the frequently asked questions about Gorilla Trades stock picking service.

How Much Does Gorilla Trades Cost?

Gorilla Trades has just one pricing tier, so there won’t be any nasty surprises or upsells after you join. The price for all of the MANY stock picks they offer is just $499.95 per annum, making it one of the best value stocking services around.

Plus they have a 30-day free trial, so you can give it a try for free to see if it lives up to your expectations.

Do They Share Past Performance?

You can see from my video just how many of the stock picks are in profits and even in a bear market stocks can perform well (plus there are short signals and options that can trade the market down). Recently, they were 18 out of 21 stocks in profit, but this does of course vary.

As soon as you join you’re able to see the performance of the stock picks, and because it’s free to test it out, there really is no need to guess or speculate about the past performance of Gorilla Trades service, just sign up and check it out for yourself!

Who Are Their Competitors Or Similar Services?

I have reviewed many other stock-picking services that are somewhat similar to Gorilla Trades, although overall I’d say it’s very hard to beat this service in terms of profitability and value.

However, for those wanting to do further research, here are some other stock-picking services that may be of interest;

Does Gorilla Trade Work?

Yes, Gorilla Trades is a reliable and comprehensive stock-picking service. Their platform offers real-time alerts for potential trades and comprehensive educational materials to help investors make informed decisions.

Is Gorilla Trades Legit Or A Scam?

Gorilla Trades is a legitimate stock-picking service that is trusted by thousands of stock market investors. They have received excellent reviews from customers and have been in business since 2001. They are certainly not a scam company, although trading stocks is a high risk, and profits are not guaranteed. Trading losses are not the same as being scammed though!

What is The Cost Of Gorilla Trades?

The cost of a Gorilla Trades subscription depends on the subscription plan chosen. They offer the annual subscription plan for just $449.95 (all services and picks included for this price). To reduce the price further, there is a 2-year subscription available for just $749.

There’s no need to worry about the cost of Gorilla Trades though because you try the service out today for FREE! Simply follow this link to get started today.

Join Gorilla Trades For FREE Today!

What is The Best Stock Picking Service?

Gorilla Trades is one of the best stock-picking services available for beating the stock market. They provide comprehensive analysis and reliable real-time alerts for potential trades, making it easier to stay up to date with the latest picks. Additionally, Gorilla Trades’ subscription fees are lower than other services and their educational materials are comprehensive for those just starting out.

How Accurate Are Gorilla Trades?

Gorilla Trades’ picks are extremely accurate, as evidenced by the overwhelmingly positive reviews from customers. They have been in business since 2001 and are trusted by thousands of stock market investors. Their real-time alerts for potential winning trades make it easier to stay up to date with the latest picks and their comprehensive educational materials ensure that all investors.

How Does Gorilla Trades Make Money?

Gorilla Trades makes money primarily through their subscription fees. They also offer additional services like real-time alerts and comprehensive educational materials which can be purchased separately or as part of a package.

How Profitable Is Gorilla Trades?

Gorilla Trades is a highly profitable service. Since they offer real-time alerts for potential trades and comprehensive educational materials, investors are more likely to be successful in their stock trading journey. Their win rate is high and customers report consistent profits from using their signals service. The current Gorilla Trades portfolio can be found within minutes simply by creating your free account!

I sincerely hope you found my Gorilla Trades review to be helpful. Please leave your comments and questions below!

This post contains affiliate links. If you use these links, we may earn a commission.

Other reviews you might like;

Gorilla Trades Review 2022

- Easy To Use?

- Cost

- Profitability

- Time Needed

SUMMARY

Pros:

- Stock Picks Are Very High Quality And Profitable

- Various Types Of Trading Available Including Large Cap & Small Cap Stocks And Options Trading

- Excellent Reputation & Long Standing Track Record

- Excellent Value For Money

- 1 Month Free Trial

Cons:

- 1 Year Subscription Not Ideal

- Signals Need To Be Manually Traded In Your Own Account (Not Automated)

13 thoughts on “Gorilla Trades Review [2024] – Plus Free Bonuses!”

Excellent knowledge. God bless

Thanks! I’m glad you enjoy our content.

Hi Jonathan, Congrats on very good article. Which service is the best for commodity trading?

Elysium Capital have a commodity copy trading service that’s very good – https://tradewise.community/elysium-capital-review-2020-100-honest-review-from-a-real-member/

Hi Jonathan, Congratulations on an informative article. As a South African Citizen, can you please recommend a trading broker which will work best with Gorilla Traders? I am a commodity trader, hence the question, is Gorilla Traders the best choice?

I have some reviews coming shortly on brokers. If you want to trade commodities only then Gorilla is not the best because it’s mostly for stocks (dow and S&P etc). However you don’t need to do your own research, just follow their signals – it’s very easy and no experience required.

Hi Jonathan, could you make a video or describe how you trade these tips via your IG spread betting account?

Hi,

Congratulations on an interesting article, a really professional approach to the topic.

Can you recommend a broker who will work best with Gorrila Trades (EU)?

Peter

I’m always a bit reluctant to recommend brokers Peter. I would suggest reading plenty of reviews and make sure that the broker has good listings for US stocks as this is what will be traded.

Hi Peter,

Did you find a broker from the EU that you might be able to spread bet various US stocks with?

I’ve struggled to find one so far, but will update on here if I do.

Thanks,

Iain

IG are good.

What Spreadbetting broker are you using in the Uk?

Thanks.

IG and have used them for about 10 years